CATEGORY

Bearings

A bearing is a machine element that constrains relative motion to only the desired motion, and reduces friction between moving parts.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Bearings.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

World's Most Powerful Offshore Wind Turbine from GE, Haliade- X, Will Have Bearings From Timken

July 05, 2022World's Most Powerful Offshore Wind Turbine from GE, Haliade- X, Will Have Bearings From Timken

July 05, 2022World's Most Powerful Offshore Wind Turbine from GE, Haliade- X, Will Have Bearings From Timken

July 05, 2022Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Bearings

Schedule a DemoBearings Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoBearings Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Bearings category is 2.50%

Payment Terms

(in days)

The industry average payment terms in Bearings category for the current quarter is 45.0 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Bearings Suppliers

Find the right-fit bearings supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Bearings market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoBearings market frequently asked questions

According to Beroe's bearing market news report, the United States, Japan, and Germany are the top three bearing manufacturing countries globally. Out of these, China is known to be rapidly increasing its presence.

The demand for bearings is highest in Asia with valuation being higher than 50 percent. The contributing factor is the increase in automobile production followed by industrialization in developing nations like China, India, and South-East Asia.

The net contribution made by the top six suppliers is more than 65 percent of the market share and this high valuation has consolidated the overall supply landscape of the bearings market.

According to the bearing market size analysis done by Beroe, multiple factors push the growth of bearing marketing on a global scale. Here are the primary reasons: - The automobile industry is the highest revenue-generating industry right now and the rapid growth of vehicles produced worldwide is further contributing to the growth of the bearing market. - Continents like Europe, America, Africa, and Asia-Pacific promise a considerable rise in bearings demand since the demand for two-wheelers and passenger cars is on the rise worldwide. - To meet industry demands and requirements in hi-tech applications, tech-oriented industries like aerospace, defense, robotics, etc. require heavy-duty, SMART, and durable bearings. This further bolsters the demand for bearings.

The main factors challenging the growth of the bearings market are: - The arrival of new key players in the market with cut-to-cut pricing and tough competition brought the bearing prices down - US manufacturers are seeing a rough competition from low-cost imports coming from developing countries within the APAC region - The counterfeiting of products has hit the bearing manufacturers badly and thus they are collaborating with channel partners to combat the growing menace.

Bearings market report transcript

Market Overview–Global Bearings Market

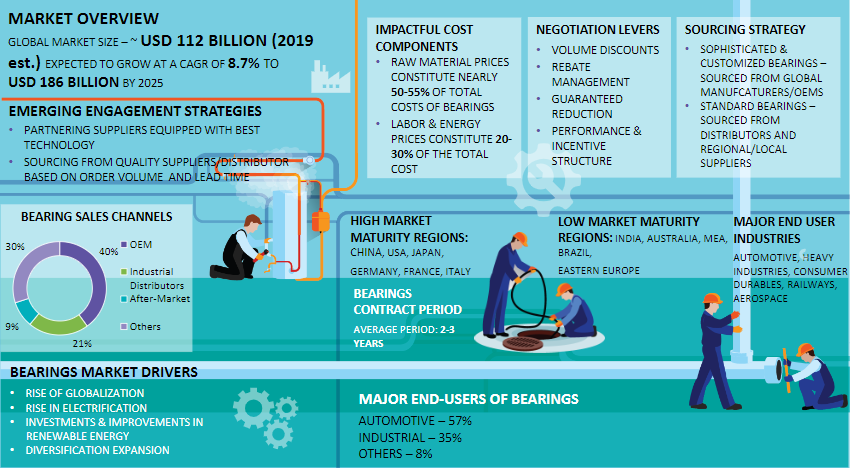

The global bearing market was estimated to have declined by 1 to 3% in 2019 as compared to the previous year. This decline was mainly due to weak demand in the automotive market, but also in off-highway and machine tool markets. However, strong growth was witnessed across renewable energy and railway sectors in the same year.

Asia-Pacific is the biggest market for bearings due to strong demand from multiple industrial sectors such as, machinery, construction, automotive, aerospace, defence, etc.

Suppliers

● The top suppliers of the bearing market include Schaeffler, SKF, NTN, and JEKT among others.

Market Dynamics–Drivers & Constraints

Drivers

Growth of Automotive Industry

- The global automotive industry is currently, one of the highest revenue generating industries in the world. The rising production of vehicles worldwide is pushing the growth of bearing market

- In the coming years, automotive bearings demand is expected to rise in Europe, Americas, Africa, and Asia-Pacific especially. This is because the demand for vehicles, mainly passenger cars and two wheelers are witnessing a constant rise worldwide

New Technological Developments

- The technology oriented industries such as, aerospace and defense, robotics, medical, etc. have witnessed a huge demand for effective, heavy-duty, SMART, and durable bearings in order to meet industry standards and demand across critical and hi-tech applications. So, a rising demand for bearings from these industries are also expected to drive the demand for bearings globally

Investments and Improvements in Renewable Energy

- In the wind energy sector, bearings are the most important components used in wind turbines. These bearings require designs that can optimize reliability and provide economic efficiency depending on the applications

- The present wind energy market is witnessing a lot of investments due to ongoing projects and innovations in wind power generation and transmission such as power transmission.. The market for wind energy is driven by China and India significantly in the Asia-Pacific region

Diversification Expansion

- The end user markets served by bearings distributors have witnessed wild swings in demand since the recession. As a result, many distributors have been expanding their target markets. Key targets for growth areas includes; food and beverage, automation, manufacturing, and energy

Constraints

Dropping Market Share

- The influx of new players with aggressive pricing and lower cost structures has caused bearing prices to drop considerably

- Manufacturers from the USA are facing increased competition from low cost imports from developing countries, especially from APAC

- The turbulence in the global industrial sector has restrained the bearing market growth. The market witnessed a decline in 2016, however, there was a recovery of the bearings market in 2017

Increasing Concern over counterfeit products

- Nearly every major bearing manufacturer has been hit over the last few years by counterfeiters – and as a result, they're working with channel partners to combat the growing issue (e.g. SKF )

- For example, NSK provides training to its distribution network on “how to identify and address counterfeiting activity of bearings”

Market Outlook

● Bearings are used in a wide range of applications. They are used in machinery and equipment. They are used in household appliances, automobile parts, and farm equipment among others. The automotive bearing market and engine bearings market will likely see an improvement in demand.

● The ball bearings, including groove bearings, are being increasingly used in the automobile market.

● Roller bearings, both taper bearings and needle bearings, are one of the fastest growing in the global bearings market according to industry intelligence.

● According to experts, the bearings which have low maintenance and are highly efficient will witness a growth in demand from various industries.

● Industry-specific bearing solutions can help propel the growth of bearings in the next 10 years. India and China will emerge as leaders in propelling the growth of the bearings market due to continual high growth in these regions. These regions will specifically be focused on vehicle-production and industrial-machinery.

● The bearings industry can also be impacted by Capex and MRO because MRO is directly linked to the bearings industry.

● Manufacturers of high performance products are increasingly using lightweight materials and in this case the bearings industry will get a boost too.

● Technological innovations and advancements, especially in seal and lubrication technologies, will witness a growth according to bearings industry experts.

● Specialized bearing solutions are likely to witness a high growth due to an increase in the demand.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now