CATEGORY

Industrial Valves Australia

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Industrial Valves Australia.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Industrial Valves Australia Suppliers

Find the right-fit industrial valves australia supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Industrial Valves Australia market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoIndustrial Valves Australia market report transcript

Regional Market Outlook on Industrial Valves

Digital technologies are playing a important role in improving performance through new applications developed for improving productivity and efficiency in the field.

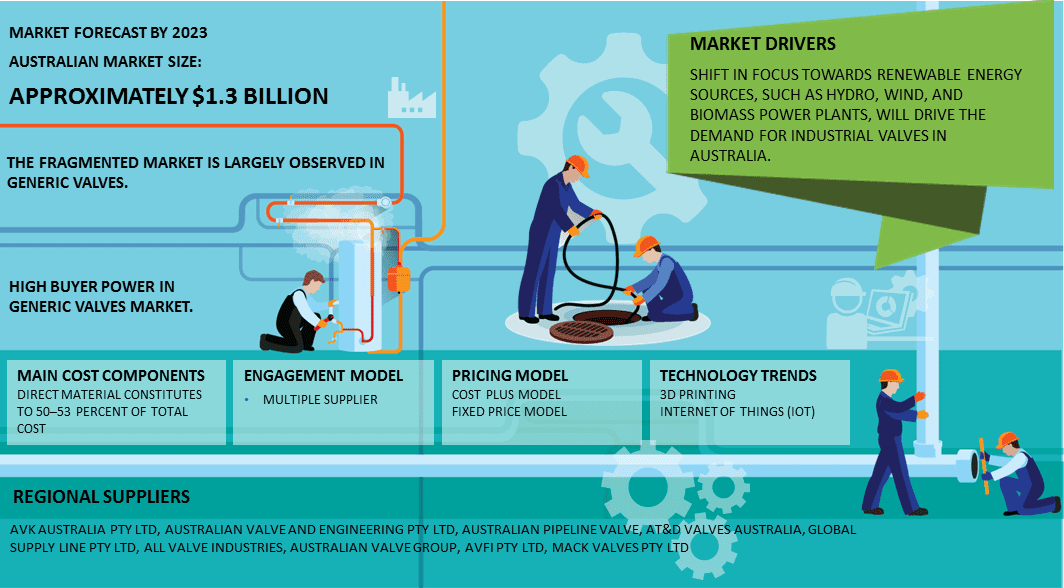

- Using 3D printing for manufacturing valves will aid in cost savings and save lead time and help in building complex design valves efficiently.

- IoT can be used to mange the plant effectively by leveraging IOT in the form of wireless drill sensors to detect failures in valves before they lead to shutdown or spill.

- Simulation software can be used to analyze and test various solutions without building and testing multiple designs and prototypes.

- The demand for smart valves continue to grow at a faster phase, due to its feature to monitor pressure, temperature, flowrate changes along with instant transfer of information, like diagnostics, control instructions, documentation between the valve and control room

Australia Industrial Valves: Drivers and Constraints

Growing water and wastewater management industry in Australia will boost the demand for industrial valves in this region.

Drivers

Market growth

- Shift in focus towards renewable energy sources, such as hydro, wind, and biomass power plants will drive the demand for industrial valves

- Replacement of manual valves with smart valves drives the market in this region

- Increase in production of Liquid Natural Gas (LNG) in Australia, due to technological advancements and the government's efforts to enable Australia to achieve the top position will drive the demand for industrial valves

Stringent environmental and safety regulations

- Environmental, health, and safety regulations, such as VOC limitations, require the end-user industries to upgrade to new and better industrial valves

Constraints

Duplication of technology

- Patent violations and copies of the original by the local players would hamper the growth of the valves market, due to the copies being relatively cheaper

Labor disturbance

- The labor market in emerging countries is mostly unorganized, and there are increasing occurrences of shutdowns, leading to loss of productivity

Porter's Five Forces Analysis: Australia

Supplier Power

- In developing markets, fewer suppliers have the capability to cater to the quality standards required in oil & gas. In such cases, supplier has medium bargaining power

Barriers to New Entrants

- Barriers to new entrants will be huge investments, technical expertise, product offerings, distribution network, and gaining buyer confidence

Intensity of Rivalry

- The market is highly fragmented

- Consolidation of market is happening with advent of global supplier into developed markets by means of M&A

- With the entry of global players into the market, competition has increased and local players are adapting newer technologies to stay competitive

Threat of Substitutes

- There is no substitute for pipes, valves, and fittings

- Constant innovation is yet to emerge in this segment, which will lead to adoption of automated valves

Buyer Power

- Switching cost to a buyer is low in the case of generic products. In the case of the oil & gas industry, which is the largest contributor to the valves industry, the buyer has higher bargaining power, due to high volume of purchase

Industrial Valves Australia Market Overview

- Increase in M&A - Global distributors are enhancing their product portfolio through M&A to achieve greater market share and to enter new markets

- Emerging markets - Australian markets have high potential to grow, due to huge investment in water management, etc.

- Eastern and Western Australia has a concentration of global and regional suppliers

- The industry is highly fragmented in nature, and the fragmentation can be seen highly in generic products

- Price wars can benefit the buyer

- Low on technology implementation - Technology implementation is capital intensive; hence, most of the players are using the old technology in manufacturing gas-based Midrex, Hyl processes, etc.

- Most adopted model: Multiple suppliers

- Pricing strategy: Cost-plus model is the preferred strategy.

- Labor costs have a minimal increase in many developed economies where highly engineered castings are made.

- Raw material prices are sensitive, and any upward movement of price is transferred to the buyers, as future trading or hedging of essential raw material is a rare practice among valve manufacturers.

- Material is the major cost driver of the valves, and it accounts for approximately 50–53 per cent of the total cost.

- The application of the valve determines which material should be used as different materials have their own unique properties.

- The pricing of the valve is dependent upon the criticality of the application, such as fluid that passes through it, pressure rating, degree of corrosiveness, need for automation, etc.

Why You Should Buy This Report

- Information on the Australian industrial valves market, including the technological trends, drivers and constraints, regional market outlook, etc.

- Porter’s five forces analysis of the Australian industrial valves market.

- Supply trends and insights, profiles and SWOT analysis of key players like Hofmann, Australian Pipeline Valve, AT&D Valves Australia, etc.

- Cost structure, pricing analysis, price forecast, key success factors, etc.

- Cross-industry analysis, sourcing models, pricing models, KPIs and SLAs.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now