CATEGORY

Marketing Fulfilment Services

Marketing Fulfilment Services basically the logistics and transportation services where all the marketing materials are delivered to the end users by the service providers

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Marketing Fulfilment Services.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

FedEx Freight expands its home delivery business with returns.

January 09, 2023To meet rising demand, Kuehne+Nagel and Vestas strengthen their relationship.

December 15, 2022Walmart plans to significantly increase automated fulfilment.

December 15, 2022Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Marketing Fulfilment Services

Schedule a DemoMarketing Fulfilment Services Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoMarketing Fulfilment Services Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Marketing Fulfilment Services category is 7.40%

Payment Terms

(in days)

The industry average payment terms in Marketing Fulfilment Services category for the current quarter is 58.1 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Marketing Fulfilment Services Suppliers

Find the right-fit marketing fulfilment services supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Marketing Fulfilment Services Market Intelligence

global market outlook

- The Marketing fulfilment services market size in Asia is the highest at $23.1–29.9 billion, growing annually at 7.5-10 percent , followed by North America $17.3-20.3 billion, growing annually at 4–6 percent. Further, the Marketing Fulfilment services market size in Europe Market Size $ 13.5- 14.25 billion, growing annually at 4–6 percent.

- The top Marketing fulfilment service providers in the world include SEKO Logistics, Arvato, FedEx, DHL, and Logwin.

The global the Marketing fulfilment services market stands at a stable level with supply and demand at a balanced level.

According to industry experts, the Marketing fulfilment services market Expected to grow at a CAGR OF 7-8 % annually to reach $80.25 – 91.8 BILLION by 2024.

The major Marketing fulfilment services market include Asia, which holds 40% of the total revenue share, followed by North America (27%), and Europe (19%).

Use the Marketing Fulfilment Services market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoMarketing Fulfilment Services market frequently asked questions

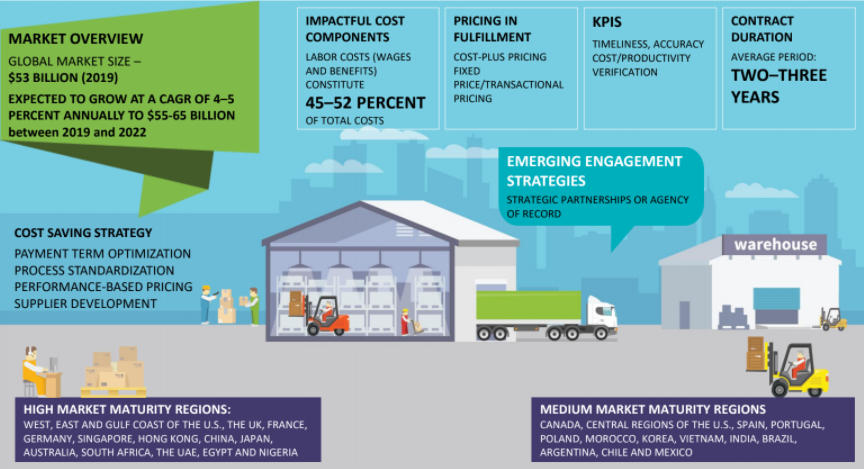

The global fulfilment market size was $53 billion in 2019. The global e-commerce fulfilment market is growing fast too. Beroe estimates that the global marketing fulfilment services market will grow at a CAGR of 4 percent to 5 percent every year until the end of the year 2022. It is estimated that the market will be valued at over $65 billion at the end of 2022 due to continued growth in the marketing operations and fulfillment service market. The growth of the fulfillment industry will continue in the future after 2022. The different regions have different market sizes according to the Beroe report. The Asia Pacific region has the largest market share with a value of $18 billion to $20 billion. The North American region has the second-largest market share and has a market value of $13.5 billion to $15.5 billion. Next, it is the European region that has a market size with a value of $12 billion to $13.3 billion. The Middle East and Asia region have a market value of $2.2 billion and $2.6 billion.

The high marketing fulfillment services market regions include Japan, the UK, Hong Kong, Australia, Singapore, South Africa, Nigeria, Germany, Egypt, the UAE, and the east, west, and gulf coast of the US. The medium market maturity regions for marketing fulfilment services include the central US, Mexico, Canada, India, Portugal, Chile, Brazil, Poland, Argentina, Spain, Korea, Vietnam, and Morocco.

The fulfilment marketing services trends are many. E-commerce fulfillment is on the rise and this means eFulfillment service among others will be more prominent in the long-term too. Pick and pack companies will use business intelligence for fulfillment to ensure efficiency is ensured at all times. Logistics services such as labeling and sorting, kitting and bundling, and campaign fulfillment can be expected according to the Beroe category intelligence report. The product fulfillment, material shipping, and order fulfillment are some of the aspects that will be focused on. The providers' focus will be on freight warehouse, fulfillment logistics, and fulfillment house. Earlier, there was more focus on the adoption of fulfilment methods whereby only local suppliers were partnered with. Today, the scenario has changed completely. Suppliers are more willing to partner with global suppliers now and this trend is likely to continue well into the future. This means higher buyer maturity too. Partnering with global suppliers is more likely to give rise to outsourcing. Some companies have already started to outsource as a way to ensure fulfilment. This is particularly true for e-commerce as the demand for fulfilment has risen substantially over the last few years. As e-commerce will continue to rise, so will the market fulfilment services.

The top fulfillment companies include FedEx, SEKO Logistics, DHL, and Logwin Logistics.

The main cost component is the labor cost which constitutes anywhere between 45 percent to 52 percent of the total cost. The labor cost includes wages and the benefits given to employees. There are various cost-saving strategies that are used. These include four main ones; supplier development, process standardisation, payment term optimization, and performance-based pricing.

The first is whether timely delivery has been made. The second important factor is the accuracy of fulfilment. The other KPIs include cost among others.

Marketing Fulfilment Services market report transcript

Global Marketing Fulfilment Services Industry Outlook

-

The global fulfillment market was valued at $85 billion in 2022. The market is expected to reach $91.8 billion in 2023

-

The market is forecasted to grow at a CAGR of 7–8 percent between 2023 and 2026F

-

Regions, such as Western Europe, North America, and some parts of APAC, including Australia, Japan, Hong Kong, and Singapore, have a high market maturity

-

APAC and parts of Latin America are expected to be the future growth-driven markets

Global Marketing Fulfilment Services Market Maturity

-

Fulfillment services penetration is high outside Europe and North America due to e-commerce

-

APAC is witnessing an increase in adoption due to the presence of regional/global suppliers with well-established fulfillment centers and strong regional footprints; global buyers are also looking at consolidating supply bases. ME and LATAM have low adoption due to the challenges in delivery because of low infrastructure and connectivity

-

Fulfillment services penetration is high outside Europe and North America due to e-commerce

-

APAC is witnessing an increase in adoption due to the presence of regional/global suppliers with well-established fulfillment centers and strong regional footprints; global buyers are also looking at consolidating supply bases. The growth of e-commerce in the APAC region attributes to the growth of fulfillment services market.

-

ME and LATAM have low adoption due to the challenges in delivery because of low infrastructure and connectivity

Global Marketing Fulfilment Services Industry Trends

-

Increasing levels of providers’ geographic footprints and adoption of global fulfillment strategy indicate increasing buyer maturity and willingness to partner with suppliers on a global scale

-

Suppliers are also improving their supply capabilities while adopting performance-based metrics for evaluation and monitoring of delivery. E-commerce is also fuelling the demand for fulfillment; this has led to outsourcing of services by buyers

Global Fulfillment Drivers and Constraints

Retail and e-commerce expansion in emerging markets is expected to strongly drive fulfillment budgets in these markets and also growth in online buying due to the increase in adoption of mobile and online technology by consumers and service providers

Drivers

Tactical Benefits:

-

By outsourcing fulfillment services to a supplier, buyers can exploit service providers’ abilities and focus on core business. Outsourcing has also reduced shipping costs due to consolidated shipment and negotiation (with the carriers) of rates on bulk shipments and also helped eliminate shipping mix-ups

Technological Benefits:

-

Outsourcing allows buyers to avail the best of technologies implemented by service providers. Technology is changing continually and constantly; 3PL companies invest a huge portion of their budget in maintaining and upgrading their technology and warehouse equipment

Operational Benefits:

-

Outsourcing to a fulfillment service provider would allow buyers to standardize the level of services across various locations. Productivity and efficiency could be enhanced through the introduction of various critical performance indicators and compliance clauses in the contract

-

Centralized procurement through global/regional service providers will save costs and efforts in paying for additional warehouse space, hiring and training employees and managing inventory

Constraints

Subcontracting Practices:

-

Subcontracting of storage and delivery is done in case the supplier does not have a network in a particular region. This practice indirectly affects the buyer since subcontractors charge a margin from the service provider, which is eventually passed on to the buyer. This margin-on-margin increases buyers’ spending

-

There is also a level of uncertainty in the delivery of order fulfillment and customer services, e.g., customer response regarding shipments. An ineffective customer support system may have a negative impact on the brand name to the buyer using the fulfillment service

Supply Trends and Insights

Global/ Regional Supplier

Increase in M&A:

-

Global suppliers are enhancing their service capabilities through M&A and expansions to achieve fulfillment contracts from large buyers

-

Logwin extended its network in South America. The organization configured its own branch in the Free Trade Zone in Bogotá

-

FedEx acquired GENCO Distribution Inc. (a third-party logistics provider) and Bongo International LLC (an e-commerce platform). This will add to FedEx’s capability to serve international customers

Customized Services:

-

Customization helps in increasing the integrity of services and brings a high level of expertise. Further, suppliers are providing training through management development programs by partnering with training agencies. Suppliers are also enhancing their same-day delivery capability

Supply Trends

-

Supplier Consolidation: The majority of global buyers are consolidating the supply base by reducing the number of 3PLs they use

-

Innovative Service Offerings: Suppliers are coming up with new contract models and service options for buyers

-

Use of Big Data in the Supply Chain: Supply chain managers and IT service providers are exploring and implementing the use of data analytics for business intelligence to improve and leverage the overall supply chain. UPS’ report on the ‘Pulse of the Online Shopper’ provides insights on smartphone usage for online shopping, the influence of social media, and how online shopping is driving in-store traffic

Engagement Treads

-

Most Adopted Model Globally: Bundled sourcing strategy

-

Why? To achieve spending visibility, risk reduction, and cost savings

-

Contract Length: Two to three years with an option of contract extension, based on performance linked with SLAs

-

Pricing Strategy: Cost-plus and fixed price transactional pricing model

Why You Should Buy This Report

- Information about the global fulfilment services market size, maturity, industry trends, drivers and constraints, and regional market outlook of North America, Europe, MEA, Asia

- Pacific, and Australia.

- Porter’s five force analysis of developed and emerging fulfilment services market.

- Supply trends and insights, supplier profile and SWOT analysis of major players like SEKO Logistic, Logwin Logistics, DHL, FedEx, etc.

- Best sourcing models, cost drivers, cost structure, pricing models, etc.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now