CATEGORY

Media Planning and Buying

Involves planning of media activities (like which channels to target) and actual buying of media slots through media agencies

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Media Planning and Buying.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoMedia Planning and Buying Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoMedia Planning and Buying Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Media Planning and Buying category is 9.00%

Payment Terms

(in days)

The industry average payment terms in Media Planning and Buying category for the current quarter is 47.5 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Media Planning and Buying Suppliers

Find the right-fit media planning and buying supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Media Planning and Buying market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoMedia Planning and Buying market frequently asked questions

According to Beroe's market reports, the global advertising market was estimated at $547 billion in 2016 growing at around 4 percent year-on-year.

Media planning and buying contribute to about 65 percent of the total market size, which was valued at $355 billion in the year 2016 as per Beroe's market analysis.

The strength of digital spending continues to be the key driving factor for the growth of the global advertising market. During the 2017 forecast period, it was expected to grow to $161 billion.

Europe, North America, and certain parts of the APAC such as Japan have high market maturity owing to the innovation and adoption of advanced technologies like programmatic buying and real-time bidding.

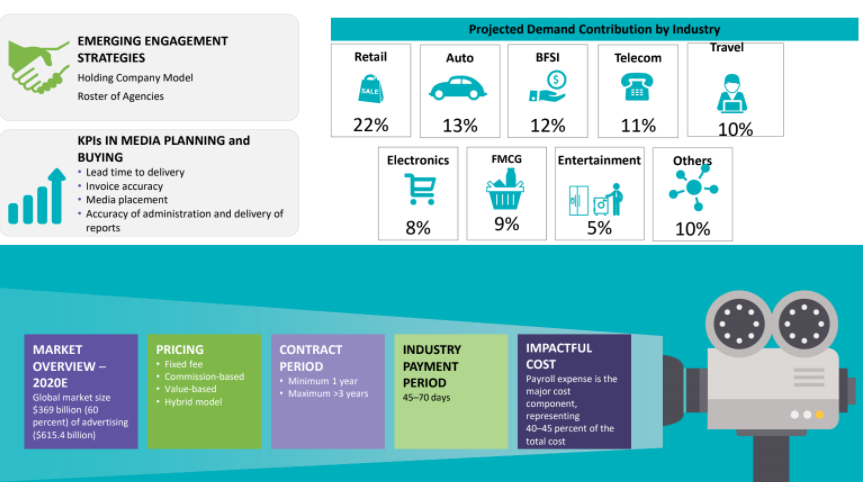

According to the 2018 market reports by Beroe, the following are the projected media planning demand contribution by industry ' FMCG (28%), Auto (9%), E-commerce (8%), Retail (7%), Telecom (6%), BFSI (5%), Services (5%), Consumer Durables (4%), Education (5%), Real Estate (3%), and Others (20%).

As per the media planning trends, payroll expense is the major cost component of the industry representing about 40-45 percent of the total cost.

The key trends in the media planning and buying services industry are ' ' The media budget is shifting from traditional to nontraditional media channels enhancing their brand and target reach. ' Increased focus on emerging regions and cross-screen planning

Top players like WPP and Publicis are focusing on acquiring niche players in the market to increase their digital capabilities. For example, WPP acquired a majority stake in the world's largest independent buyer of digital media, Essence Digital Limited

Lead time to delivery, invoice accuracy, media placement, the accuracy of administration, and delivery of reports are the major KPIs followed in the global media planning and buying agencies.

Starcom MediaVest, Carat, OMD Worldwide, Havas Media, Mindshare, Vizeum, Mediacom, ZenithOptimedia are the top names among the global service providers in the media planning and buying market.

Media Planning and Buying market report transcript

Media Planning and Buying Global Market Outlook

-

The global media expenditure is expected to grow by 3-5 percent, reaching $520-550 billion in 2023 with a continuous growth as per the industry experts

-

Investments in digital are increasing rapidly accounting for about 52 percent of the overall media spend

Media Planning and Buying Global Market Maturity

-

North America and Europe have higher concentration of network agencies; so, buyers can have one or several centralized contracts, covering geographies

-

In APAC, large buyers are increasing their footprints, fuelled by their massive consumer base and adoption of technology

Media Planning and Buying Industry Trends

-

Non-traditional media channels are gaining more investments, with increasing focus on Programmatic DOOH

-

Advertisers are moving their budgets from traditional to digital channels, which enhances their brand and target reach. Trends, such as voice assistants and addressable TV, which are driving the spend for traditional media, are at a nascent stage

Cost Structure of Media Buying and Planning

-

Labor cost contributes the maximum cost amounting to 65–73 percent of the overall agency cost structure and comprises of direct cost (direct payroll cost). Profit margins in the industry average at 9–18 percent. The cost structure of a Media Agency does not change by region.

Global Media Planning and Buying: Drivers and Constraints

Digital channel has continued to drive global advertising, powered by the upsurge of online video and mobile. Traditional advertising is also seeing a boost, due to the number of key technologies, such as streaming on-demand

Drivers

Increasing Digital Penetration:

-

Online video is expected to grow at 19-22 percent and mobile forecasted at 16–17 percent, both mediums continue to drive growth within the overall digital ad spending

Revival of Investments in TV:

-

Addressable (or connected) has enabled marketers to reach target audience similar to online ads. It now accounts for 1 percent of the total linear TV advertising market and is expected to account for 7 percent by mid of 2023

Sporting Cyclical Events:

-

Sporting events, such as Rugby World Cup 2023 and the FIFA Women’s World Cup 2023, are expected to increase the ad spending across the Asian and European regions

Constraints

Varied Regulations across Industries and Geographies:

-

Several codes of advertising provide guidelines or norms that need to be followed while creating advertisements. For example, the CAP non-broadcast code in the UK has rules that cover non-broadcast advertising (e.g., print, online), sales promotion and direct marketing

-

Different countries look differently on the advertising of products and service. In India, the Tobacco Prohibition Act prohibits all direct and indirect advertising of tobacco products in all media

Why You Should Buy This Report

- The report details the media planning market size, maturity, media planning trends, drivers and constraints, etc.

- It gives the regional outlook of media planning and buying services market in North America, Europe, Asia-Pacific and Australia.

- It gives the Porter’s five force analysis of the global media planning and buying market, gives insight into supply trends and details the key media planning suppliers.

- The report details the cost breakdown, pricing analysis and forecast and lists out the sourcing, engagement and pricing models.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now