CATEGORY

Marketing Automation Software

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Marketing Automation Software.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

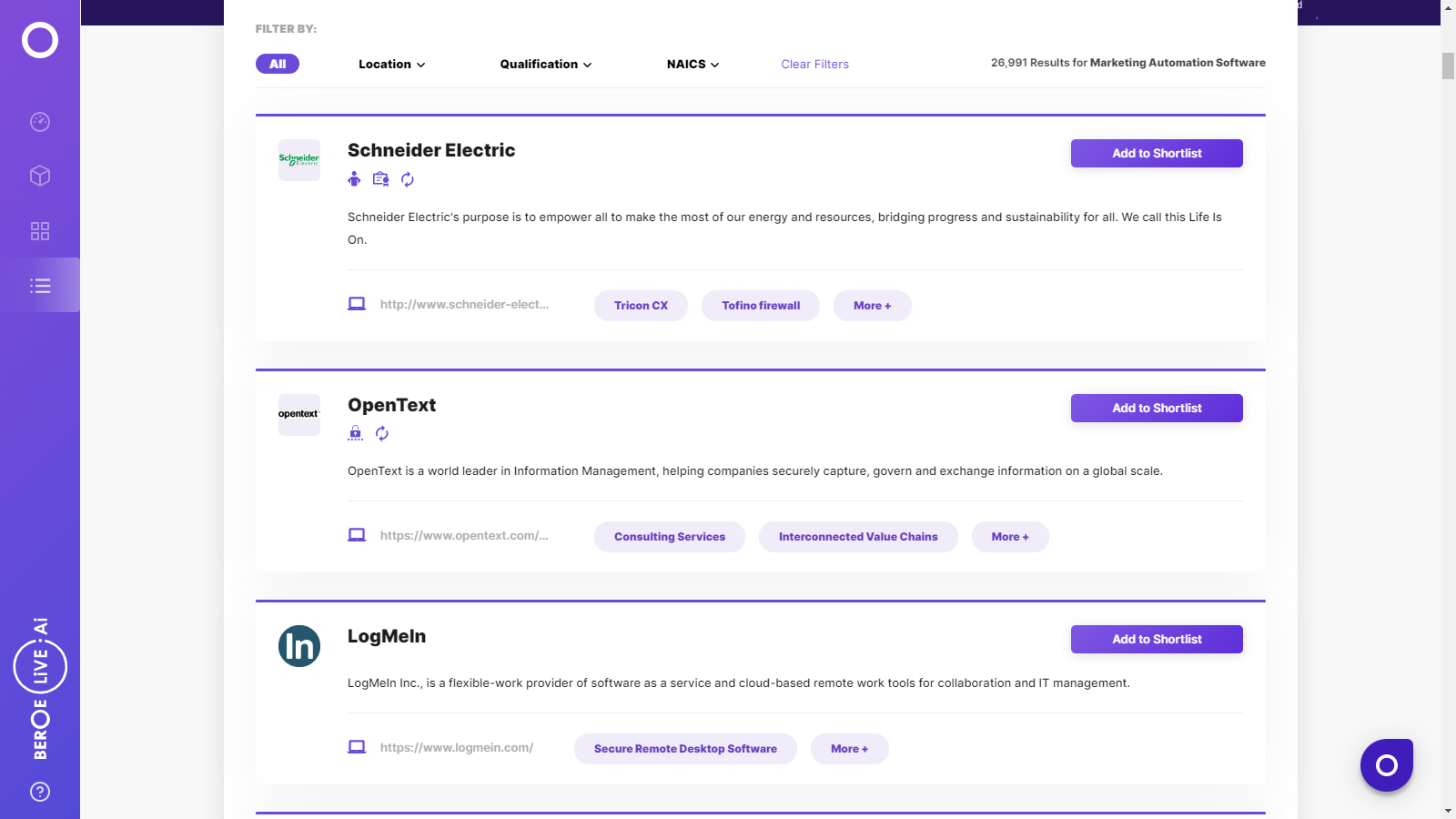

Marketing Automation Software Suppliers

Find the right-fit marketing automation software supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Marketing Automation Software Market Intelligence

global market outlook

- The global MarTech industry is estimated to be $340 billion with a CAGR of 6-7% by 2022.

- The market has seen a lot of value in serving the MarTech technology essentials along with the MarTech stack that includes DAM, Marketing Automation, content management system (CMS), lead management, marketing automation, social media management, customer relationship management.

- North America and APAC are the key MarTech markets, where the demand is created by retail, FMCG, BFSI and IT industries.

- Owing to the rapid digital evolution, MarTech is expected to grow at a CAGR of 17–19 percent in regions like Latin America and Middle East & Africa.

Use the Marketing Automation Software market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoMarketing Automation Software market report transcript

Marketing Automation Software Global Market Outlook

-

The Marketing Technology (MarTech) sector has experienced massive growth, due to the high demand for digitalization in the recent past

-

The global MarTech industry is estimated to be $340 billion, with a CAGR of 6.7 percent in FY 2023(E)

-

Latin America and the Middle East & Africa are expected to grow at a CAGR of 17–19 percent

-

North America and APAC are considered to be the matured markets in serving the MarTech industry

-

The market has seen a lot of value in serving the MarTech technology essentials, along with the MarTech stack that includes DAM, Marketing Automation, CMS, etc., where every stack mentioned has an individual market on its own

Impact of COVID-19 on Marketing Automation Software Industry

-

MarTech category has seen multifold growth in the past two years and pandemic being the one main reason for heavy digitalization in any industry. Prior to COVID-19, the overall online ad spend exceeded the global offline and traditional ad spend.

-

LinkedIn, being the top most used platform for advertisements and promotions, followed by google analytics for content and experience, Salesforce trailed by Salesloft for social and relationship, commerce, and sales, respectively. The above MarTech stack tools are being rated high

-

The demand for MarTech stacks in the highest order of demand: Email, Social Media, Content Marketing and Management, CRM, Analytics, data management

Global Marketing Automation Software Industry Trends

-

Social media scheduling tools, conversational interface, like AI Chatbots, Email marketing software, SMS marketing, Data analytics are few of the upcoming trends in the MarTech industry. High adoption rate in the matured regions, like NA, the APAC, and Europe.

-

The APAC is one of the highly matured region, with respect to the availability of the service providers and still outsource their services to the matured buyers. Hence, buyers are the reasons for the most customized and innovative MarTech tools, as the overall industry trend is driven to serve their niche requirements.

-

Growing geographical footprint: It is estimated that there are about 8,000+ MarTech solutions available around the globe. Especially the pandemic played a huge role in digitalization and most of the technology transformation is said to happen during this time. Hence, every region has seen an enormous MarTech supply market expansion and growth.

Global Marketing Automation Software Market: Drivers and Constraints

Industry Drivers

-

Mergers and acquisitions: Mergers and acquisitions, one of the drivers, as the global agencies acquire an innovative and customized tools with high potential serving any sectors. Salesforce’s acquisition of Slack for $27.7 billion and Mailchimp is acquired by Intuit for $12 billion. Likewise, the mergers and acquisition in the MarTech amounts to 30.3 billion in Q1 2022

-

Catching up with the marketspace: With high demand for customized stack tools, like content, data and analytics, and DAM, the service provider should keep up with technology with the right set of talent pool. This is considered to be one of the main drivers in MarTech, as the market growth is commendable to keep up the pace and deliver the foreseeable services

-

Digital transformation: New entry small and medium companies are one of the largest drivers in the MarTech so far and is the number that making the difference rather than the value of the account

-

Consolidation of MarTech stack tools: Buyers engage with a minimum of 6 to 7 MarTech service providers to suffice all their marketing needs. This has been seen as a driving force, as the agencies are coming up with an end-to-end Marketing Technology solutions

Constraints

-

High cost components of MarTech: One of the major drivers of MarTech is the high-cost components, like hardware, software, and the labor costs. Hardware and subscription cost has been climbing in double digits every year, and this is one of the difficulties for companies upgrading systems and enrolling in a new platforms. Cost of software has always been expensive but now with the syndicated cloud-based applications, the prices should go down and became affordable but instead, prices almost doubling vs. 5 years back. Companies need to hire the right talented specialists, who can bring innovative solutions, in order to foresee and built new technology platforms

-

Lack of public sector digitization: Public sector delay in rolling digital services is one of the largest factors that hold back the countries moving forward with MarTech

-

Customized contents: MarTech is based on the majority of syndicated platforms and services and the only large investment is the consultation for customizing the platform to the business need

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now