CATEGORY

Point of Sale Materials (PoSM) Australia

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Point of Sale Materials (PoSM) Australia.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Point of Sale Materials (PoSM) Australia Suppliers

Find the right-fit point of sale materials (posm) australia supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Point of Sale Materials (PoSM) Australia market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoPoint of Sale Materials (PoSM) Australia market report transcript

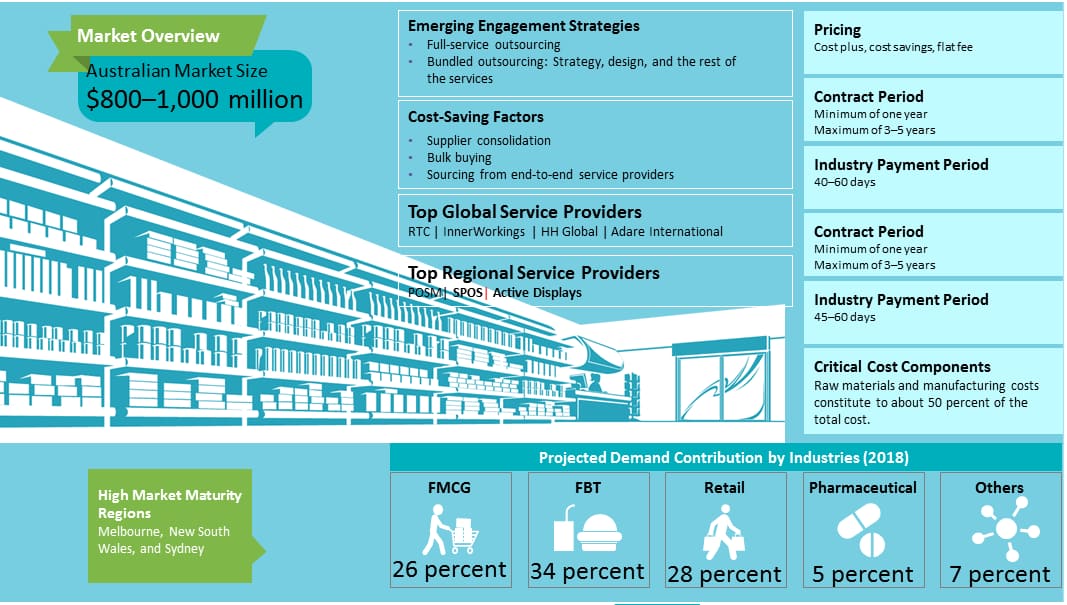

Regional Market Outlook on Point of Sale Materials

- The Australian POSM market was estimated at $800–1,000 million in 2018

- The market is likely to grow at a CAGR of 1.9–2.7 percent during the forecast period of 2017–2022

- The top three industries that contribute to the POSM market are FMCG, FBT, and retail

- Major global players present in the Australian market with strong capabilities are HH Global, Inner workings, Adare, and RTC

Supply Market Outlook

Opportunities

- Presence of fully capable suppliers across cities makes it difficult to consolidate the supplier base. The proximity of stores and potential suppliers assist in cost savings with respect to logistics. This plays an important part in the selection process of the service provider

- Buyers can engage in effective cost negotiation, due to the presence of fully capable local suppliers across the Australian continent

Challenges

- Higher labor rates compared to the developing markets

- Material prices are high, which forces most of the leading POSM suppliers to source their raw materials from China

Porter's Five Forces Analysis: Australia

Supplier Power

- Supplier power in the emerging markets ranges from low to medium, owing to the highly fragmented supply base, resulting in the buyers having enormous options to choose from

Barriers to New Entrants

- Major global players (aggregators) take care of requirements in developing regions, due to lack of full-service providers with sufficient capabilities

- Buyers would definitely prefer to work with a local player, if they could offer end-to-end services in these markets

Intensity of Rivalry

- The intensity of rivalry is medium, since there are few full-service providers in the market, and most of them are local players who are more operational than tactical in nature

Threat of Substitutes

- The threat of substitution will be low. POS specialist providers and aggregators are still favored in Australia

Buyer Power

- The demand for POSMs is expected to grow stronger, with the growth of modern retail trade in the emerging markets

- Buyers will have higher buyer power, as suppliers compete to grab a higher share of buyers' spend

PoSm Australia Market Overview

- In Australia, major buyers are increasing their footprint in an attempt to tap the large consumer base

- Major end-users are CPG, pharmaceuticals, media, and advertising companies.

- Adoption of the online POP management software is prevalent among few buyers in Australia, and it is expected to increase in the forthcoming years

- This technology is being offered by most of the regional and global suppliers to avoid chances of wastage and to improve savings

- Customized catalogs find limited adoption among buyers since the supply market is mature. Buyers already source POSM services, using a homogeneous approach.

- Suppliers are using more technology platforms to integrate and manage sourcing across different markets.

- The adoption of digital POP displays is increasing in Europe. The usage of electronic label displays, digital signage, etc., are expected to increase in the coming years.

- Retailers are increasingly finding new ways to utilize various innovative solutions that engage customers and also provide valuable data on shopping patterns.

- Buyers could develop a pricing strategy for each type of display by tracking the price variations of key raw materials and by tracking dynamic changes in the key cost drivers

- The weightage for each parameter varies based on the specification of displays and type of materials used

- Buyers could predict price variations in displays and plan accordingly while display procurement and supplier negotiation.

- Buyers could use the price projections of materials to calculate price variations likely to occur every year

Why You Should Buy This Report

- Information on the Australian PoSM market size, maturity, industry trends, regional outlook, etc.

- Porter’s five forces analysis of the PoSM Australia industry.

- Innovations, index-based pricing

- Supply trends and insights, supplier list, profiles and SWOT analysis of major players like HH Global, InnerWorkings, Adare International, etc.

- Sourcing models, cost-saving opportunities, pricing models, SLAs, KPIs, etc.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now