CATEGORY

Loyalty Programs

Loyalty programs are structured marketing strategies designed by merchants to encourage customers to continue to shop at or use the services of businesses associated with each program. These programs exist covering most types of commerce, each one having varying features and rewards-schemes.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Loyalty Programs.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoLoyalty Programs Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoLoyalty Programs Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Loyalty Programs category is 7.40%

Payment Terms

(in days)

The industry average payment terms in Loyalty Programs category for the current quarter is 58.6 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

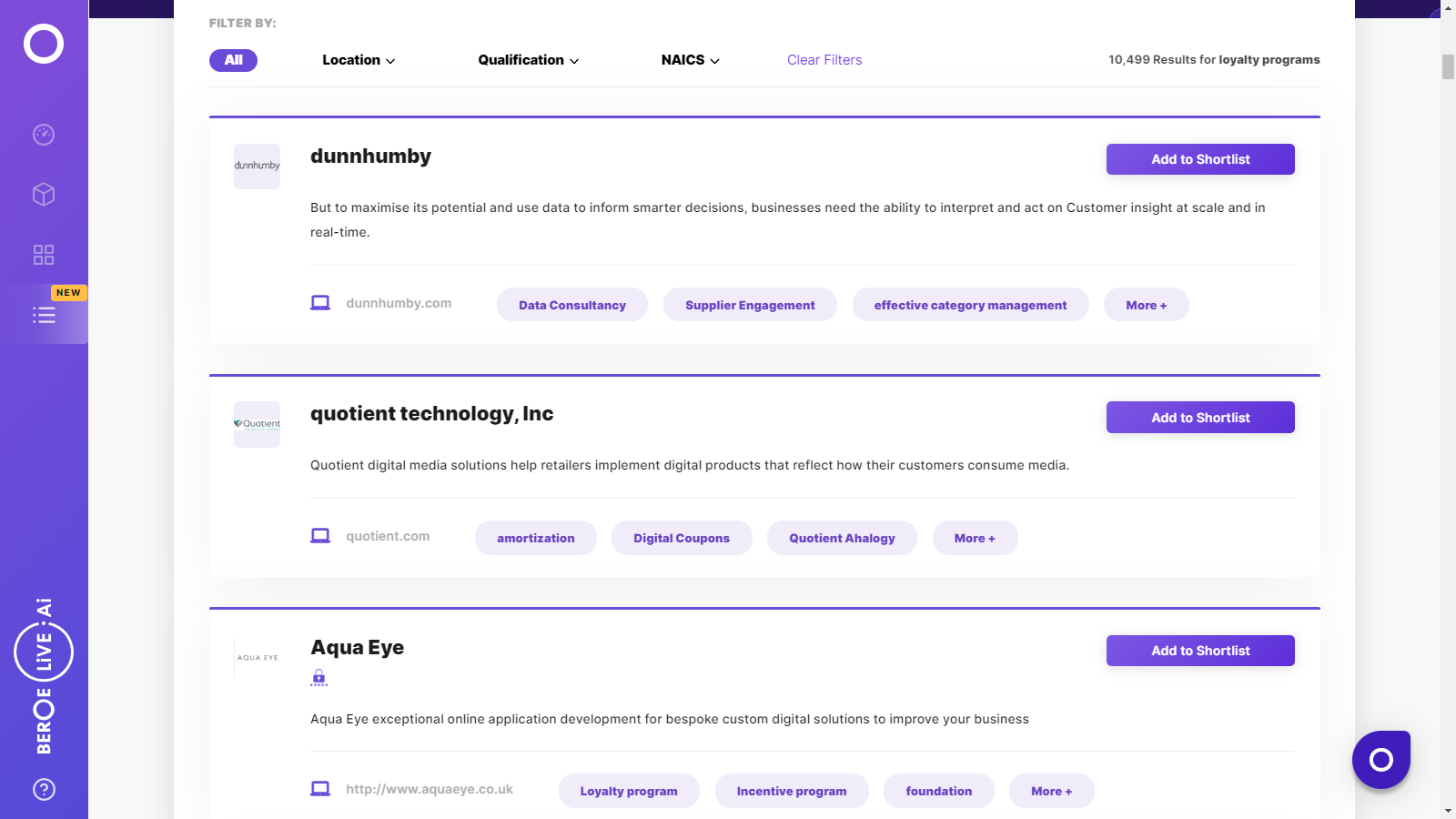

Loyalty Programs Suppliers

Find the right-fit loyalty programs supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Loyalty Programs Market Intelligence

global market outlook

- The global loyalty program market is valued at $8-$9 billion in 2022 (E). The market is forecasted to grow at a CAGR of 5–6 percent to $179–191 billion between 2022 and 2026(F) . Regions, such as Western Europe, North America, and some parts of APAC, such as Australia, Japan, Hong Kong, Singapore, have high market maturity. The APAC and parts of Latin America are expected to be the future growth driving markets for loyalty program services.

- Price, input cost and demand movements are in a neutral/almost favorable condition to procurement, while the competition is stable.

- Loyalty program penetration is high outside Europe and North America, due to increasing e-commerce and online buying behavior of the customers.

- High adoption for Loyalty Program in APAC, due to the presence of regional/global suppliers with established technology platform and regional/local merchant network offering iconic reward catalog. Global buyers are looking at consolidating the supply base.The Middle East and Africa have low adoption, as infrastructure and connectivity pose a challenge in rewards sourcing, fulfillment, and delivery in certain locations.

Use the Loyalty Programs market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoLoyalty Programs market frequently asked questions

The global loyalty management market is expected to reach a market size of $215-$216 billion by 2022.

As per Beroe's loyalty program report, the high market maturity regions in the loyalty management market are West, East, and Gulf coast of US, UK, France, and Germany, Singapore, Hong Kong, China, Japan, and Australia, South Africa, UAE, Egypt, and Nigeria. The medium maturity markets are Canada and the central regions of the US, Spain, Portugal, Spain, Portugal, Poland, Morocco, Korea, Vietnam, India, Brazil, Argentina, Chile, and Mexico.

The various loyalty program trends are that there is an increasing cooperation between buyers and sellers in the loyalty management market which is leading to growing maturity. Suppliers are also ramping up their supply capability and monitoring their performances. E-commerce is also leading to rising demand for B2C loyalty.

Beroe's loyalty program analysis shows that the global loyalty management market is expected to grow at 4-5% by 2022.

Some of the key drivers for the loyalty programs market are cost benefits, demand from potential industries, and operational benefits.

Loyalty Programs market report transcript

-

The global loyalty program market is valued at $7–8.5 Billion (2023F)

-

The market is forecasted to grow at a CAGR of 7-8 percent to 8.5–9 billion between 2024 and 2027(F)

-

Regions, such as Western Europe, North America, and some parts of APAC, such as Australia, Japan, Hong Kong, and Singapore, have high market maturity

-

The APAC and parts of Latin America are expected to be the future growth-driving markets for loyalty program services

Global Loyalty Program Market Maturity

-

Loyalty program penetration is high outside Europe and North America, due to increasing e-commerce and online buying behavior of the customers

-

High adoption for Loyalty Program in APAC, due to the presence of regional/global suppliers with established technology platform and regional/local merchant network offering iconic reward catalog. Global buyers are looking at consolidating the supply base.

-

The Middle East and Africa have low adoption, as infrastructure and connectivity pose a challenge in rewards sourcing, fulfillment, and delivery in certain locations.

Global Loyalty Program Industry Trends

-

The growing geographic footprint of service providers and adoption of global loyalty program strategy by buyers indicate the increasing maturity and willingness of both supplier and buyers to partner on a global scale.

-

Suppliers are also improving their supply capability while adopting performance-based metrics for evaluation and monitoring of both channel and customer loyalty program.

-

E–commerce is fueling the demand for B2C loyalty, whereas B2B is driven by customer retention, as the marketers aim to guard their brand against generic products in the market. This has led to outsourcing of services by buyers.

-

In order to boost loyalty program participation in the Middle East, suppliers are investing in analytics and business intelligence tools to personalize the program for relevant rewards and incentive schemes.

Growth Drivers and Constraints

The growth of retail and e–commerce in the emerging markets is expected to drive loyalty program budgets in these markets. Growth in online buying culture, high adoption of mobile and smartphone by the consumers had raised the need for digital loyalty program strategy. This will be a major growth driver in mature markets.

Drivers

Cost Benefits

-

Outsourcing has led to reduction in the number of hours billed for technology platform. The initial infrastructure cost for creating a technology platform, is a one–time spend and this platform is customized to suit client requirements. Hence, the margins on a long-term contract in providing this platform to clients is high and the supplier passes on a part of margin as a discount to clients

Potential Industry Sectors

-

The demand for loyalty services is primarily driven by the retail, financial services, consumer product and food and beverage industries. Demand for digital reward program, analytics and business intelligence for customization by the retail, food and beverage industries is a key driver

Operational Benefits

-

Outsourcing allows buyers to standardize the level of services across various locations. Productivity and efficiency could be enhanced through the introduction of various critical performance indicators and compliance clauses in the contract

-

Centralized procurement through global/regional service provider will save cost by reduction of the cost per unit of reward fulfillment (supplier provides discounts as the number of merchandizing units increases owing to economies of scale)

Constraints

Subcontracting Practices

-

Subcontracting of reward sourcing and delivery is done in case of suppliers lack proper network in a particular region or when the program requires high localization. This practice indirectly affects the buyer since subcontractors (Local Agency) charge a margin to the service provider, which is eventually passed on to the buyer. This margin–on–margin increases the spend of the buyer

Limitation of Technology Platform

-

The loyalty program that runs on plug and paly SaaS model and is limited by SaaS capability, customization of program may spike cost of program, cost saving by avoiding customization may lead to dissatisfied customer

COVID-19 Impact on Loyalty Program Market

The COVID-19 crisis is positively impacting the loyalty market as a majority of customers are rapidly shifting toward digital channels to buy products or services amidst the nationwide lockdown and related restrictions. The unprecedented growth of the e-commerce industry during the public-health crisis has influenced retailers to attract and retain maximum consumers to their websites, setting high hopes for loyalty platform providers.

Why Should You Buy this Report?

This report on the loyalty market also provides a descriptive industry overview in areas such as North America, Europe, Middle East, Africa, APAC, Australia, and Latin America. It also explores the various opportunities and challenges affecting the loyalty programs industry, along with Porter's five forces analysis of developed and emerging markets.

Methodology for Writing This Report

Beroe gathers intelligence through primary sources that include industry experts, researchers, and consultants, as well as current suppliers, producers and distributors. Secondary sources include business journals, newsletters, magazines, market research data, company sources, and industry associations. Following data collation, analysis, and strategic review, the Final Research Report is published on Beroe LiVE.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now