CATEGORY

Programmatic Buying and Digital Asset Management

Programmatic buying is the algorithmic purchase and sale of advertising space in real time through a bidding platform. The process involves the automation of buying, placement, optimization of media inventory.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Programmatic Buying and Digital Asset Management.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

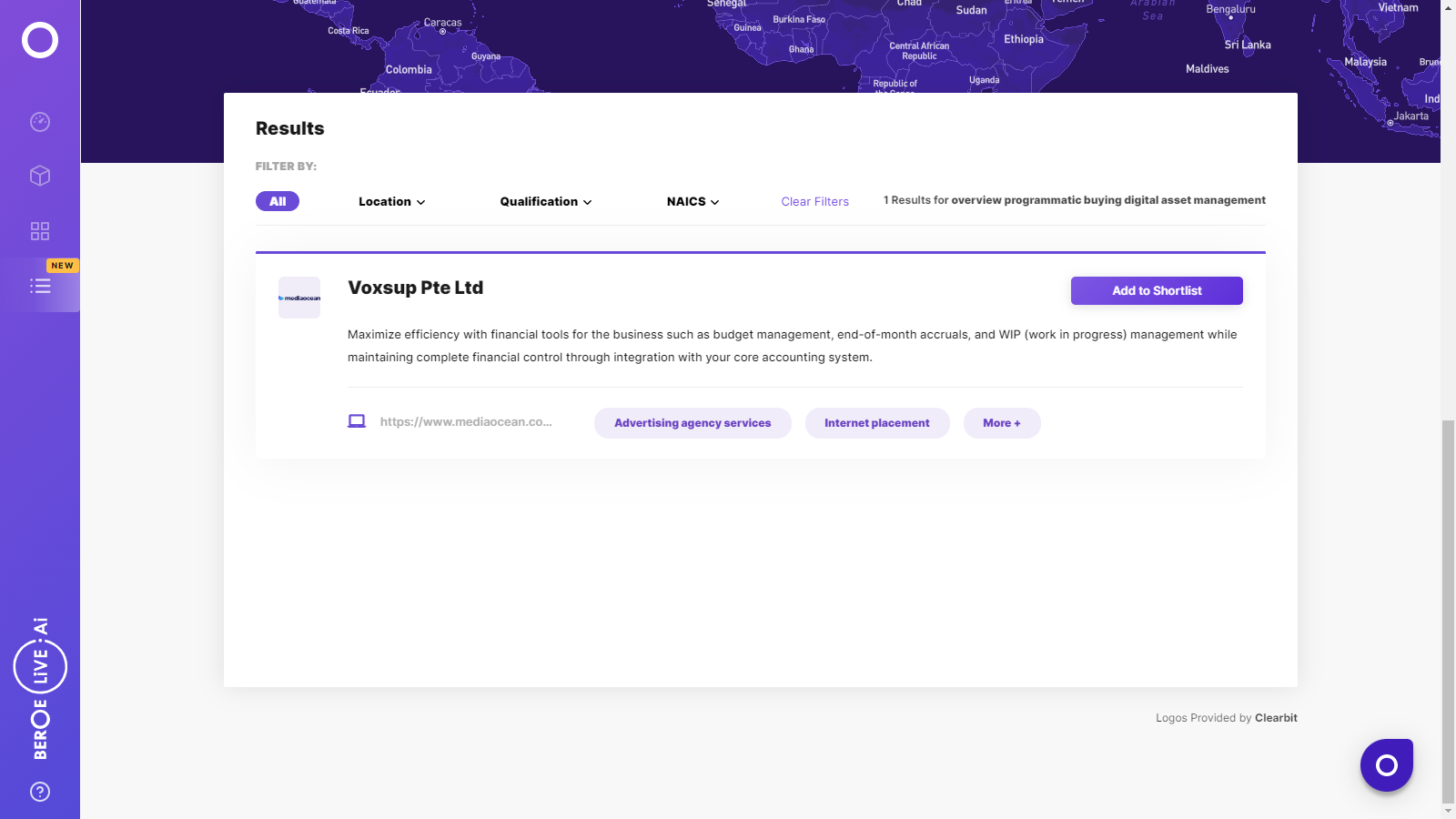

Programmatic Buying and Digital Asset Management Suppliers

Find the right-fit programmatic buying and digital asset management supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Programmatic Buying and Digital Asset Management market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoProgrammatic Buying and Digital Asset Management market report transcript

Global Market Outlook on Programmatic Buying and Digital Asset Management

Reduction in transection cost for both buyer and seller, opportunity to enhance monetization, effective targeting of ad campaigns, coupled with transparency involved in the automated buying process, is paving the way for tremendous growth of programmatic buying.

The US will continue to lead this pack. Mobile banner and video ads will attract maximum dollar spent in the coming years

Key Insights

- Market growth: Programmatic spend is blustering. The global market will be more than double by 2020, with promising growth rate of around 20% for the next 3–4 years

- Marketer are realizing number of benefits through programmatic buying that includes, but not limited to are

- Opportunity to reduce transaction cost

- Enhance monetization opportunity

- Improve efficiency of ad campaigns by using consumer data

- The US is by far the largest market of programmatic spend, owing to technological advancement. The UK and Germany managed to secure place in the top five positions, due to rising preference for display ads

- Banner and video ads on mobile device would be mostly traded through this platform. While video ad will expand its share to 52% by 2019, up from current 26% share

Programmatic Buying – Outsourced Model

Pros:

- Allows to consolidate global media account and leverages agency buying power

- Has access to premium inventory from global media owners

- Bespoke technology

Cons:

- Lack of transparency: The agencies do not disclose much information on their cost structure and cost of media

- Discounts from publishers may not be passed to the client

- Limited control and input by advertiser

Overall Media Cost under Outsourced Model

- Low cost is maintained, due to leverage of agencies media buying expertise and relationship with publishers

- Amortization of technology spread out over multiple clients allows agencies to spend a great percentage on the publishers. This does not imply that its expensive, they are bulk buyers, and therefore, high portion of the spend goes into the inventory

Channel Specific Trends

Mobile Search

- Advertisers are increasingly using ad extensions (e.g., click-to-call, map location, and ad site links) in the mobile paid search ads to improve CTR and conversions

- Limitation: The absence of mobile optimized landing pages in many mobile paid search campaigns is a major obstacle to increase conversions through the mobile search channel

Mobile Messaging

- Integrated campaign: Advertisers are using the SMS channel to attract in-bound text messages from users to avail mobile coupons or deals promoted via print or TV media

- Smartphone-specific MMS marketing (involving hyperlinks, images, videos, etc.) are practiced in mature markets, like the US, Western Europe, etc.

Mobile Rich Media and Video Ads

- Advertisers use rich media display ad formats (e.g., expandable and floating banner ads), which optimally use device features when delivering in-app advertisements for high-end smartphones

- Videos ads have stated gaining larger dollar share of overall digital ad spent

Category Definition – DMP

A DMP is a centralized DMP that allows the user to create target audiences based on a combination of in-depth first-party and third-party audience data. It helps in accurately targeting campaigns to these audiences across third-party ad networks and exchanges and helps them measure with accuracy, which campaigns performed the best across segments and channels to refine media buys and ad creative over time.

Benifits of DMP

Receive marketer's first-party audiences: Some vendors enable publishers to receive audiences of first-party data from marketers—in a privacy compliant way—provided that the marketer is on the same platform. The publisher can then target the precise audience the marketer is interested in and charge a premium as a result.

Segment audience data: By leveraging DMPs, marketers can effectively segment and analyze their target audiences by analyzing their own first-party data as well as supplemental third-party data. As they analyze the gathered visitor data (industry, interests, purchase history, etc.), marketers can develop audience segments and sell those segments to advertisers or other media buyers, enabling them to target consumers that fall under each segment category.

Understand your audience to increase CPMs: A good DMP will come with preloaded third-party data. A publisher can then use that data to unlock insights about her readers that could increase the value of those impressions.

Reduces waste: Marketers can use the tool to identify audience with the same demographics sourced from multiple touch points and avoid repetitive data, resulting in a more efficient budget allocation among media and data vendors.

Data security: Some vendors offer data protection enabling publishers to monitor potential data leakage.

Personalization: DMP can be used to personalize client's website and the subscription sign-up flow.

Audience analytics: The third-party data in the DMP can be used to better understand what type of users drive their most popular content.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now