CATEGORY

Domestic Transportation South Korea and Japan

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Domestic Transportation South Korea and Japan.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

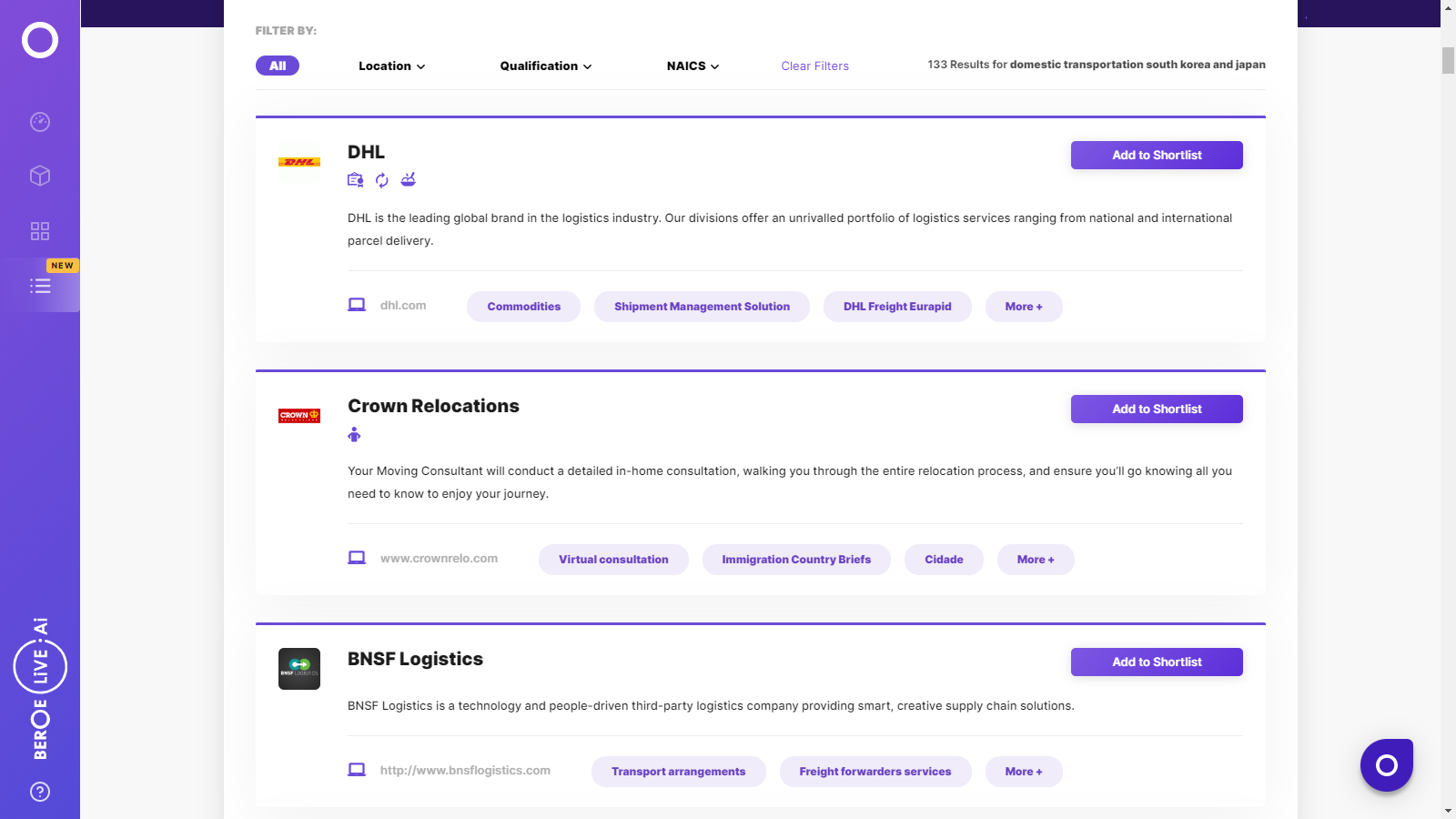

Domestic Transportation South Korea and Japan Suppliers

Find the right-fit domestic transportation south korea and japan supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Domestic Transportation South Korea and Japan market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoDomestic Transportation South Korea and Japan market report transcript

Regional Market Outlook on Domestic Transportation

LTL and B2C sectors will be the major drivers for road freight in Japan, since containerized shipments are gradually getting shifted to rail/intermodal to reduce cost.

In Japan, approx. 90% of the domestic cargo transportation is carried out by road mode with the B2C and LTL sector in logistics is cited to grow at a rate of 4–6 percent in the coming years, due to higher demand from the e-commerce sector.

- Road is the predominant mode for freight transportation in Japan, as it transports 90% of the total freight in the country

- The B2C and LTL sectors constitutes to nearly 40% of the trucking market in Japan and is expected to grow in the coming years

- The road freight market size is estimated to be 1.4 trillion Yen for 2017

- The trucking market size is expected to increase by approximately 0.5–1%, due to a rise in demand for cargo movement for the e-commerce sector

The number of mini cars and vans for cargo movement are expected to increase, due to booming e-commerce business.

Road is the predominant mode for domestic freight transportation in Japan, carrying nearly 90% of the country's freight by volume. The B2C sector in logistics is cited to grow, due to increase in e-commerce business

Commodities Spit by Tonnage 2017(E)

- Food & agro products and construction sector constitutes to nearly 50% of the commodities hauled in Japan by volume

- Rise in e-commerce has increased the volume of general freight transported in Japan

Vehicle Types Split 2017(E)

- Mini cars, vans, and light trucks with a capacity of less than two tons constitute to nearly half of the commercial transport vehicles hauled

- Growth in online shopping and e-commerce has resulted in increased demand for small capacity vehicles of less than two tons

Cost Structure Analysis – Japan

Driver shortage trend witnessed in the market will have a influence on the total operating cost of truck in the market.

The driver wages and fuel are the main cost drivers for trucking in Japan. It is observed that there is shortage of drivers in the market in the recent times, which will have an impact on trucking operating cost.

Japan Market Trends – Tonnage and Price Index

The index is expected to remain stable throughout the year, indicating no major price fluctuations and minimal impact on freight rates.

The index is expected to be flat throughout 2017 with no major changes, due to stable demand and supply scenario.

- The road freight index depends upon the labor wages, which constitute to nearly half of the trucking cost

- The other factors include the country's economic health and industrial activity, which drives the demand for transportation services

- The diesel rates does not have any major impact on the road freight indices, since fuel costs are less than one-fifth of the total trucking costs

- The truck driver shortages and increase in demand for light trucks & mini vans were the main drivers for increase in road freight index during 2015–2016

Japan Trucking Regulations

The trucking regulations in Japan have remained same for the past few years, and the trucking industry has adopted these changes and has a minimal impact on the current operation.

Japan has stringent laws in place against emissions and many old trucks are gradually being phased out, due to these regulations.

Automotive NOx and PM regulation

- This regulation was implemented to elimination of the oldest, most polluting vehicles from the current fleets

- This was mainly implemented to reduce the NOx and PM pollution

Road trucking vehicle law

- This law necessitates the installation of speed control devices in heavy duty trucks

- The maximum speed for heavy duty trucks is limited to 80 km/hour

Weight regulation

- For vehicles where the width, length, loading size and weight exceeds the limit specified by laws and regulations, permission from road administrators is required

- The weight limit regulation depends upon the type of road that the trucks ply on

Regulations for special vehicles

- Special vehicles with length, breadth, and weight (25–37 tons) more than the prescribed value must travel only in dedicated express ways

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now