CATEGORY

Industrial Valves

Industrial valves are used across multiple industries to regulate the flow and pressure of liquid,gas etc. within a industrial system

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Industrial Valves.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

FloWorks Acquires NetMercury

July 11, 2022FloWorks Acquires NetMercury

July 11, 2022FloWorks Acquires NetMercury

July 11, 2022Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Industrial Valves

Schedule a DemoIndustrial Valves Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Industrial Valves category is 7.50%

Payment Terms

(in days)

The industry average payment terms in Industrial Valves category for the current quarter is 75.0 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Industrial Valves Suppliers

Find the right-fit industrial valves supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Industrial Valves market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoIndustrial Valves market frequently asked questions

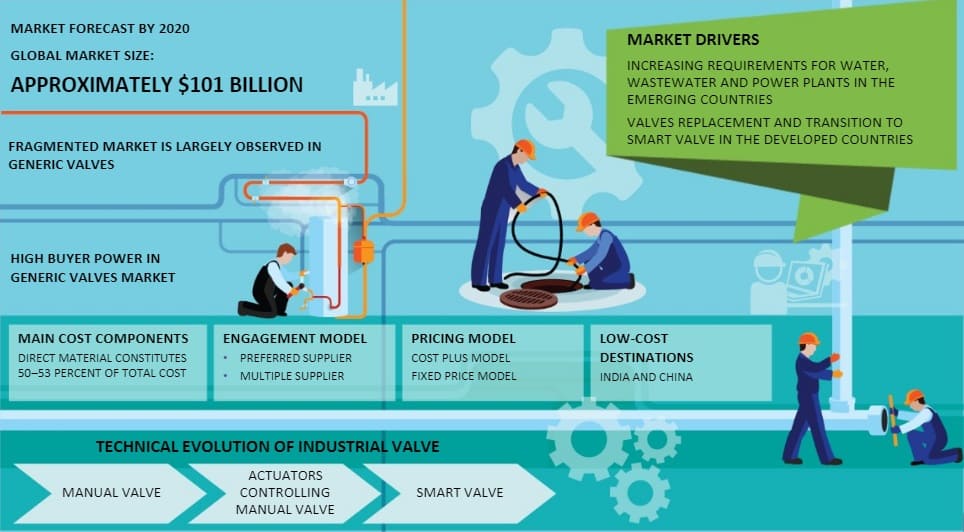

According to the industry analysis report by Beroe, the global industrial valves market size is expected to reach $101 billion growing at a CAGR of 4-5 percent from its earlier value of $83.5 billion in 2016.

The valve industry trends show that the main engagement models used in the industry are ' preferred suppliers and multiple suppliers. Mainly, the cost-plus model and fixed price model are used.

The key market driver in emerging countries is the increasing requirement for water, wastewater, and power plants, whereas, in developed countries, valve replacement and transition to smart valves are driving the market growth.

The markets in North America and Europe are increasingly adopting smart valve usage because they can control fugitive emissions, which is a crucial aspect of environmental regulations compliance. Besides, it also helps to ensure better health of the buyer's employees.

From Beroe's industrial valves market outlook report, the increased investment in infrastructure, such as power plants, water supply lines, sewage water treatment facilities, etc. will boost the growth of industrial valves in developing regions like LATAM, Middle East, Africa, and APAC.

According to Beroe's industrial valves market forecast and analysis, some of the constraints that the market faces comes from patent violation and copying the original technology by local players, unorganized labor market, and drop-in requirement from petrochemical industries.

Industrial Valves market report transcript

Global Industrial Valve Outlook

-

The global industrial valve market was estimated at approximately $93.6 billion in 2022E*, and it is expected to grow at a CAGR of 3–4 percent to $104.6 billion by 2025

-

Asia-Pacific, including China, is a major market led by rapid industrialization and with a parallel increase in industrial and manufacturing activity; investments in upgrading and replacing plant and production equipment are increasing as well

Global Industrial Valves: Market Maturity

-

Smart valves are increasingly being adopted in North America and Europe because of their ability to control fugitive emissions, which are required for compliance to environmental regulations, and also to ensure better health of the buyer’s employees.

Global Industrial Valves Regional Trends

-

Developing regions, such as LATAM, Middle East, Africa, and APAC, will boost the growth of industrial valves globally due to increased investment in infrastructure (power plants, water supply lines, sewage water treatment facilities, etc.).

Global Industrial Valves: Drivers and Constraints

-

Emerging countries provide a low-cost manufacturing base

-

These countries are also the potential demand markets due to the need for considerable investments in key areas like water, power, municipal waste water treatment, pipelines, etc.

Drivers

Market growth

-

Rapid urbanisation in developing regions has given rise to the need for power plant investments, leading to an increase in demand for industrial valves

-

Replacement of manual valves with smart valves drives the market in the developed regions

-

Process-oriented manufacturing units strive to continuously increase their operating efficiencies, resulting in increase in demand for valves

Stringent environmental and safety regulations

-

Environmental, health and safety regulations such as Volatile Organic Compound (VOC) limitations require the end-user industries to upgrade to new and better valves

Constraints

Duplication of technology

-

Patent violations and copies of the original by the local suppliers would hamper the growth of the valves market due to the copies being relatively cheaper

Labor disturbance

-

The labor market in emerging countries are mostly unorganized, and there are increasing occurrences of shutdowns leading to loss of productivity

Drop in requirement from petrochemical industries

-

The drop in oil prices has resulted in deteriorating margins, thus requiring petrochemical industries to reconsider capital spend, which led to a decrease in valve requirements from this sector

Why You Should Buy This Report

- It details the global industrial valves market size, maturity, valve industry trends, drivers and constraints, etc.

- It provides the regional market outlook on North America, Asia, Middle East, Europe, Africa and LATAM regions.

- The report does Porter’s five force analysis of emerging and developed industrial valves market.

- It gives insight into supplier trends and does a SWOT analysis of major players like Flowserve, KITZ, Metso, etc.

- It breaks down the cost structure and gives the pricing analysis and price forecast for industrial valves.

- The report gives information about the best sourcing and pricing models for the industrial valve market.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now