CATEGORY

3PL Services Australia

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like 3PL Services Australia.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

3PL Services Australia Suppliers

Find the right-fit 3pl services australia supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the 3PL Services Australia market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a Demo3PL Services Australia market report transcript

Regional Market Outlook on 3PL Services in Australia

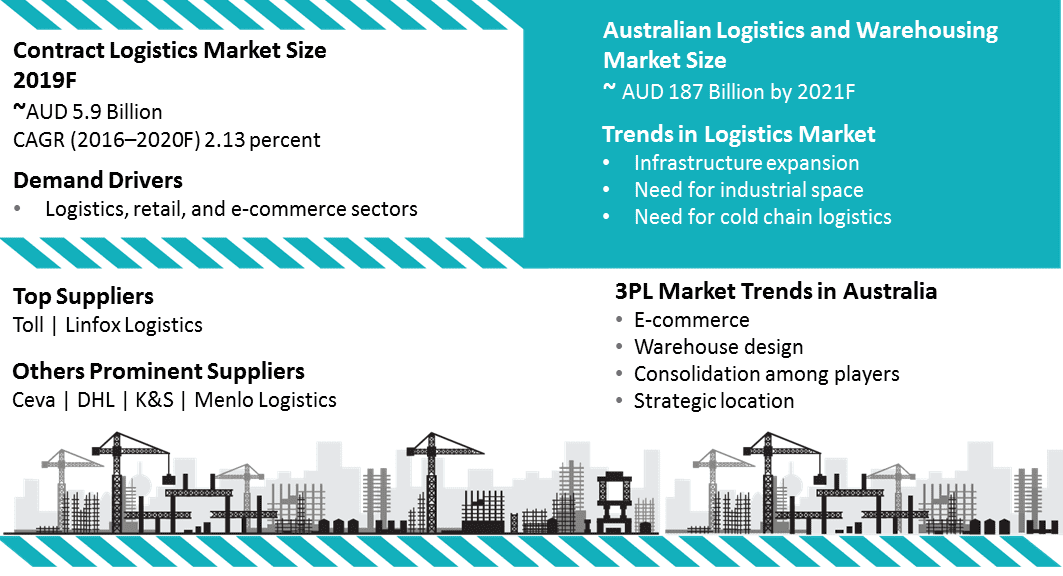

The logistics market is fragmented in Australia with the top suppliers, such as Toll and Linfox, contribute to only 9–10 percent of the total market and remaining are contributed by other top prominent global/regional suppliers, such as Ceva, DHL, K&S, and Menlo Logistics.

- Contract logistics market in Australia is expected to grow at a CAGR of 2.13 percent from 2016 to 2020, majorly due to demand from logistics, retail, and e-commerce sectors

- Toll Logistics and Linfox logistics are the two top warehousing and contract logistics suppliers. Both the suppliers serve on a national level and have warehouses across all the major logistics locations. Other top prominent suppliers are Ceva Logistics, DHL, and K&S

Logistics Market in Australia

The Australian logistics market has been growing, and it represents 8.6 percent of the nation's GDP. Major end users of logistics service are manufacturing, retail, wholesale, construction, agriculture, and mining industries. The Australian logistics and warehousing market is expected to reach AUD 187 billion by 2021. It is predicted that the freight forwarding industry will continue to account for large share in the revenue, supported by growth of 3PL companies. The government investment is also a key factor for growth of the logistics industry. The government is planning to spend AUD 75 billion for improvement of road and rail infrastructure from 2018 to 2027.

3PL Market Trends in Australia

E-Commerce

- E-commerce volume is simultaneously pressuring and expanding logistics businesses and conventional shippers/retail

- The e-commerce and 3PL sectors have accounted to ~75 percent of the total industrial take up (more than 1.1 million sq.m.) in 2017, and this boom in demand is expected to continue for the coming years

- E-commerce operators prefer to have a well-located distribution centers to service their shops and customers directly, and this is leading to a net increase in the demand for quality distribution space

Consolidation

- Consolidation in 3PL sectors indicates that there is an enormous change in amount of industrial space these companies occupy as well as significant investment in automated warehouse facilities

- Most of the 3PLs are looking for warehouse space in excess of 75,0002 sq. m. to ensure that they are able to access a pipeline of development

- Major acquisitions are Toll Group has become a part of Japan Post, Australia Post is now the sole shareholder in Startrack, and has been rapidly inventing as logistics supplier and Brookfield's acquisition of Asciano (Australian Freight Logistics company)

Warehouse Design

- Increase in demand from retail and e-commerce sectors has translated the design into more sophisticated warehouse with slabs that handle greater loads, larger cubic capacity, and high bays

- Sustainability continues to play a role, and more facilities are moving to a six-star rating as the major focus from occupiers is to operate the warehouse through out the 24 hours in a day

- With the changes in the way, warehouses are built, there is expected to be increase in vacancy rates for secondary warehouses compared to primary grades, and in few areas of South Sydney, these secondary vacant spaces are used as residential properties

Strategic Locations

- Port land tend to attract the highest rents and land values

- Sites in and around intermodals or other road/rail infrastructure represent a trade-off between access to markets and land cost. This has further transformed into the development of larger warehouses and super-sized distribution centers within greater metropolitan areas

- Key strategic locations that are considered by occupiers in Australia are Melbourne's Derrimut, Laverton and Truganina, Sydney's Eastern Creek and Erskine Park, Brisbane's South West, the Australia TradeCoast, Direk in South Australia, and Hazelmere in Western Australia

- Proximity to workforce is also an important consideration for the selection of strategic industrial locations

Australian 3PL Market Overview

-

The Australian warehousing industry is driven by strong growth from the automotive, consumer, and construction sectors

-

There are around 700+ warehousing companies in Australia

-

Major warehousing companies include McPhee Distribution Services, MJ Logistics, Adelaide Warehouse and Distribution Services, QLS Group, and Yusen Logistic

-

The Australian express delivery market has seen growth in the last five years, driven majorly by growth in the e-commerce sector

-

The major players include TNT, Toll Holdings, FedEx, Star Track Express, and DHL. These players are active in B2B segments. Many startups, such as Passel, Sendle, Go People, and Zoom2U, have also entered the 3PL Australia market

-

The Australian 3PL market is highly fragmented with local, regional, and global suppliers, however, only the top global and regional firms, such as DHL, Toll, Linfox, etc., have the capability to offer services on a national level.

-

The 3PL market Australia has been consolidating, with few acquisitions, such as Menlo’s acquisition of XPO, Brookfield’s acquisition of Asciano, and Toll Group, are now a part of Japan Post.

-

Buyers prefer engaging with the top suppliers, such as Toll, Linfox, etc., due to their maturity within the market and capability to offer a wide variety of services. These are major logistics firms who offer services across the globe and can offer a wide array of services.

-

Few players include large-sized firms, such as DHL, Toll, Agility, etc.

-

Regional firms with the capability to handle warehouse operations and other services with their focus on a particular region.

-

Local suppliers have their capability restricted to only a certain set of services and offer services only on a national/county level

Why You Should Buy This Report

-

Information on the 3pl Australia market size, overview, landscape market, logistics, market, trends, impact, etc.

-

SWOT analysis of in-house and outsourced warehousing

-

Supplier landscape of the Australian 3PL market.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now