CATEGORY

Fasteners

A fastener or fastening is a device that mechanically joins or affixes two or more objects together, in general fasteners creates temporary joints. These were used in various industries like Automotive, Industrial, Construction and others

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Fasteners.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

NORMA Group receives major order for joining solutions in electric cars

March 07, 2023EFC International acquires Inventory Sales Company

March 07, 2023SPIROL acquires Ford Aerospace

March 07, 2023Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Fasteners

Schedule a DemoFasteners Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoFasteners Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Fasteners category is 4.50%

Payment Terms

(in days)

The industry average payment terms in Fasteners category for the current quarter is 73.3 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Fasteners Suppliers

Find the right-fit fasteners supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Fasteners market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoFasteners market frequently asked questions

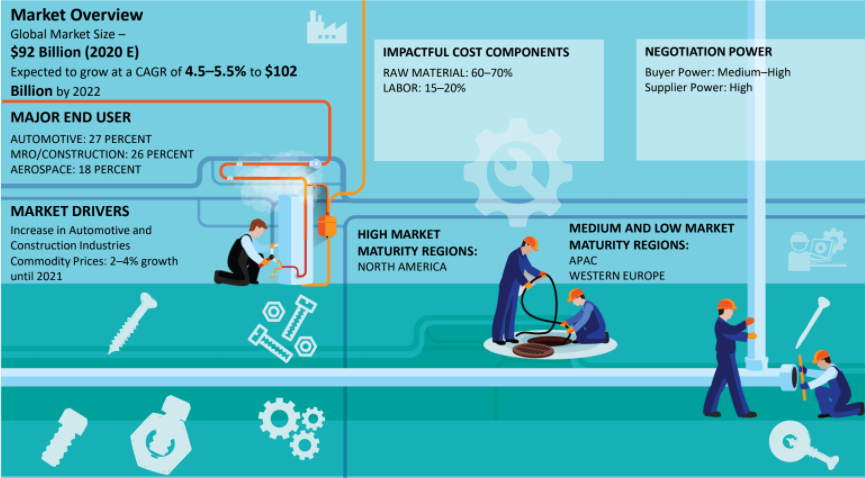

According to Beroe's fastener market analysis report, the market was estimated at $95.24 billion in 2019.

The global fastener market is driven by the following factors. ' Increase in automotive and construction industries across major economies driving the demand for metals, thereby supporting the fastener market growth ' 5-6 percent growth in the commodity prices

The major end-users in the global fastener industry are - automotive at 27 percent of the total market, MRO/ construction at 26 percent, and aerospace at 18 percent.

ITW, Precision Castparts, Alcoa, LISI, and NIFCO are the top global suppliers in the fastener industry.

The impactful cost components in the fasteners market are raw material (60-70 percent) and labor (15-20 percent).

According to Beroe's industry analysis, the global fastener market size is expected to reach $110.2 billion by 2021 growing at a CAGR of 5-6 percent.

In the coming years, the APAC will have the highest demand for standard fasteners due to the increased demand for construction, maintenance and repair activities and automotive industry growth in the region.

China, India, South Korea, Brazil, Thailand and Saudi Arabia will the major demand areas supporting the overall growth of the fasteners market.

The competition is fierce among local manufacturers as well as among different countries because the six biggest fastener suppliers (ITW, Precision Castparts, Alcoa, LISI, NIFCO, and Stanley Black & Decker) occupy around 13.6 percent of the market share at a global level. Besides, the market is slightly capital-intensive which is a stiff barrier for the local fastener manufacturers.

' In the first quarter of 2017, Stanley Black & Decker acquired the tools business of Newell Brands for $1.95 billion. ' The US Court of International Trade upheld the US Department of Commerce decision that imposed anti-dumping duties on Stanley Black & Decker on the nails originating from China.

Fasteners market report transcript

Global Fasteners Market Outlook

-

Global manufacturing is on the path to recovery post the Covid-19 pandemic. However, the overall production targets for 2022 for major industries have been lowered due to the production losses caused by temporary halts and lockdown measures

-

APAC is expected to remain the dominant region for the global fasteners market with automotive, construction and aerospace industries driving the fastener demand. Zero COVID policy and Russia-Ukraine war have created an impact on the supply market; thereby causing lead time delays and price increase

Industry Drivers and Constraints : Fasteners

-

Fasteners industry is witnessing consolidation, with large manufacturers growing further, and small manufacturers being specialized and flexible are expected to remain healthy in terms of growth but would remain small

-

Aerospace and automotive to remain the key fastener demand drivers in North America and EU

-

Potential impact of new variant of infections, supply chain issues, labor shortage will lead to longer lead times, and delay in final production.

Drivers

Increase in demand from medical industry

-

The industry has seen an increase in demand for fasteners is the medical device industry. Respiratory systems and monitoring equipment, such as ventilators, all require very specific assembly, including fasteners.

-

Additionally, with the new infrastructure law now signed by President Biden in the US, the industry is likely to see demand increase rapidly for domestically manufactured fasteners.

Innovation in Materials and End-use Process

-

Increasing developments in fastener materials to support performance-based demand from key end use applications to support the global fastener market

Constraints

Zero-COVID policy in China

-

The Zero-COVID policy in China has significantly impacted the fabrication supply market; thereby leading to lead time delays and supply chain constraints

Impact due to Russia-Ukraine war

-

The Russia–Ukraine war has impacted the raw material supply (Copper, Aluminum, etc.), as Russia accounts for about 6 percent of global aluminum production and about 4 percent of global copper production

Supply Chain and Freight Issues

-

Due to the recent lockdowns in China, lots of shipments are being delayed, due to port congestion, and suppliers find it challenging to ship the fasteners components to Europe and US from Asia. To counter this, European suppliers are bringing home production, which will increase the demand in Europe

Fasteners Market Size and Trend

The overall key demand for industrial fasteners is expected to be led by the MRO, Construction, and Automotive industries from the APAC region.

Global Market Outlook:

-

The global market for industrial fasteners is estimated at $99.8 billion in 2022, and the same is expected to grow at a CAGR of 3.5-4 percent to reach $109.7 billion by 2024 mainly driven by the demand from automotive, electrical and electronics, construction, aerospace, and machineries industries

Key Market Trends:

-

Anti-dumping duties on China are leading to companies turning to fastener manufacturing companies in Turkey, as Turkey has direct connection via road route towards Europe, so freight issues are expected to be less

-

Currently, there are logistics issues with companies running multi source strategy, along with China- structural, multi sourcing, along with preventing purchasing

-

Companies are bringing home production to Europe, which will increase demand in Europe. However, this will result in unpredictability and lead times will go higher when sourcing from Asia, which has happened for last 20 years, and will have direct impact on the European manufacturers

Industry Best Practices: Engagement Models and Contract Terms

Engagement Models

-

Major end-use industries prefer to have a long-term total service contract, which give the manufacturers a clear insight on the company’s long-term requirements

-

Supplier-managed inventory services: Major distributors support supplier-managed inventory service, along with logistics to its customer. This approach eliminates non-value-added activities, like inspection, material handling, while reducing inventory

-

Kitting services: Major industries prefer kitting services, which allows to group various components and fasteners together to keep the production more organized and efficient

Contract Description

-

Prices vary, depending on the fastener specification (standard/special/tailor-made product), market conditions of the region

-

Typical long-term contract (1–3 years), fastener manufacturers prefer a monthly schedule for the supply of screw, bolts/nuts/washers, anchors

Payment Options

-

Regarding payments, either the companies (buyers) can pay 100 percent payment, within 30 days of receipt and acceptance at site, or can pay 10 percent advance against pro forma invoice and balance 90 percent payment, within 30 days of receipt and acceptance at the site

Supply Trends and Insights : Fasteners

Supply Market Overview

-

Industrial Fasteners supply base is fragmented with suppliers serving to multiple industries such as Construction and Building, Automotive, Aerospace, etc.

-

The market comprises of both manufacturers and distributors with both standard and customized fasteners

-

Nuts, bolts, screws, washers, anchors, etc., are the key product varieties of industrial fasteners

-

Supply base concentration is found to be relatively higher in countries such as China, U.S, India, etc.

Supply Capabilities

-

ITW, Precision Castparts, Alcoa (Arconic), LISI, NIFCO, and Stanley Black & Decker are the top global manufacturers who together account for ~15 percent market share at a global level. The market is moderately capital-intensive, which poses as a stiff barrier to the local or domestic fasteners manufacturers

-

Majorly, suppliers are found to have ISO 9001 quality certifications. Certification and Standards requirement vary by industry and are primarily required by the aerospace and automotive industries. Fastener Quality Act Compliant to ensure overall product quality management of the company. They are also becoming part of standard requirements for procurement.

Emerging Markets

-

Supply base is emerging in countries, such as Mexico, Poland, Czech Republic, etc., due to factors, such as increasing supply base concentration, low labor cost, access/proximity to OEM production hubs, etc.

-

The growing exports for fasteners products from Taiwan and Vietnam and the key trade partners include US, Germany, Netherlands, Japan, Canada, UK, Italy, Poland, Mexico, Sweden, Thailand, France, China etc.

-

Regional/local sourcing strategies post supply disruptions caused by the Covid-19 pandemic have been supporting the emerging supply bases mentioned above

Fasteners Industry Overview

Fasteners industry is raw material intensive. The industrial fasteners cannot be replaced, due to the specific nature of operations. However, the use of them may be reduced. Therefore, the threat of substitutes is determined to be medium. Major clients prefer to engage directly with a fastener manufacturer or through their sales offices for screws, bolts/nuts/washers, and anchors. These industrial fasteners suppliers have multiple sales offices in various countries around the world. The fasteners demand is driven, primarily by the volatility of commodity prices, including prices for coal, copper and iron ore, product lifecycle, competitive pressures and other economic factors, affecting the construction and equipment industry. Labor accounts for about 20 percent of the fastener manufacturing cost and increasing labor costs, and unionized labor environments are a risk to fastener manufacturers.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now