CATEGORY

Global Air Freight Australia

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Global Air Freight Australia.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

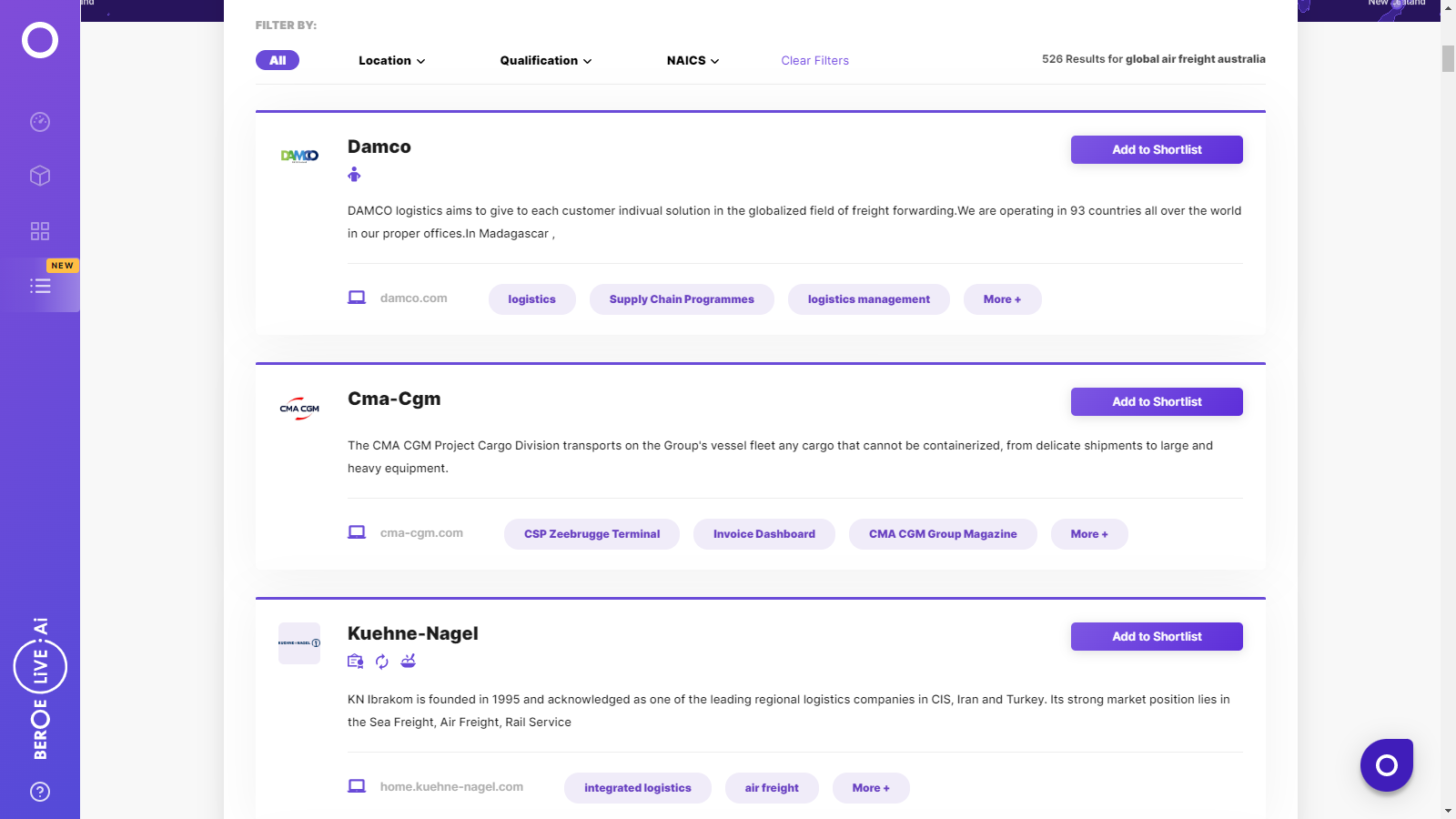

Global Air Freight Australia Suppliers

Find the right-fit global air freight australia supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Global Air Freight Australia market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoGlobal Air Freight Australia market report transcript

Air Freight Australia Market Overview

- Buyers are leveraging on lower utilization rate of freighter fleet segment resulting in marginal rise in utilization rates, however only deferred shipments can be consolidated in freighter fleet segment

- It is observed that the share of inbound and outbound volumes have changed over the years due to geographical presence of the country and it also clearly defines its dependence on air freight

- Despite strong growth in e-commerce and courier market across Australia, Sydney, Melbourne, Brisbane and Perth have been the major airports contributing to Freight movements

- Australia relies more of Asian counties such as Singapore, China, Japan and Singapore for movement of freight. Sydney and Melbourne are two major airports who connect to international hubs

Market Overview – Challenges

Reduced Passenger Fleet Capacity

- Buyers of belly-hold capacity like DHL, TNT and Toll Aviation would have high challenge in terms of capacity constraints as major airlines are expected to reduce passenger fleet capacity

- Airlines are planning to improve profitability with increase utilization rate

Static Freighter Fleet Capacity

- Major airlines such as Qantas and Virgin has remained static in terms of expanding capacity in freighter fleet segment for domestic market

- With minimum scope of freighter fleet expansion, buyers would be challenged with available belly-hold space in the air freight market

Growing Demand of E-Commerce:

- Buyers of freighter and belly hold capacity would be challenged by increasing volume of e-commerce shipment

- With growing volume Australia post and Australian air express accommodate more than 80 percent freight volume which is more likely to create challenge for other buyers in the market

Drop in Passenger Fleets Trips

- With major airlines cancelling the trips of passenger fleets connecting top airports would create capacity crunch for belly-hold buyers in Australian domestic freight market

- Last minute cancellation history would result in drop in reliability factor for airlines and delay in shipments delivery in courier and parcel market.

Porter's Analysis – Australia Domestic Freight Market

Supplier Power

- In the supply side of domestic freight market, Qantas, Jet, Virgin and Tiger Australia airlines have strong bargaining power

- More than 70 percent of domestic freight capacity is dominated by Qantas Airline group which has stronger hand on buyers of the market

- Suppliers tend to alter capacity in the market to alter profitability of the market

Barriers to New Entrants

- Barriers for new entrant is high due to highly competitive nature of the market and large capital investment required to sustain competition from Qantas and Virgin Airlines group

- New entrant will be challenged with high complex and high cost operating environment in Australian aviation market

Intensity of Rivalry

- Despite consolidated nature of the market, domestic air freight market has remained highly competitive in Australia

- Qantas domestic airline is slowly starting to lose volume to Virgin Domestic airline in terms of volume handled in the passenger fleet.

- However, Qantas group still remains as market leader in domestic freight market

Threat of Substitutes

- Threat of substitute very low for air freight market in Australia, buyers utilize air freight capacity to serve industries such as e-commerce and, courier and parcel

- With growth prospective remaining strong for end-user's industry and high dependency on air freight

- Alternate mode of transport would have very minimum support for e-commerce and the courier and parcel market

Buyer Power

- Buyers of domestic air freight space is majorly dominated by Australian post and Star courier with more then 70 percent market share

- Other buyers such as Toll Aviation, TNT and DHL have very minimum bargaining power due to consolidated nature of the market

Air Freight Australia Market Overview

- The volume of freight moved in the passenger fleet has remained flat, due to a couple of reasons. One primary reason being drop in passenger fleet capacity in the market and the other reason is cancelled passenger fleet schedules, reducing the reliability factor for shipments in the air freight Australia market.

- The total volume of shipments moved in February 2019 was 91,640 tons, which was 7.4 percent lesser than the volume recorded in August 2018. Inbound reduced by 9.3 percent and outbound reduced by 5.2 percent.

- The top four airports constitute about 95 percent of the total volume of air freight in Australia as of August 2019.

- Air freight volume has been increasing since the start of 2019, with notable contributions from Inbound freight, which has been the major reason behind the increase.

- Sydney –Singapore, Sydney to Auckland, and Melbourne to Singapore contribute to about 15 percent of total international movements, amounting to 16,249 tons put together in August 2019.

- Australia’s largest trading partners are Singapore, China, and New Zealand, which contribute to about 25 percent of the total cargo movement in the air freight Australia market.

- The domestic air freight Australia market is highly dominated by the capacity available in passenger fleets with a minimum share on freighter fleets, volume growth in Melbourne, Brisbane, Perth, and Adelaide are majorly driven by the passenger fleet belly-hold shipment.

- Shippers moving consignments through belly-hold capacity are expected to face the challenge of capacity constraints, due to a drop in the number of trips connecting major airports of Australia.

- Virgin Australia and Qantas are the two major airlines operating in Australia

Why You Should Buy This Report

- Information on the air freight Australia market overview, shipments, challenges, analysis of airport terminals, etc.

- Porter’s five forces analysis of the air freight Australia industry.

- Service provider’s landscape.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now