CATEGORY

Mannequins

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Mannequins.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoMannequins Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoMannequins Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Mannequins category is 7.40%

Payment Terms

(in days)

The industry average payment terms in Mannequins category for the current quarter is 58.6 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Mannequins Suppliers

Find the right-fit mannequins supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Mannequins Market Intelligence

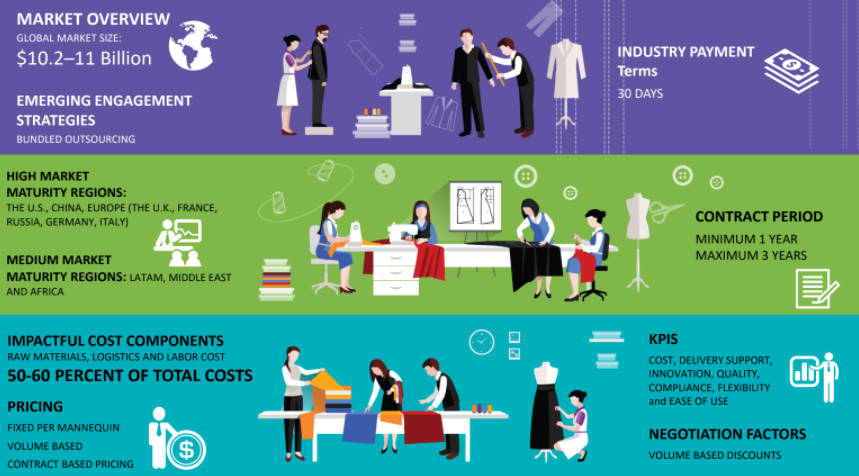

global market outlook

- The global mannequin industry is estimated at $12.5–13.2 Billion in 2022 (E) .North America, Western Europe, and markets in Asia Pacific, such as Chia, and in Europe (the UK, France, Russia, Germany, Italy), have a high market maturity.

- Asia-Pacific, excluding Japan, is anticipated to remain the largest market for mannequins. The mannequin market in Asia-Pacific is projected to register the highest CAGR through 2022, followed by North America. Markets in the Middle East and Africa and Latin America are expected to be high-growth markets.

- North America, Europe and APAC are the key mannequin markets, with high penetration of apparel retail (key end consumers of mannequins), and large number of global and local suppliers supporting these regions.

- Full body mannequins will continue to be the most lucrative among products in the global mannequin market. Sales of full body and upper body mannequins are projected to register the fastest expansion in the market . Adults segment is expected to remain dominant in the global mannequin market.

Use the Mannequins market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoMannequins market report transcript

Mannequin Market Analysis and Global Outlook

-

The global mannequin industry is estimated at $13.86- 14.5 Billion in 2023 (E)

-

North America, Western Europe, and markets in Asia Pacific, such as Chia, and in Europe (the UK, France, Russia, Germany, Italy), have a high market maturity

-

Asia-Pacific, excluding Japan, is anticipated to remain the largest market for mannequins. The mannequin market in Asia-Pacific registered the highest CAGR through 2022, followed by North America

-

Markets in the Middle East and Africa and Latin America are expected to be high-growth markets

Global Mannequin Market Maturity

-

North America, Europe and APAC are the key mannequin markets, with high penetration of apparel retail (key end consumers of mannequins), and large number of global and local suppliers supporting these regions

-

Full body mannequins will continue to be the most lucrative among products in the global mannequin market. Sales of full body and upper body mannequins are projected to register the fastest expansion in the market

-

Adults segment is expected to remain dominant in the global mannequin market

-

Infants & toddlers' segment is expected to be the least lucrative target-group segment in the global mannequin market. Sales of infants and toddlers will witness a steady expansion in the market over the forecast period

Global Mannequin Industry Trends

-

Suppliers are increasing their geographic footprint as mature buyers move towards supplier consolidation. Many established suppliers in Europe have started operations in other key demand markets like the US

-

Global suppliers are focusing on manufacturing Eco friendly mannequins, due to the increasing demand from apparel retailers in Europe (UK, France, Italy, Germany) and the US

Global Drivers and Constraints : Mannequins

Growing expansion of modern retail in the emerging markets is expected to strongly drive mannequin sales. The growing trend of online shopping has necessitated the retailers to make more attractive windows in which mannequins plays an inevitable role

Drivers

Mannequins leveraging technology advancements

-

Mannequins are no longer utilized only for displaying merchandize but also operate as a key source of information by leveraging technological advancements like facial recognition and beacon technology

-

Retailers use beacon enabled mannequins to enhance the customer experience, as well as to retrieve valuable data regarding shopping behavior

-

Innovative applications have increased the demand for mannequins, in addition to its importance in a store environment

Increasing significance of window displays

-

Higher adoption of online shopping, and pre-shopping online research by customers, have increased the significance of window displays as the most powerful tool to drive walk-ins

-

Mannequins have become the most important component of window display, as compared to any other sign or graphic

-

In addition, mannequins have also become an integral part of a brands’ visual identity and hence retailers are ready to invest on mannequins and not compromise on the premium look and quality

Constraints

Hologram Mannequins

-

Hologram mannequins can interact with customers and also offer coupons that can be scanned and redeemed using a smartphone

-

Hologram mannequins used in combination with physical mannequins can reduce the planned number of mannequins, near the store entrance, which can indirectly impact the demand of mannequins

-

Virtual mannequins are being explored in retail stores, airports, corporate offices, shopping malls, etc., to enhance customer experience and drive sales

Increasing adoption of E- Commerce Retail

-

Increasing online shopping would reduce the significance of other retail formats, posing a threat to the sales of Brick and mortar stores which can affect the demand for mannequins

Innovations

Retailers are increasingly finding new methods to utilize various innovative solutions that engages customers and also provides valuable data on shopping patterns.

Beacon Enabled Mannequins

-

For the brand, Beacons can provide valuable data on customers shopping habits, and can boost customer engagement as well as help to pull further customers in-store

-

For the customer, engaging with Beacons gives them access to special content, in-store mapping, and the chance to take advantage of special offers and discounts

3D Printing

-

3D printing is utilized to replace sculpted representation which is later used to prepare the mould

-

This can help reduce the lead time by a few weeks which is a significant period of time in the manufacturing lead-time

-

3D Printing is expected to lower the price of customization as prototyping cost is significantly reduced

Environmental Friendly Production Methods

-

Mannequin manufacturers are focussing on producing environmental friendly mannequins not only to improve working conditions but also to reduce the impact on environment

-

Automated production techniques are utilized to reduce the time taken for production

Face Recognition

-

Retailers are deploying mannequins with facial recognition technology that can identify age, race, gender and dwell time around a display

-

This technology is also used to identify shoplifting suspects, by cross-referencing with a database for a match with past shoplifters or criminals

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now