CATEGORY

MRO Mining

This refers to all MRO OEM and Non-OEM spares and industrial supplies related to mining industry

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like MRO Mining.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

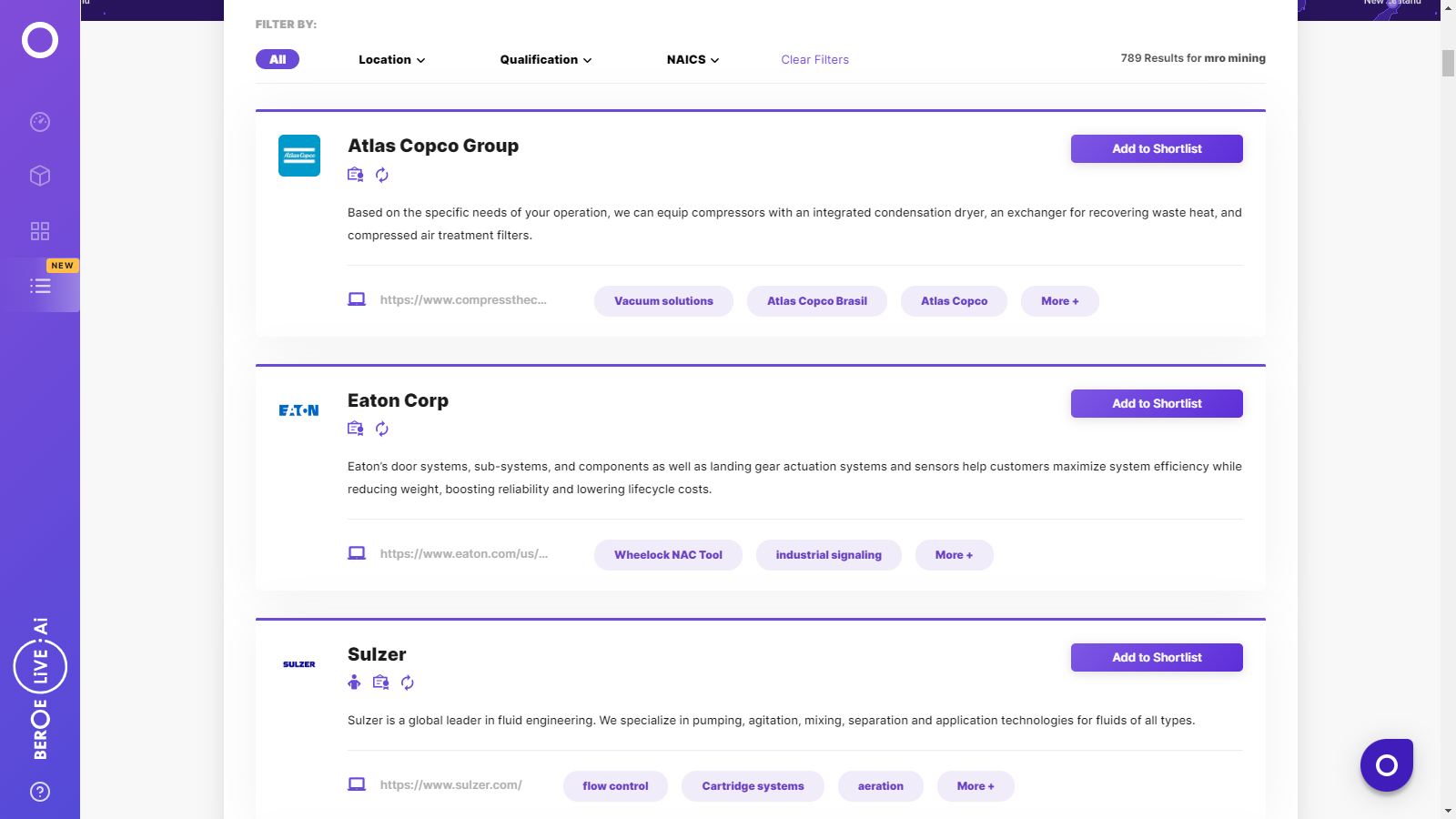

MRO Mining Suppliers

Find the right-fit mro mining supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the MRO Mining market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoMRO Mining market report transcript

MRO Mining Regional Market outlook

- The total global mining equipment service market which includes HME(Heavy Machinery Equipment), Mining Equipment, Mining Auxiliaries was valued at $137.1billion in 2016 and is expected to grow at a CAGR of 3-4 percent to $158.1 billion in 2018

- Equipment service market is highly fragmented, however for mining equipment the OEMs and its authorised dealers constitutes the majority of the market share followed by Global Distributors .North America, Australia are the major regions for mining services

- The total global Heavy Machinery Equipment (HME) service market was valued at $31billion in 2016 with a forecasted growth of 3-4 percent CAGR to $33 billion in 2018

- Equipment service market is highly fragmented, however for mining equipment the OEMs and its authorised dealers constitutes the majority of the market share followed by Global Distributors Key Takeaway

Global Maintenance Service Market Maturity

- The repair and maintenance market is fragmented, since service portfolio of equipment service providers are not diversified covering all range of equipment categories

- Maintenance services demand is not much affected by slowdown in mining industry and the falling commodity prices. To improve the equipment life and performance by reduced the down time, mining companies have to keep up the maintenance activities on

Global Market Overview for Mining Equipment

- Global Mining Equipment market was worth $66.7 billion in 2014 and is expected to grow at a CAGR of 8.1 percent and reach $84.2 billion by the end of 2017. APAC accounted for over 59 percent of global mining equipment demand in 2014, and demand is expected to grow at an estimated CAGR of 8.42 percent during the forecast period

- Surface mining equipment accounts for approximate 36 percent of the global mining equipment market and is expected to remain in the similar range (34 percent to 38 percent) until 2017.

- Due to depleting ore grade in surface mines, global mining is witnessing an increasing shift towards underground mining. Demand for underground mining equipment is expected to grow at ~5 percent CAGR compared to that of surface mining equipment at 7.6 percent until 2017

Global Market Overview for Equipment Maintenance Services

- Demand for the machinery maintenance and heavy equipment repair services industry is steadily recovering from severe losses during the recession in last decade

- The equipment repair and maintenance service industry is extremely fragmented and competitive catering to a variety of industries with vast end- user segments and suppliers. Hence, it provides opportunities to lower costs in every market where a business operates

- Service portfolio of equipment service providers are not diversified covering all range of equipment categories, mostly suppliers specialize in particular range of equipment

- For mining sector OEMs have the major hold on the service market followed by the OEM authorized service providers and the third party vendors

- The countries contributing to major demand are emerging market, such as Australia, China, India, Chile, Brazil, Ghana, Nigeria and other African continent due to increasing mining activities to support market demand

- The aftermarket demand for mining equipment declined in North America and Europe with the after effects of the global recession while Asia witnessed steady increase in after market demand

- Service providers are expected to involved in more mergers and acquisition to increase their geographical presence and further vertical integration in their operation

Cost Structure Analysis

MRO is generally categorised into segments to ensure ease of sourcing and management. The parameters that determine the categories are as follows:

- Ability to consolidate sourcing based on distributors catalogue

- By the nature and purpose of products

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now