CATEGORY

Personal Protective Equipment Australia

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Personal Protective Equipment Australia.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

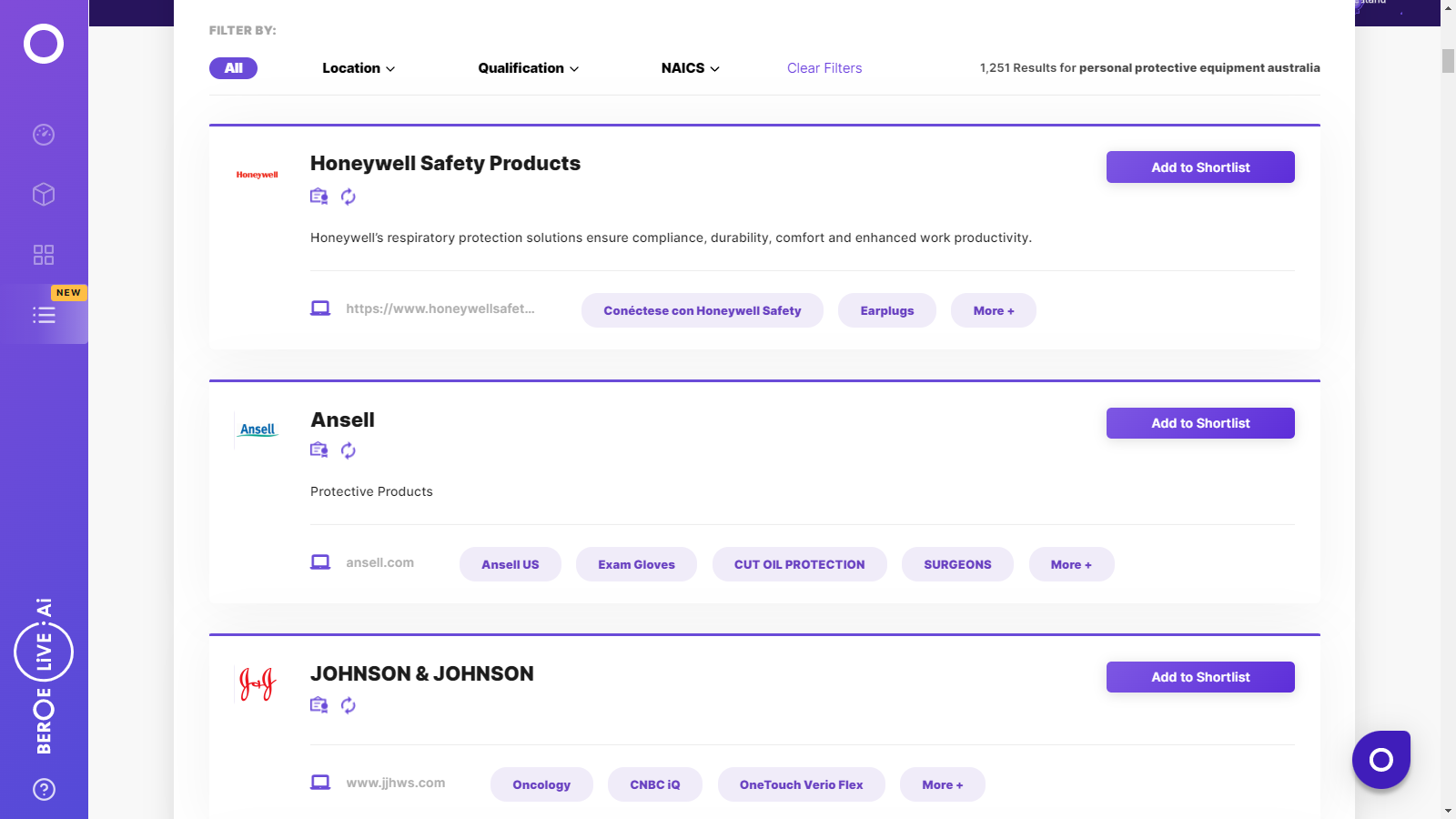

Personal Protective Equipment Australia Suppliers

Find the right-fit personal protective equipment australia supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Personal Protective Equipment Australia market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoPersonal Protective Equipment Australia market report transcript

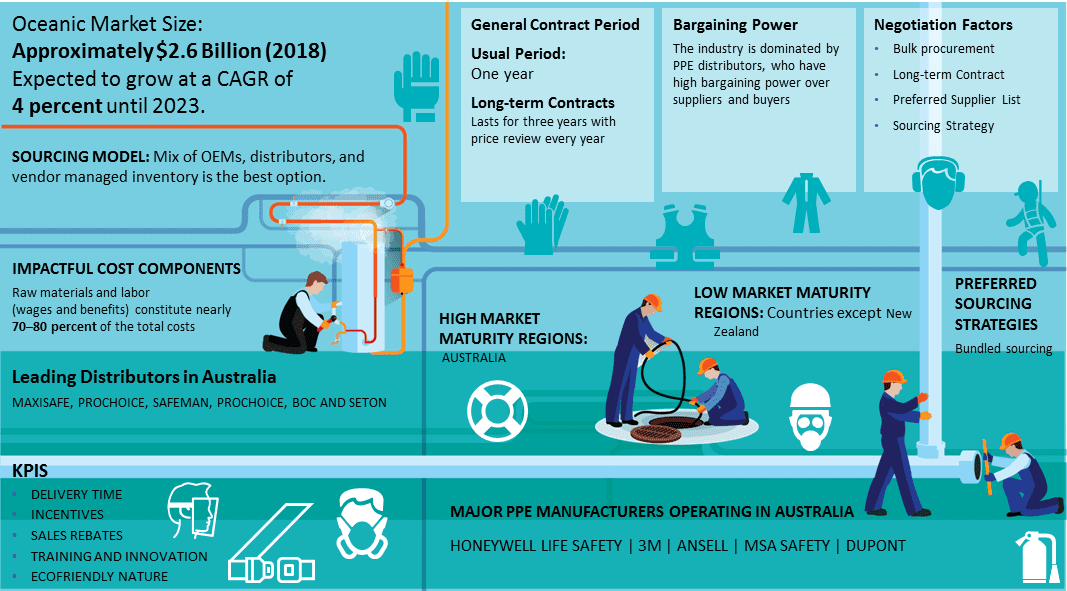

Regional Market Outlook on Personal Protective Equipment Australia

- The Oceanic PPE industry has fragmented supply market and is an import-driven market

- Major markets, like Australia and New Zealand, import most of the PPE requirements from the APAC countries, such as China, Indian, and Taiwan

- Another reason for this high imports is that China and Australia has Free Trade Agreement (FTA) and most of the OEMs of PPE have manufacturing bases in China and Taiwan

PPE Drivers and Constraints

The oil & gas and mining industries are important end-user industries for PPE market, due to high level of occupational hazards

Drivers

- Improved regulations, such as laws on health and safety (occupational safety) in the work place, and employee safety programs by various governments have increased the awareness of PPE products, which, in turn, increases the demand for PPE

- Increasing demand for coal mining in China and Taiwan will drive the demand for PPE

Constraints

- Increasing use of green energy sources and biofuels, due to environmental concerns, related to greenhouse gas emissions

- Fluctuating raw material prices

- The other major constraints of the PPE industry are the quality and regulation aspects for these products (which vary according to regions), which force manufacturers to adhere to required specifications. These aspects generally affect the growth of the industry

- The slowdown in major end-use sectors, like chemical and mining, is expected to reduce the demand for the industry, especially with protective apparels and head protection equipment

Porter's Five Forces Analysis: PPE Industry

Supplier Power

Penetration from Low-cost Country Manufacturers

- Increased imports from low-cost countries, such as China, Malaysia, and Taiwan, lower the market price of PPE products, thereby reducing supplier power, due to competitive supply base shift

- In regions, like Africa, supplier power is low, due to imports from neighboring regions and in regions, like North America and Europe, the supplier power is high, hence, making the overall supplier power medium across globe

Low Product Differentiation

- Product differentiation is comparatively lower, as these products are regulated and standardized, which leads to low bargaining power

Dependency on Distributors

- The manufacturers are mostly dependent on local distributors, owing to their strong logistical network and assurance of continual supply to buyers

Barriers to New Entrants

Regulated Industry

- The industry is highly capital intensive and regulated

Brand Identity

- Brand identity is very high in this industry. Major players have established brand names, which increases the barriers to new entrants

Intensity of Rivalry

Fragmented Industry and Competitiveness

- The PPE industry is highly fragmented, and the competition is in terms of pricing and product ranges

- Imports from low-cost countries have intensified competition among domestic players

Distribution Channel

- The predominant distribution channel to the buyers are through local distributors and agents, who have higher share of the profit margins

Threat of Substitutes

Bargaining Power

- The buyer has high negotiation power because of high spend, as PPE is the major requirement in mining industry, where higher proportion of labor force is engaged, and there exists intense competition among PPE suppliers (as the supply base is highly fragmented)

Procurement from Distributors

- The buyer relies heavily on the distributors and agents for the supply of PPE products

Uninterrupted Supply

- The manufacturer's lead time is around 16 weeks for PPE products, hence, buyers are dependent on distributors for a continual supply of products

- Distributors usually stock enough supplies in their large warehouses for buyers, which are available any time, giving them more bargaining power over buyers

Personal Protective Equipment Australia Market Overview

- The supplier base is very fragmented, many small-scale manufacturers and distributors from the APAC region are supplying to the demand from the Oceanic region.

- Buyers have medium maturity, but because of stringent industry regulations, along with a growing concern regarding occupational illness and injury cases, the buyers are increasingly aware of the importance of the use of PPE products

- Oil and Gas: It’s one of the largest end-user industry

- Construction: Overall construction growth is expected to remain largely static in Western Europe through 2016, with Poland, Germany, and the U.K. showing slow signs of recovery, which may slow down the growth in demand for PPE products, such as fall protection gear, hard hats, safety glasses, long trousers, safety vest, and steel toe boots

- Chemical: The chemical industry is steadily generating demand for PPE products, such as waterproof suit/gloves, chemical-resistant apron, footwear/hood

- Healthcare: The healthcare industry is growing at a rapid rate, resulting in high demand growth for disposable gloves, face mask, hair net, full cover apparel, respirator, safety glass, splash apron, safety shoes/covers, and hearing protection.

- Respiratory protection is the largest segment and is expected to grow at the highest CAGR, due to government regulations in the harsh working environment

- Protective clothing is expected to grow at a CAGR of 14 per cent between 2017 and 2023

- Hand and arm protection are not only used to protect an individual from hazards or injuries but also enable comfort during the work

Why You Should Buy This Report

- Information about the Australian personal protective equipment market size, outlook, market maturity, demand, trends and implications, etc.

- Drivers and constraints, regional market outlook and Porter’s five forces analysis of the Australian PPE market

- Supply trends and insights, market innovation, key vendor list, etc.

- Cost structure, breakup, pricing analysis, etc.

- Sourcing models, negotiation strategies, etc.

Click to know more about global personal protective equipment

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now