CATEGORY

Outbound Contact Center Supply Market Overview US

Contact center, also referred to as a customer interaction center. And the e-contact center is a central point from which all customer contacts are managed. These calls include inbound calls, outbound calls, technical support etc.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Outbound Contact Center Supply Market Overview US.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

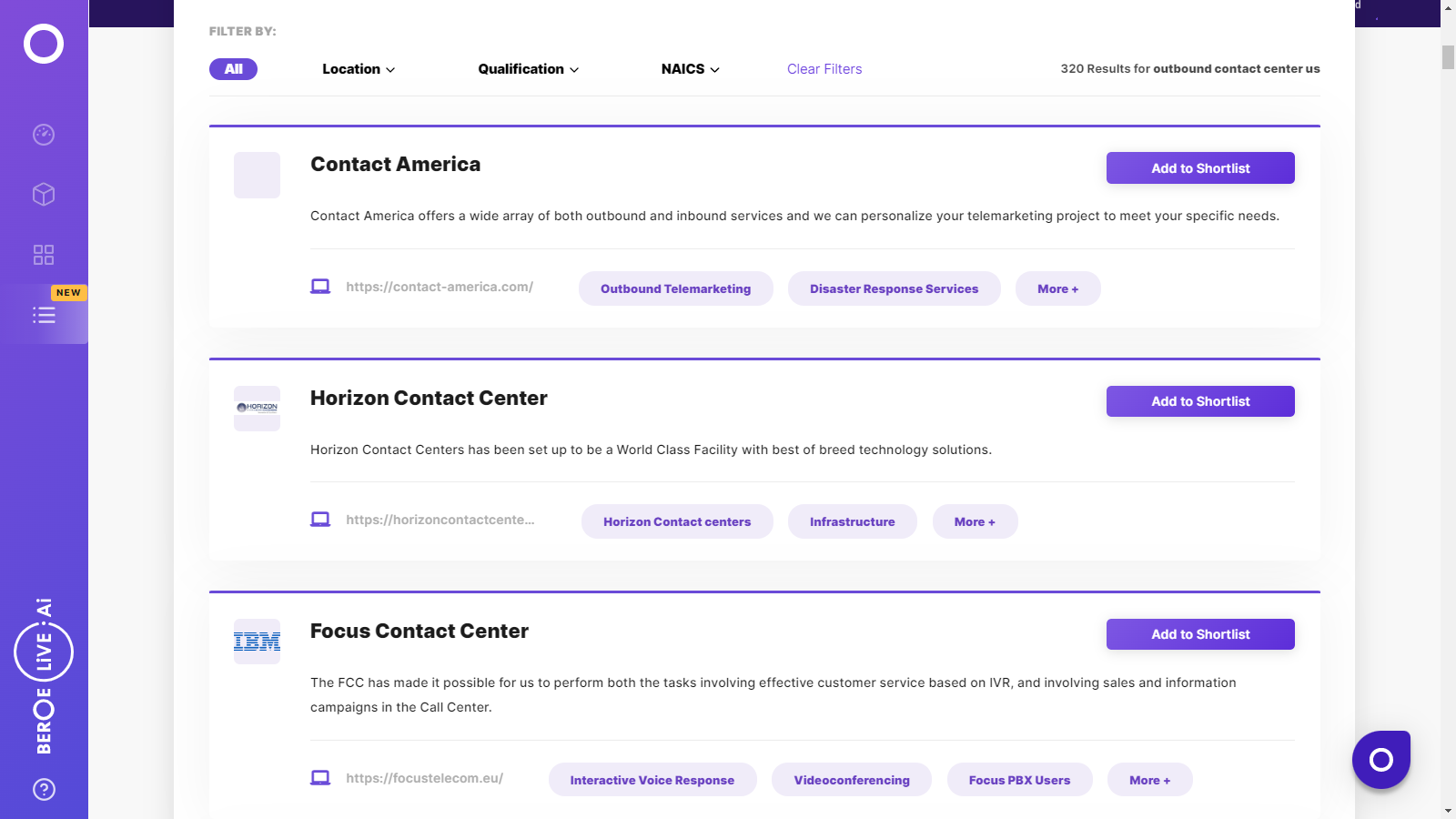

Outbound Contact Center Supply Market Overview US Suppliers

Find the right-fit outbound contact center supply market overview us supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Outbound Contact Center Supply Market Overview US market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoOutbound Contact Center Supply Market Overview US market report transcript

Global Contact Center Market Outlook–Demand Overview

The contact center market was valued at ~$340 billion in 2017, of which ~24–26 percent is outsourced. Majority of outsourced demand driven from North America, Europe, and the UK. Technology and BFSI would remain the largest buyer, however, healthcare demand will go up in next 2–3 years.

Key Insights

- Market Outlook: The global contact center market was valued at $340 billion in 2017,of which 75 percent of the contact center services are maintained in-house through captive centers, and the rest 25 percent is outsourced to third parties

- The industry is dominated by in-house (captive centers), and this trend will continue in next 3–4 years

- Demand Perspective: Majority of the contact center outsourcing demand is generated from North America

- Within Europe, Western Europe and the UK are the leading buyers of the contact center services. Some parts of APAC have seen an uptick in customer service outsourcing to third party contact center service providers due to the growth in domestic demand. Example: HGS India is managing the domestic demand

- Major Buyers: Technology and BFSI continues to be the major buyer, however, contact centers' demand will increase because of the healthcare sector (with the rising number of aging population, patient-based, and high priority on customer satisfaction)

Contact Center Regional Market Outlook

Rising cost, quality issues and regulation restrictions are expected to surge reversal of operations to onshore locations in the future.

Key Insights on Contact center industry

- Market Outlook: The contact center market was valued at $24.8 billion in 2017 which will further increase to $27 billion in 2022

- Earlier, outsourcing to low cost countries was considered as mainstream activity for local companies. However, a reverse trend of shifting operations to onshore locations has been observed due to quality issues and regulations across all the offshore destinations

- Major Buyers: Healthcare Contact centers' demand will increase with the rising number of aging population, patient based and high priority on customer satisfaction

Key Insights on Cloud based Contact Center

- The cloud-based contact center market is estimated to grow at a CAGR of 22.8 percent during 2018 to 2022

- It is expected to reach $22 billion by 2022 from $8.8 billion in 2021

- 2016 was the year of cloud-based contact centers. Lot of companies started adopting cloud based models especially in North America, as a large number of suppliers started implementing the latest technologies like call routing (inbound and outbound) IVR, Automatic Call Distributor (ACD)

- The main traction is that, companies, irrespective of their sizes, can embrace cloud

Global Contact Center Market Outlook – Supply Overview

India and Philippines would continue to dominate the supply market for outsourced contact center services, however, other developing regions, such as Caribbean, Central America and Eastern Europe will emerge as tough competitors in next 2–3 years.

Sourcing

Market Shift

- Onshore Deployment: A shift in relocation of contact center and backoffice operations to onshore is happening in the market predominantly due to quality complaints, rising cost and new regulations

- APAC- Dominating Region: Philippines holds the highest share within APAC due to a huge pool of health background agents and nurses. However, China's contribution will increase from 4 percent to 7 percent by the end of 2017 due to aggressive government initiatives such as

- Formation of new technology parks exclusively for the BPO industry

- Subsidy of ~$650 to the outsourcing company on hiring a college graduate

- Formation of a BPO task force by the central government to promote investment and outsourcing activities

New Locations

- Moderate number of outsourcing contracts are expected to move towards emerging locations such as Caribbean and Eastern Europe

Supply Market Overview – North America

The customer interaction market is highly fragmented and competitive with presence of huge mix of diverse suppliers. However, market is moving towards consolidation. Majority of acquisitions are happing in order to expand presence and capability enrichment with value added services

Supply market scenario

Market is moving towards consolidation yet highly fragmented. Outbound services falls under the gamut of three different set of service providers: Contact Center, BPO, Sales & Marketing.

- Contact center service providers has a strong focus on sales, customer services and retention services

- BPO suppliers are of the BPO players have their business unit to provide customer service and sales services

- Sales and Marketing companies whose major focus is on telemarketing (upsell/cross-sell) along with lead generation, campaign generation, research.

In general, the west coast region is dominated by the global contact center players like Teleperformance, Teletech, Alorica, Sitel etc., So the number of local contact center service providers offering Outbound services are less when compared to the BPO and Sales & Marketing agencies.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now