CATEGORY

Loyalty Programs Australia

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Loyalty Programs Australia.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

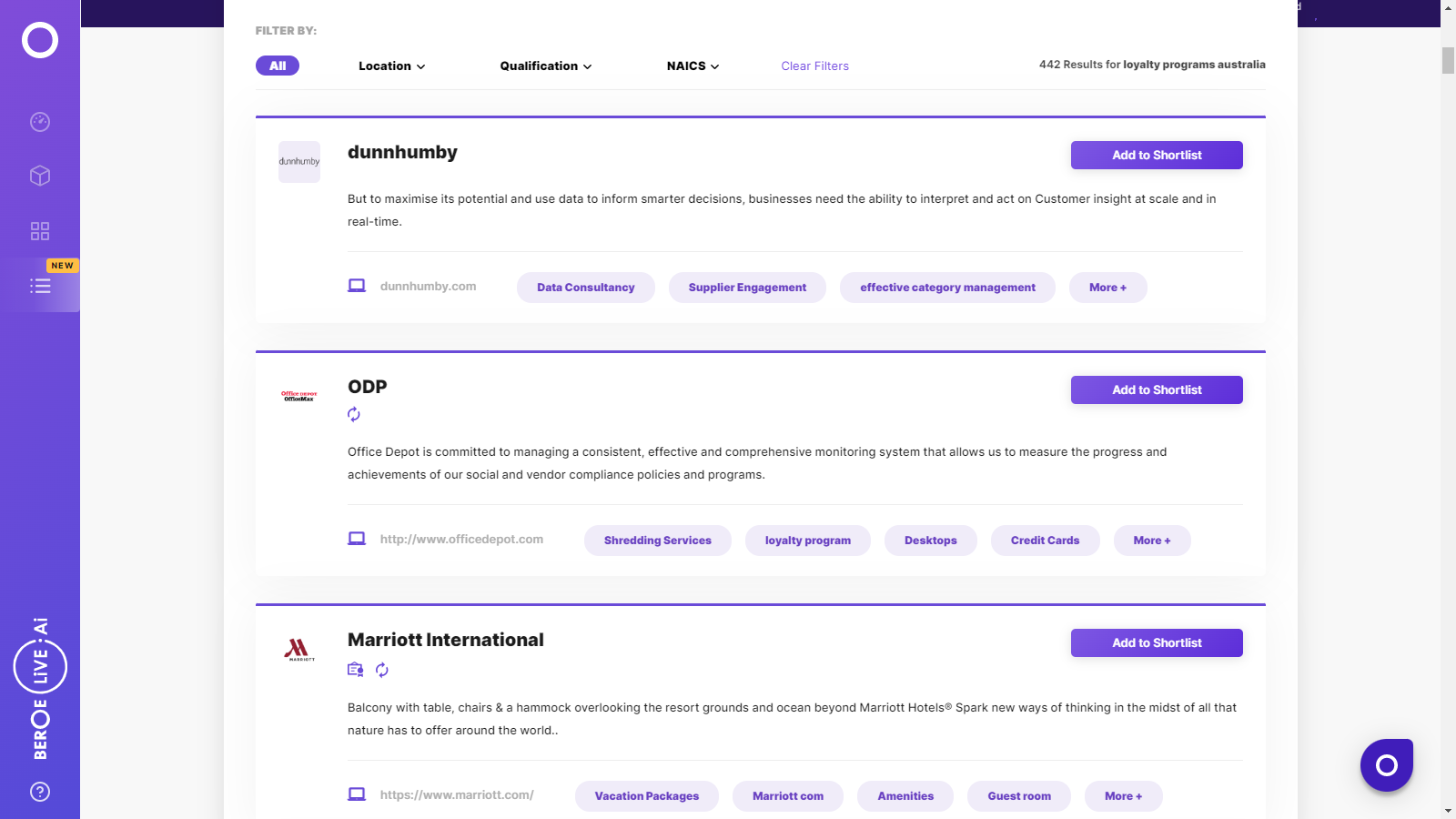

Loyalty Programs Australia Suppliers

Find the right-fit loyalty programs australia supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Loyalty Programs Australia market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoLoyalty Programs Australia market report transcript

Regional Market Outlook on Loyalty Programs

- The global Loyalty Program market was valued at $169 billion in 2018

- The market is forecasted to grow at a CAGR of 4–5 percent to $199–201 billion between 2017 and 2022

- Regions, such as Western Europe, North America, and some parts of APAC, such as Australia, Japan, Hong Kong, Singapore, have high market maturity

- The APAC and parts of Latin America are expected to be the future growth driving markets for loyalty program services

Global Loyalty Program Market Maturity

Loyalty program penetration is high outside Europe and North America, due to increasing e-commerce and online buying behavior of the customers

High adoption for Loyalty Program in APAC, due to the presence of regional/global suppliers with established technology platform and regional/local merchant network offering iconic reward catalog. Global buyers are looking at consolidating the supply base.

The Middle East and Africa have low adoption as infrastructure and connectivity pose a challenge in rewards sourcing, fulfillment, and delivery in certain locations.

Growth Drivers and Constraints

The growth of retail and e–commerce in the emerging markets is expected to drive loyalty program budgets in these markets. Growth in online buying culture, high adoption of mobile and smartphone by the consumers had raised the need for digital loyalty program strategy. This will be a major growth driver in mature markets.

Drivers

Cost Benefits

- Outsourcing has led to reduction in the number of hours billed for technology platform. The initial infrastructure cost for creating a technology platform, is a one–time spend and this platform is customized to suit client requirements. Hence, the margins on a long term contract in providing this platform to clients is high and the supplier passes on a part of margin as a discount to clients

Potential Industry Sectors

- The demand for loyalty services is primarily driven by the retail, financial services, consumer product and food and beverage industries. Demand for digital reward program, analytics and business intelligence for customization by the retail, food and beverage industries is a key driver

Operational Benefits

- Outsourcing allows buyers to standardize the level of services across various locations. Productivity and efficiency could be enhanced through the introduction of various critical performance indicators and compliance clauses in the contract

- Centralized procurement through global/regional service provider will save cost by reduction of the cost per unit of reward fulfillment (supplier provides discounts as the number of merchandizing units increases owing to economies of scale)

Constraints

Subcontracting Practices

- Subcontracting of reward sourcing and delivery is done in case of suppliers lack proper network in a particular region or when the program requires high localization. This practice indirectly affects the buyer since subcontractors (Local Agency) charge a margin to the service provider, which is eventually passed on to the buyer. This margin–on–margin increases the spend of the buyer

Limitation of Technology Platform

- The loyalty program that runs on plug and paly SaaS model and is limited by SaaS capability, customization of program may spike cost of program, cost saving by avoiding customization may lead to dissatisfied customer

Porter's Five Forces Analysis – Australia

Supplier Power

- Global service providers with established presence have higher supplier power, but the price points of local service providers and competition in the market pegs the supplier power at medium level

Barriers to New Entrants

- The threat of new entrants is comparatively lower since top buyers still prefer to engage with established suppliers rather than newer suppliers especially for advanced loyalty program services and technology

- High investments in terms of technology and infrastructure act as a barrier for new entrants to compete with existing players and the difficulty in attracting and retaining top talent acts as deterrent for new entrants

Intensity of Rivalry

- The competition in the loyalty program space is primarily driven by acquisition and expansion in the emerging markets

- Loyalty program providers are investing in the market to establish themselves as an end to end service providers and few suppliers are also enhancing their digital loyalty program capability

Threat of Substitutes

- Threat of substitutes is low for loyalty program as the there is huge dependency on loyalty service providers in all markets

- Rapid growth of e-commerce and demand for innovative or differentiated program has made it difficult for buyeras to develop in-house capability

Buyer Power

- The demand for loyalty program services is expected to grow sturdily with the growth of the middle-class income, the rapid evolution, and modernization of the retail trade in the emerging markets. Clients will have higher buyer power as the suppliers compete to grab higher share of clients' spend

Loyalty Programs Australia Market Overview

- The growing geographic footprint of service providers and the adoption of global loyalty program strategy by buyers indicate the increasing maturity and willingness of both supplier and buyers to partner on a global scale.

- Suppliers are also improving their supply capability while adopting performance-based metrics for evaluation and monitoring of both channel and customer loyalty program.

- ECommerce is fueling the demand for B2C loyalty, whereas B2B is driven by customer retention, as the marketers aim to guard their brand against generic products in the market. This has led to the outsourcing of services by buyers.

- Certain brands in the loyalty industry are looking at rewarding the customers in innovative ways for example rewarding point for sharing product information on social media.

- Bands are investing in analytics in order to provide relevant rewards and tailor-made program based on customer behaviour.

- Implementing best loyalty programs Australia has its challenges during the initial phase of implementation, in terms of program development, high investment and time involved in commencing the program. The program failure may incur massive losses to the buyer.

- Project-based models are preferred by buyers when they are engaging with different service providers for different program activities (Reward sourcing and Fulfilment, analytics)

- Full-time dedicated resources are appointed by the service provider for specific tasks

- It helps buyers forecast the budgets for best loyalty programs Australia activities, and it also allows the service providers to manage their resources effectively.

Why You Should Buy This Report

- Information on the Australian loyalty programs market including the market maturity, industry trends, supply-demand trends, best loyalty programs Australia, growth drivers and constraints, etc.

- Regional market outlook, factors affecting loyalty programs and Porter’s five forces analysis of the loyalty programs market.

- Supply trends and insights, profiles and service portfolios of key players.

- Sourcing models, pricing models, cost structure analysis, cost-saving opportunities.

- End-user industry updates.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now