CATEGORY

Point of Sale Materials

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Point of Sale Materials.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

Samsung aims to elevate the sights (and sounds and smells) of retail.

February 09, 2023Smurfit Kappa named sustainability top performer.

February 09, 2023Euro Shop 2023- The World's No.1 Retail Trade Fair

February 09, 2023Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Point of Sale Materials

Schedule a DemoPoint of Sale Materials Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoPoint of Sale Materials Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Point of Sale Materials category is 7.40%

Payment Terms

(in days)

The industry average payment terms in Point of Sale Materials category for the current quarter is 75.0 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

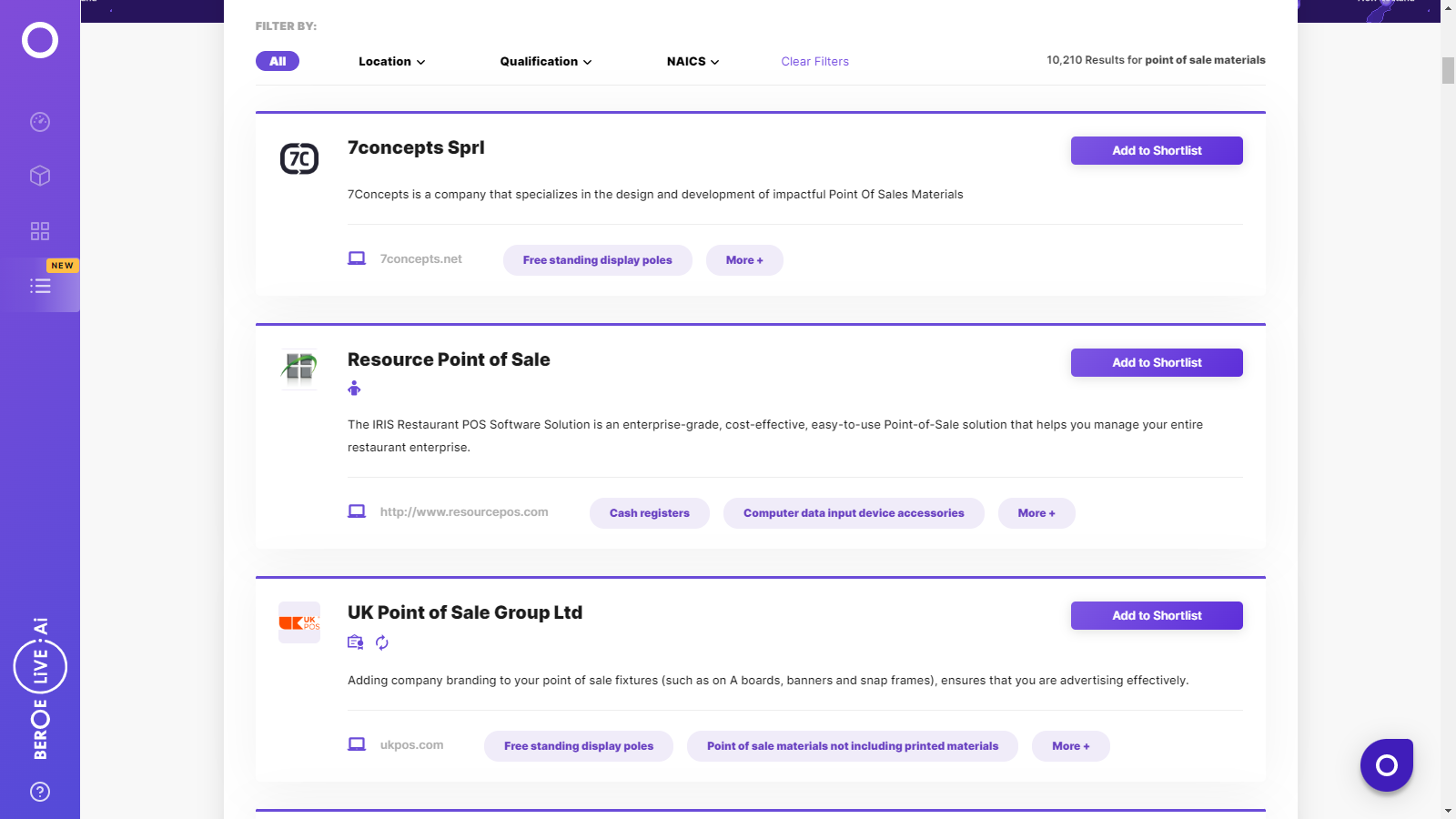

Point of Sale Materials Suppliers

Find the right-fit point of sale materials supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Point of Sale Materials Market Intelligence

global market outlook

- The global POSM market is estimated to be 43.5 billion USD in 2022. Market size in North America is the highest at 14.5Billion, followed by Europe with a market size of $11.40–11.98 Billion. APAC is estimated to have a market size of 9-9.54 Billion.

Global players in the POSM industry includes Idx Corporation, RTC, HH Global, Smurfit Kappa.

According to industry experts, the global demand is expected to grow at around 7.8% CAGR (2021-2026F).

The top three industries that contribute to the POSM market are FMCG, CPG, and FBT.

In case of POS displays, there is increasing demand for sustainable materials, like recycled cardboard, recycled aluminum, etc. Compact POS displays are gaining the market share, which helps in reducing the space occupied.

Use the Point of Sale Materials market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoPoint of Sale Materials market frequently asked questions

Beroe's POS market analysis discovers that the high market maturity regions are North America and Europe and the medium market maturity regions are parts of Eastern Europe, Latin America, and Asia.

Beroe's point of sale market research report finds out that the latest POS trends are that suppliers are covering more geographical ground with increasing maturity of buyers, rising demand for NFC-ready systems which in turn is leading to the growth of the point of the sale market.

The point of sale market is expected to witness a forecasted growth at a CAGR of 12.57% by 2022.

The key drivers of the point of sale (POS) terminals market are the rise of cosmetic, and personal market segments and also the rapid growth of store formats such as hypermarkets, supermarkets and convenience stores. The cost drivers include raw materials and manufacturing costs.

Point of Sale Materials market report transcript

Global Point of Sale Materials Industry Outlook

-

The global POSM market is estimated at $46.06 billion in 2023 (E). It is expected to reach $53.86 billion by 2025 with a CAGR of ~7–7.8 percent from 2022 to 2026

-

The market is likely to grow at a CAGR of 7.8 percent during the forecast period 2022–2026F

-

The top three industries that contribute to the POSM market are FMCG, FBT, retail, and pharmaceutical.

-

The APAC region is expected to grow fastest at a CAGR of 3.6 percent during the forecast period 2022–2024. On the other hand, North America and Europe are also anticipated to be key regional markets during the forecast period

Global Point of Sale Materials: Market Maturity

-

POSM is gaining prominence in overall in-store promotion. Demand for POSM across all the regions is expected to increase in 2023. The US and the UK markets are expected to register higher growth, followed by APAC

-

Demand from the FMCG/CPG industry will increase in 2023, followed by FBT

Global Point of Sale Materials:Industry Trends

-

Suppliers are growing their geographic footprint as mature buyers move toward consolidation of sourcing and widening of their service portfolio to offer a wide range of services to bring in a bigger share of buyers’ trade marketing spend

-

The increasing demand for NFC–ready systems is contributing to the growth of the global POS market

-

Suppliers are growing their geographic footprint as mature buyers move toward consolidation of sourcing and also widening of their service portfolio to offer a wide range of services to bring in a bigger share of buyers’ trade marketing spend

Global POSM: Drivers and Constraints

-

POP display has significant growth in the global markets especially in FBT, cosmetic and personal care segments

-

Store formats such as hypermarkets, supermarkets and convenience stores are likely to increase (especially in emerging markets) and are thus anticipated to increase the global POP display market over the forecast period of 2020 to 2025

Drivers

Growth of retail store formats in the developing markets

-

Development of modern retail in tier-2 and tier-3 cities, especially in the developing markets in Asia and LATAM, will increase the demand for POSMs. Retailers are tapping opportunities to grow in the developing markets and are investing more in the developing markets

Sustainability

-

With increased awareness of environmental issues, sustainable POSM materials are becoming more in demand

Rise in technology adoption

-

Suppliers invest more in technology to improve their capabilities, thereby adding more value with respect to the services offered, thus providing a high level of accountability to buyers

Constraints

Rise in e-commerce retail

-

Consumer preference for online stores may increase further in the future. This would reduce the significance of other retail formats and would result in lesser demand for POSM in the future

Supply Trends and Insights : Point of Sale Materials

Global/regional supplier

Global/regional suppliers

-

Global suppliers are enhancing their geographic and service capabilities to attract large buyers

-

Buyers in North America prefer to work with strong regional players, since the supply market is more matured and sophisticated compared to any other markets

Consolidation of suppliers

-

Aggregators are trying to expand their service capabilities in LATAM and Europe, in order to increase their geographic capabilities. This is mainly because most of the local suppliers have different printing and fabricating capabilities. Thus, buyers prefer to work with aggregators, who would ensure supplier standards and consistency across these markets

Supply trends

-

Technology platforms: Suppliers are offering better technology platforms, like could-based platforms, to update the materials, starting from design till production and installation stage, print quality platforms to ensure print quality, color quality and color consistency

Engagement trends

-

Most adopted model globally: Bundled outsourcing strategy (especially in Europe and LATAM)

-

Why: To achieve spend visibility and cost savings

-

Suppliers preferred (Retail): Buyers in retail industry prefer to work with POS specialists than aggregators

-

Suppliers preferred (Other industries): Usually, aggregators who are usually global print management companies and who could take care of multiple services, like print, POS displays and promotional items

Why You Should Buy This Report

- The report on the point of sale industry provides market trends and the regional market outlook of Australia, APAC, LATAM and Europe.

- It details Porter's five force analysis of developed and emerging regional markets.

- It highlights the innovations in detail such as digital displays, AR and offers information about the innovative point of sale advertising materials utilized by retailers such as Geo-fencing, iBeacons, and QR codes.

- The report provides insight into supply trends and offers a service portfolio and SWOT analysis of key POSM manufacturers including RTC, HH Global, and Innerworkings, to name a few.

- Further, the research study provides a comparative analysis of pricing models and lists out cost-saving opportunities.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now