CATEGORY

Media Planning And Buying Australia

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Media Planning And Buying Australia.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Media Planning And Buying Australia Suppliers

Find the right-fit media planning and buying australia supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Media Planning And Buying Australia market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoMedia Planning And Buying Australia market report transcript

Regional Market Outlook on Media Planning And Buying

- All the top global media buying suppliers have their presence in the Australian market

- Australia is the eighth-largest market, and one of the top 10 countries that accounts for more than 80 percent of all ad spend growth in 2019

Opportunities

- Media buyers in Australia are continuing to increase investment in audio and streaming ad. This provides an opportunity in the integration of audio and overall brand integration

- Consumer usage of voice-assisted technology and devices has taken-off in 2018 and marketers are reviewing their opportunities in this space

- Media agencies also are assessing their approach to voice marketing on behalf of their clients

Challenges

- The media buying industry in Australia does not have strict laws banning media rebates as in the US. The practice is legal provided there is full disclosure to clients. Marketers don't fully understand complex fee structures, especially around the way digital inventory is traded and the value derived from it

Australia Media Planning and Buying-Drivers and Constraints

Across the board, digital will be the largest area of investment for Australian advertisers with 54.9 percent of the total media spend, trailed by TV (21.6 percent) and print (9.8 percent).

Drivers

Increasing Digital Penetration:

- Australia's ad spend is expected to grow by 4.4 percent to $17.2 billion in 2019 off the back of strong display advertising investments

- 13.6 million Australians were streaming audio content on their digital device during 2017-2018. This has increased investment in streaming ad opportunities and usage of broadcast, digital, streaming and podcasts. An increase in investment was seen in 2018 in all media formats which was driven by the investment in audio advertising

- In the US, podcasting ad revenues reached over $220 million in 2017, an 85 percent increase from 2016. This growth trajectory for podcasting ad revenues is expected to follow the same trend in the Australian market as in the US (85 percent increase). Agencies tried different forms of podcasting advertising in 2018; with many looking at integrated native options and bespoke podcasts for brands

Constraints

Evaluation and Varied Regulations

- Evaluating digital media spend has become more difficult over the past five years and advertisers are likely to change the primary metric used to measure campaigns over the years. This implicitly means that suppliers need to come up with innovative metrics and ROI, i.e. outcome based approach for their propositions

- In December 2018, the ACMA made the Broadcasting Services (Australian Content in Advertising) Standard 2018; the objective of the standard is to ensure that the majority of advertisements on commercial television are Australian-made. To achieve this, the standard requires at least 80 percent of the advertising time broadcast each year by a licensee, between the hours of 6 AM and midnight is to be occupied by Australian-produced advertisements

Porter's Five Forces Analysis: Australia

Supplier Power

- The top media agencies in Australia are global agencies having a medium to low bargaining power due to high level of consolidation.

- Global agencies are also aquiring smaller independent agencies to gain niche capabilities.Most of the suppliers are unable to offer seamlessly integrated services currently.

- There is a high growth in the number of independent suppliers focused on digital and online content.

Barriers to New Entrants

- Most of the engagements are based on long term relationship between the agencies and advertisers. New entrants may find it difficult to make inroads unless set up by prominent personnel with abundant experience in the industry.

- Primarily we see independent agencies in Australia having digital mix in their service offering as a niche and cater as adhoc agencies to clients.

Intensity of Rivalry

- Large advertisers account for majority of revenues for the agencies making them strategic accounts. This provides a good room for advertisers to negotiate and demand concessions.

- Marketers (particularly digital marketers) are looking at new metrics to measure digital media placement thereby putting agencies under further pressure to evolve their pricing strategies and value proposition.

Threat of Substitutes

- With the rise of independent agencies and formation of independent agency groups that can cater to multi-market requirements, clients now have a viable substitute for dominant network agencies in the media buying space.

- There is a significant increase in in-house media, in 2013, 58 percent of marketers were involved in some form of in-house advertising, which is expected to reach around 65 percent by 2019.

Buyer Power

- CPG Advertisers have better negotiation power as they are investing in partial in-house team. Auto and FBT advertisers (top spenders) may follow suit

- Across the board, digital will be the largest area of investment for Australian advertisers. Fueled by such investment, buyers will tend to move away from traditional agencies

- Costs associated with change of supplier is expected to take a backseat if the rational for such change revolves around adoption of digital strategy

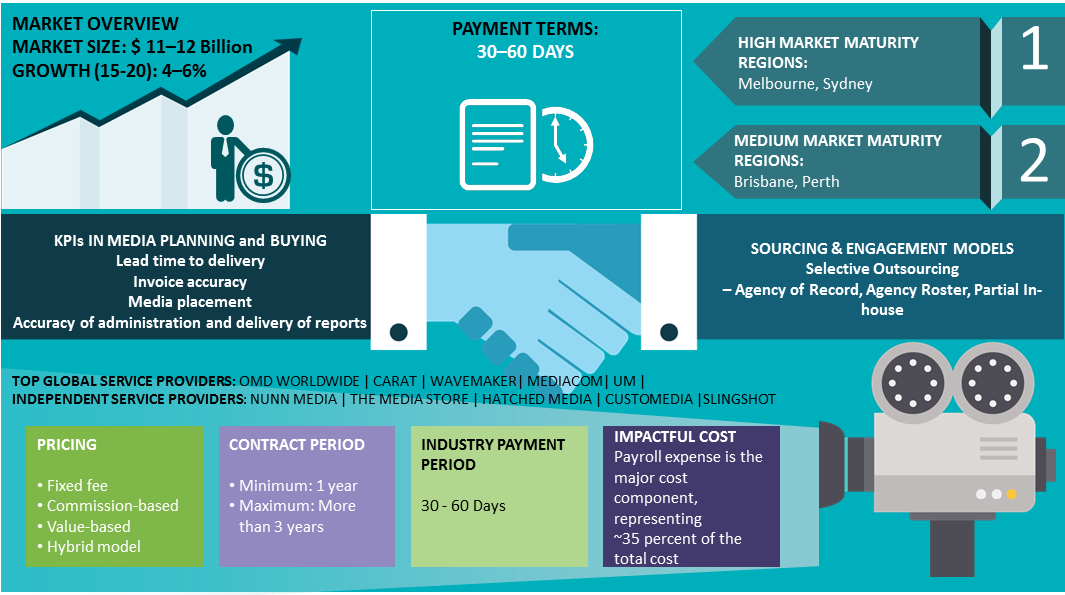

Media Planning and Buying Australia Market Overview

- Large number of Australia-based media agencies are available to provide end-to-end services in the market. Hence, the maturity of service providers is high in these markets.

- Buyer maturity is very high in Australia. Hence, major U.S.-based agencies are trying to expand their capability in the region.

- Australian marketers are known as quick adopters of technology once it has been introduced, challenges holding back the technology include a shortage of skills and wariness by media buyers Australia.

- Australian households have up to nine (9) connected devices, a figure that is set to rise dramatically to 24 by 2019. Agencies that can come up with a way to produce a single customer view this year will be a step ahead of the competition.

- Enormous movement around traditional television data sets and also the ability to automate the entire trading process of linear television.

- Digital ad spending will make up more than half of paid media ad spending in Australia for the first time in 2018, reaching 51.4 per cent of the total.

- Prices of media services vary according to the profit margins set by media agencies; profit margins in mature cities will be lesser than medium mature cities due to lower degree of negotiations. Profit margin is 16–20 per cent.

- Payroll is a major component of media planning and buying. Payroll cost contributes 34–36 per cent of the total cost.

Why You Should Buy This Report

- Information on the Australian media planning and buying market maturity and trends, regional outlook, drivers and constraints, etc.

- Porter’s five forces analysis of the Australian media planning industry.

- Mergers and acquisitions, supply trends and insights, list and service capabilities of media buyers Australia.

- Cost breakdown, pricing analysis, etc.

- Sourcing models, pricing models, engagement models, KPIs, etc.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now