CATEGORY

Instore Merchandisers

North America is the highest adopter of In-store Merchandising services, with approximately 35 percent of the global spend, followed by Europe, with more than 20 percent of the total global spend. The maturity of both buyers and suppliers in these regions is high, due to the market structure which is predominantly modern retail. In APAC, major buyers are increasing to adopt In-store merchandising with the increase in modern retail services and brand’s investment to improve physical retail.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Instore Merchandisers.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

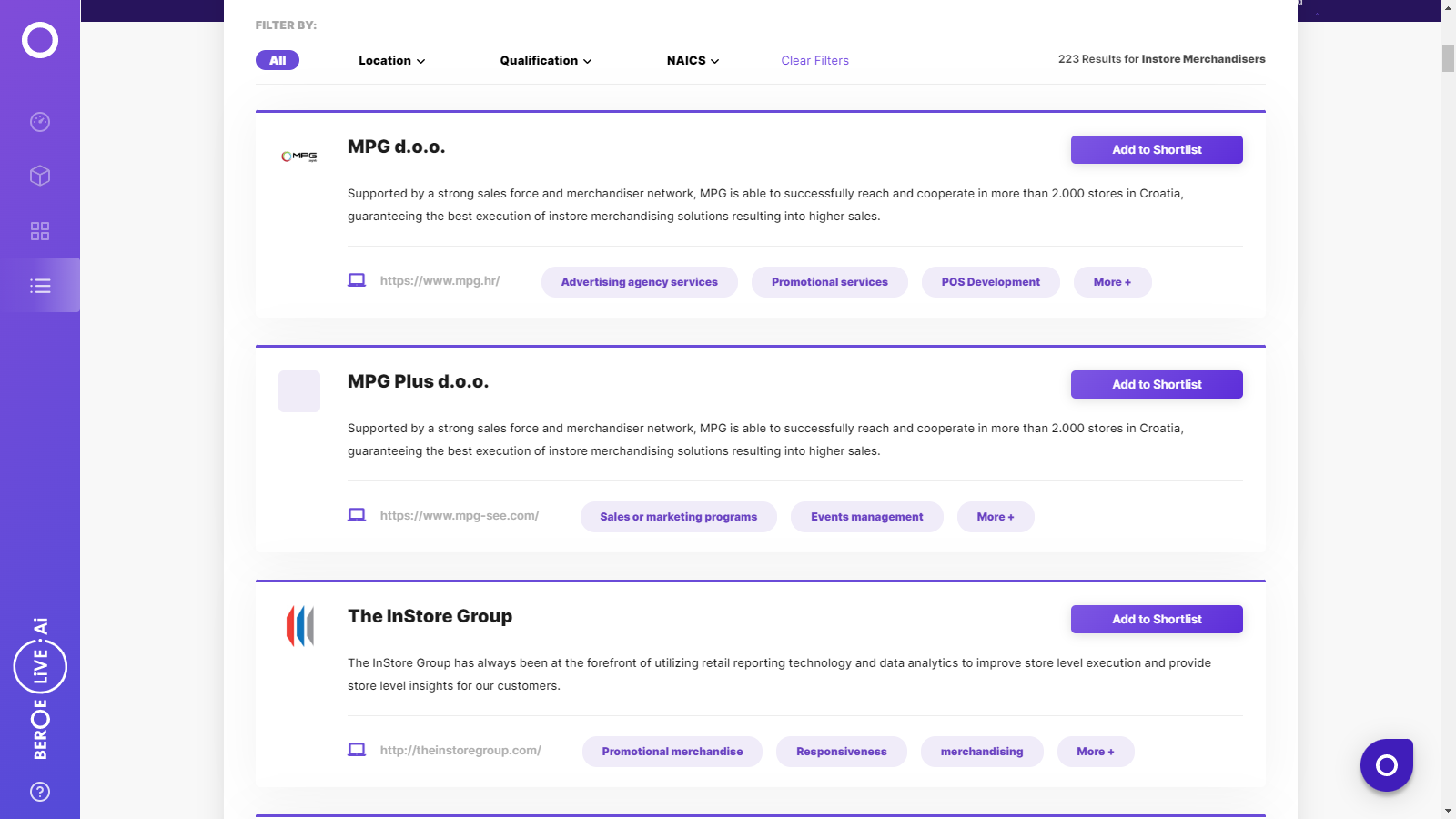

Instore Merchandisers Suppliers

Find the right-fit instore merchandisers supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Instore Merchandisers market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoInstore Merchandisers market report transcript

Instore Merchandisers Global Market Outlook

-

The global In-store merchandising market is valued at $6-6.2 billion in 2023 E, and it is growing at approx. 5 percent year-on-year. The growth will be driven by the increase in adoption of modern retail channels in retail market and premium brand’s investment in physical retail

-

Most of the growth in demand will be from the emerging markets in Asia and LATAM, in addition to the United States (US), Oceania and the Middle East

-

Major buyers of the services are Retailers, CPG, Packaged Food, Beverages & Tobacco, Consumer Electronics followed by Pharma Retail

Instore Merchandisers Industry Trends

-

Mature markets like the US and Canada are moving towards the use of technology by the way of analytics, tools and applications to compete in the retail environment

-

Less mature markets of LATAM adopt the merchandising agencies moving from their traditional engagement agencies for better retail execution

-

Mature markets like UK, Germany are moving towards the use of technology by the way of analytics, tools and applications to compete in the retail environment

-

Less mature markets like Southeast Asia, India start to adopt the merchandising agencies moving from their traditional engagement agencies for better retail execution

Instore Merchandisers Drivers and Constraints

-

Increase in modern retail stores is a major driver for in-store merchandising category

-

Growth of e-commerce channel is a major constraint

Drivers

-

Increase in the retail market evolution, moving towards modern retail in the growing markets like APAC, LATAM and Eastern Europe

-

Increase in the focus of physical retail by premium retail brands by investing in in-store merchandising

-

Increase in the competitiveness in the retail market, which the brands use visual merchandising as an aid to increase shop sell-outs

-

Expansion of merchandising in major markets like China, India and Southeast Asia

-

Sectors like consumer electronics, pharma retail focusing on retail merchandising like the well-established sectors like CPG and FMCG.

Constraints

-

Increase in the growth of e-commerce and consumers wish to use online platform for shopping is a major constraint to the category

-

In certain markets like India, Africa and in certain countries of LATAM and Southeast Asia, the retail model still doesn’t suit visual merchandising as an effect of the store size

Cost Structure of In-store Merchandising

- Labor cost contributes a maximum of 50–60 percent of the total buyer cost; overhead cost includes the technology and other investments.

Price Drivers

-

Profit margins are not likely to increase and are kept transparent mostly

-

Overhead cost of retail merchandising agencies are not changed considerably in this scenario

-

Labor cost includes the salary of employees and also the employments cost and benefits. Labor costs are likely to increase with the shortage of labor

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now