CATEGORY

Mobile Application Procurement

In digital category, the Mobile app service providers one who provides the mobile app development along with advanced technologies like Virtual Reality (VR), Augmented Reality (AR), IOT, Chatbots, Location based services (LBS)

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Mobile Application Procurement.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

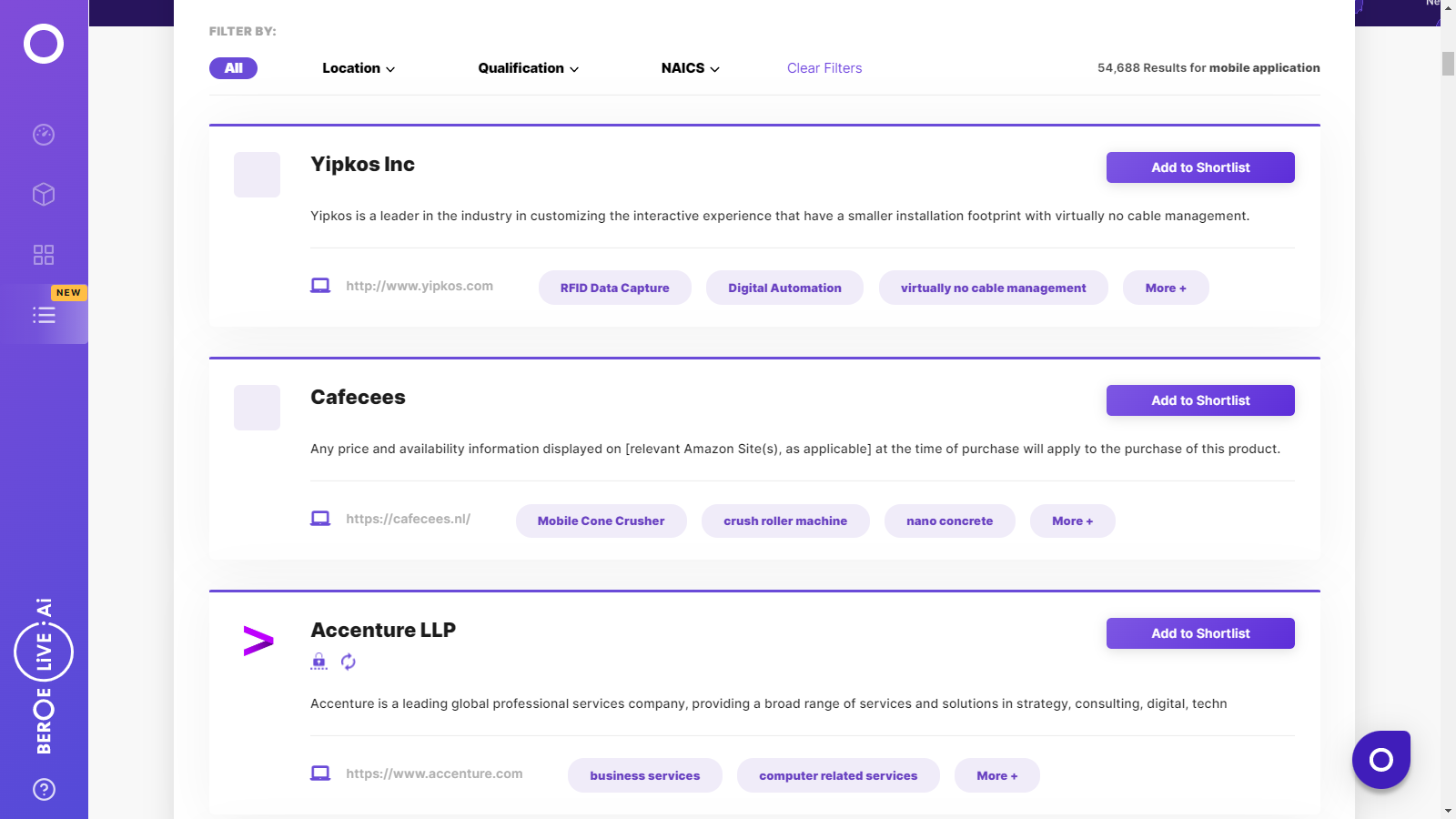

Mobile Application Procurement Suppliers

Find the right-fit mobile application procurement supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Mobile Application Procurement market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoMobile Application Procurement market report transcript

Global Market Outlook- Mobile Marketing

USA and China are the two major markets that will drive mobile ad spend over the period 2016-2020. 16-18% of growth in digital ad sales is driven by mobile advertising. Central and Eastern Europe are expected to grow at Y-o-Y growth rate of nearly 7 percent over next 2-3 years.

Mobile Advertising Market Outlook (2016–2020)

- Globally, North America will continue to dominate the mobile marketing industry by contributing around 50–55% towards the global digital marketing category spend

- Digital ad spend in APAC has surpassed Europe and this growth is primarily driven by China and emerging Asian markets due to increasing investments in technology and digital platforms

- Video advertising is growing as rapidly as social media, this year growth is expected to be 28-30%, which will bring total video advertising spend to $20-23 billion

- Social media is the second largest format of digital budgets and it grew by 46 percent globally in 2016

- This modest growth is due to the positive spend inclination from key sectors like Retail, BFSI, Pharma and CPG

Mobile Marketing Market–Regional Outlook

European region has the most dynamic mobile marketing penetration in the healthcare sector.

Also, Asia Pacific accounts for 60-65% of growth rate in 2016 for using mobile applications especially for accessing social media. Improved access to smartphones and Internet of Things (IoT) have helped developing economies grow at a faster rate.

Mobile Advertising Regional Outlook

- North America drive the most of the growth followed by Asia Pacific and Europe. Asia Pacific market growth is driven majorly by two countries China and Japan

- China records 250 percent growth in mobile ad spend because of the country's population and improved access to the smart phones

- In 2016, Germany recorded the highest spend in mobile video from Europe

End-User Segmentation

By focusing on mobile applications, and new immersive ad placements, pharma industry has become one of the fastest growing verticals in digital advertising.

Digital advertising is largely dominated by mobile advertising and predicted to make up 70-72% of all digital spend by 2019.

Key Highlights

- Pharmaceutical industry has become one of the fastest growing verticals in digital advertising. Pharmaceutical industry is projected to grow at a CAGR of 13-14%

- Pharma sector is investing heavily in mobile messaging, location technology, personalization technology, and mobile search

- Among other ad spending industries Food & Beverage was down by 7 percent in Q17 and retail was down by -3 percent

- Financial services companies are using digital channels to instruct consumers on the value of using digital banking tools and apps

- In Financial services industry, 50-53% of their digital ad spend goes into mobile advertising

- Travel sector is investing in virtual reality and 360 degree video to sustain in a competitive landscape

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now