CATEGORY

Industrial Pumps

Industrial pumps are used across multiple industries in order to move many different types of fluids including water,chemical,petroleum,oil,slurry etc. from one point to another in the industry based on application

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Industrial Pumps.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

Grundfos quits Russia and Belarus

January 25, 2023Tencarva Machinery acquires Fischer Process Industries

August 24, 2022Atlas Copco completes acquisition of Lewa and Geveke

August 04, 2022Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Industrial Pumps

Schedule a DemoIndustrial Pumps Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Industrial Pumps category is 5.50%

Payment Terms

(in days)

The industry average payment terms in Industrial Pumps category for the current quarter is 90.0 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Industrial Pumps Suppliers

Find the right-fit industrial pumps supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Industrial Pumps market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoIndustrial Pumps market frequently asked questions

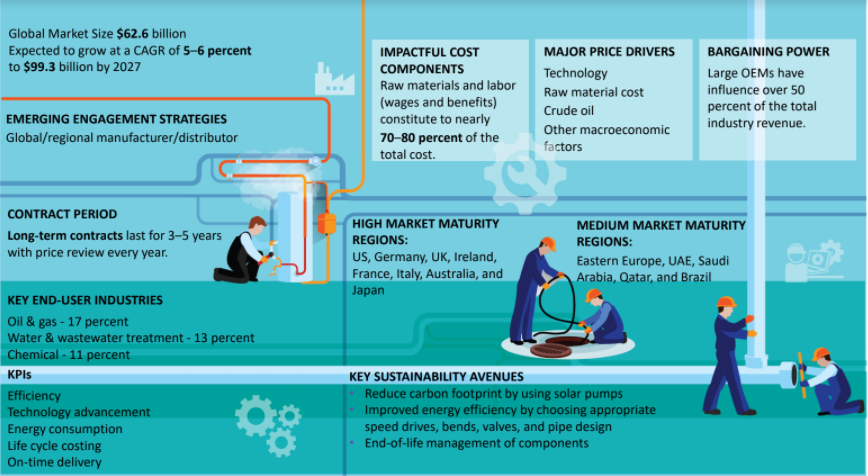

As per Beroe's analysis, the pump market is expected to grow at a CAGR of 4 ' 5 percent bringing the valuation close to $54.6 Billion. On a global scale, the APAC region is the largest demand-generating region capturing ~38 percent of the global market, followed by North America And Europe. The market is dominated mostly by the Tier-1 industrial pumps suppliers who produce pumps of high-quality and customize it as per requirements.

According to Beroe's pumps market report, countries like the U.S., Germany, UK, Ireland, France, Australia, and Japan fall in the segment of high maturity regions, while countries like Eastern Europe, Brazil, Saudi Arabia, UAE, and Saudi Arabia fall into the low market maturity region for the pumps industry.

The global pump market size is ruled by the APAC region at a whopping valuation of $19.2 Bn. The second place is captured by North America (~$9.4 Bn), followed by Europe and the Middle East ' Asia at a valuation of $8.9 Bn, and $8.8 Bn respectively.

Industrial Pumps market report transcript

Global Pump Market Outlook

-

The global pump market was valued at $65.12 billion in 2022(E).

-

The market is forecast to grow at a CAGR of 4–5 percent to $90–100 billion by 2028

-

The US held the largest share in the North American market in 2021.

Global Industrial Pump Market Maturity

-

The global pump market is estimated to be $65.12 billion in 2022 (E) and is forecasted to grow at a CAGR of 4–5 percent to $80–90 billion by 2028

-

Asia-Pacific accounted for the largest share of 43 percent in 2021

-

The pump market is extremely fragmented and competitive, catering to a variety of industries with vast end-user segments and suppliers

Global Industrial Pump Market: Drivers and Constraints

-

Raw material price fluctuation and environmental laws & regulations, with regard to water and waste disposal and air emission are the key constraints

-

Development activities in oil & gas, agriculture, construction and wastewater sectors are the primarily growth drivers of the pump industry

Drivers

-

Increasing oil & gas exploration activities in North America and the Middle East

-

Growing mining activities in the Asia-Pacific region

-

Emerging application of submersible pumps in wastewater treatment

-

Demand for Pumps from the Agricultural Sector – As a part of sustainable agriculture goal of UN, the growth in the agricultural sector with emerging farms and cultivation fields will warrant a heavy supply of pumps of various types, and the vendors in the pumps market will be reaping the benefits of this noticeable demand influx

-

There is a remarkable surge in the construction of commercial properties, such as malls and corporate offices - evidently, these buildings are incorporated with fire protection systems and sanitation system, which require pumps for the flow of water, which further flourishes the pumps market

Constraints

Raw material price fluctuation

-

Fluctuations in currency exchange rate, as well as fluctuations in raw material prices, risk net revenue and operating margin of global manufacturers, respectively

Regulations

-

Stringent environmental laws and regulations, with regard to water and waste disposal and air emission

-

Non-industrial pump manufacturers in developing countries enter the attractive industrial pump segment by taking advantage of their low-cost manufacturing base and distribution network. It indicates a major threat to global industrial pump manufacturers

Cost Drivers and Cost Structure : Industrial Pumps

-

Steel is the highly correlated material in the cost index of pumps followed by aluminium and copper. Though stainless steel is associated with manufacturing of industrial pumps. The trend of steel captures the material movement

-

The average electricity price decreased from 35.67 €/MWh in to 32.43 €/MWh in the quarter, which is a decrease of 9.1 percent over the previous month. The price decrease is due to the warmer weather in Europe compared to previous month, due to which there was decrease in the heating demand

-

Average wholesale electricity prices in the Euro Zone are expected to increase, as the reservoir levels will decline compared to the levels in previous year and this will trigger the price increase

Key Price Drivers : Industrial Pumps

-

The major factors affecting price points and margins are large volume orders, specifications of the product and quality of the product.

-

The variations in price points and margins between a local and global supplier are primarily due to quality and criticality in terms of specifications and operations.

Volume

-

The quantity and frequency of the order from a buyer significantly affect the conversion time for suppliers and hence affect pricing levels. For low to medium critical products discounts based on volumes can be provided by the manufacturer. For highly specification based and critical products volume discounts are tough to bargain with manufacturers.

Quality

-

The quality of the product is another attribute based on which price points and margins are arrived at by manufacturers. Global manufacturers use quality as a selling point for their products and similarly for their spare parts also.

Technical Specification

-

Products which need high-end customized specification based on criticality of operations have higher price points and margins and global manufacturers benefit from this attribute the most due to the ability to manufacture high critical specification driven products.

Why You Should Buy This Report

The report provides a detailed analysis of the global industry outlook and the various opportunities and challenges in the industrial pumps market. It also covers the key technological trends in the pump industry, including energy-efficient and renewable pumps, smart sensors & remote monitoring, predictive software, and engineered machined products (EMP). The report also discusses the procurement strategies and provides a comprehensive overview of major industry suppliers.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now