CATEGORY

Industrial Supply, Hardware & Fasteners Product Categories

A fastener is a hardware device that mechanically joins or affixes two or more objects together. In general, fasteners are used to create non-permanent joints; that is, joints that can be removed or dismantled without damaging the joining components.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Industrial Supply, Hardware & Fasteners Product Categories.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

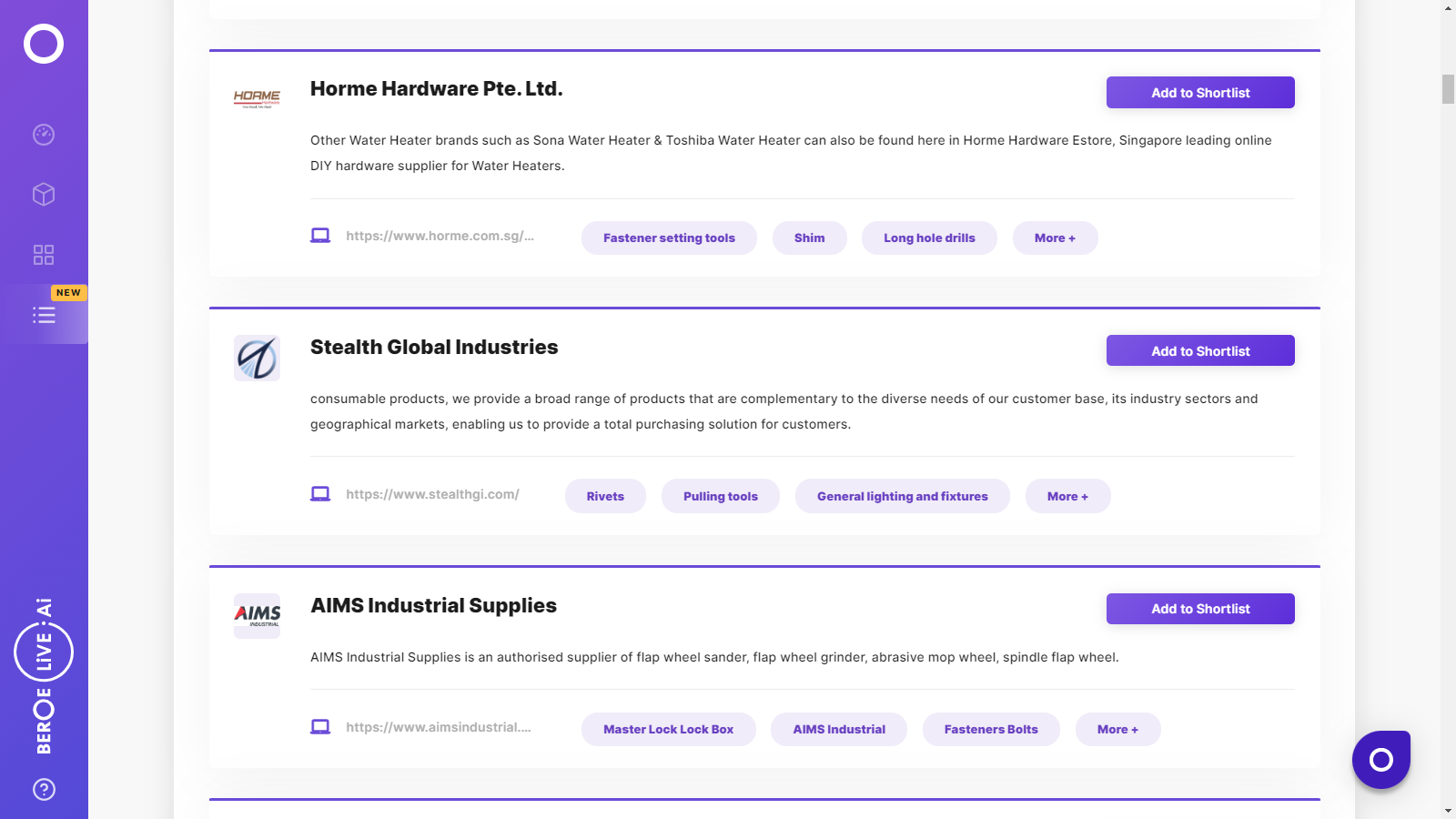

Industrial Supply, Hardware & Fasteners Product Categories Suppliers

Find the right-fit industrial supply, hardware & fasteners product categories supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Industrial Supply, Hardware & Fasteners Product Categories market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoIndustrial Supply, Hardware & Fasteners Product Categories market report transcript

Market outlook on Industrial Supply, Hardware & Fasteners Product Categories

The global MRO market for industrial supply, fasteners & hardware was valued to be worth $242 billion in 2016 and is expected to grow at a CAGR of 1.5 percent until 2020. This segment of the MRO industry is extremely fragmented and is competitively catering to a variety of industries with vast end-user segments and suppliers. Industrial supply, fasteners & hardware form approximately 35–45 percent of the overall MRO segment, in terms of revenue

Opportunities

North America

- Favorable supply and buyer landscape for implementing large MRO contracts, whereby helping buyer to achieve consolidation across categories

Latin America

- Owing to geographical proximity to North America, MRO contracts can be extended to Latin America in the long run

- Global players have a presence in major countries, such as Brazil and Argentina

Europe

- Suitable environment for implementing sub-regional MRO contracts across various geographies of Europe, thereby leading to supply base consolidation

APAC

- Bundling of categories across certain countries having high to medium level of supply base maturity can lead to some level of supplier consolidation

Middle East and Africa

- Owing to the relatively smaller market size (thus, buying volume), engaging with local suppliers in African regions will be financially beneficial for the buyer

Challenges

North America

- Implementing integrator model has its initial risk/challenges. The engagement model must be well planned and should be in a phased manner

Latin America

- Certain countries in Latin America have low supply maturity (Peru, Colombia, Venezuela, etc.) and even global MRO providers might not have presence in these regions. In such cases, a truly regional contract is not possible

Europe

- Fragmented levels of market maturity in Europe make it difficult to implement a single large contract across Europe. Integrator model cannot be entirely ruled out either

APAC

- Fragmented levels of market maturity make supply base consolidation difficult to attain

- Low levels of technology adoption in these areas translate to less efficient processes in terms of services and KPIs

Middle East and Africa

- Lack of presence of global suppliers will lead to service quality inconsistency

- Low level of technology penetration in Africa will result in decreased service quality

Past Trends and Future Outlook: Developed Regions

North America

Current Trends

- Around 56 percent of the total MRO sales in the US is contributed by industrial supplies, and 30 percent by clean room and lab supplies

- Smaller distributors are under pressure to differentiate themselves and stay competitive, these players have consolidated together and formed an association like IDG to offer their service to the customers

Future Outlook

- Large number of M&A's is expected, which will increase market share of big suppliers, like Grainger (currently less than 5 percent), hence increasing the market prices

- Existing suppliers are focusing on customers, by offering services, such as e-commerce, inventory management, and vending machines

- Only 10 percent of the total MRO market in the US is serviced by integrators currently, which is expected to grow by 10–15 percent for the next three years

Europe

Current Trends

- Considerable increase in MRO demand has been obtained from end-user segments, such as pharmaceutical, machine building, metal works, automotive, and heavy manufacturing industries

- E-Procurement adoption in the European region has been as low, ranging between 5 percent and 10 percent. The Nordic region in the European market has made maximum progress in adopting E-Procurement, due to better usage of working capital and cost savings, due to improved carbon footprint

Future Outlook

- The MRO market is expected to grow at a slow pace of 2–3 percent per year across Europe, due to the volatile economic condition

- Many companies are investing in the e-commerce channels and adopting the best practices from the US, which enables in seamless integration

- Multinational European suppliers are expected to increase their footprint in, dominated by regional suppliers

MRO Segment Focus: Industrial Safety and Tools

Segment Overview

- The industry is fragmented and well established, with Asia as one of the fast growing markets for industrial MRO in countries, such as China, Japan, and India

- The automotive, manufacturing, and contractor customers provide a customer base with large-sized business to MRO integrators and distributors, and hence are the focus of the top MRO distributors, such as W.W Grainger

Category Trends

- The rate of increase in product portfolio of industrial distributors are high, especially by large distributors

- Safety and green are some areas introduced by distributors, such as Grainger, HD supply, and MSC Industrial supply, in order to meet customer needs

- Leading distributors are focusing on catering to a variety of industry segments by distributing more industry relevant tools, safety, and material handling equipment to their customers, with importance on reduction of cost

- M&A among industrial distributors has ramped up in 2012, a post recession recovery, and is expected to continue until 2014

- E-commerce is gaining popularity among smaller industrial distributors, while larger players, such as Grainger, are already having large sales figures from e-commerce

- The use of automated machines to stock high volume industrial and safety products have been introduced into the industrial MRO market

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now