CATEGORY

Japan Courier, Express, and Parcel Logistics

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Japan Courier, Express, and Parcel Logistics.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

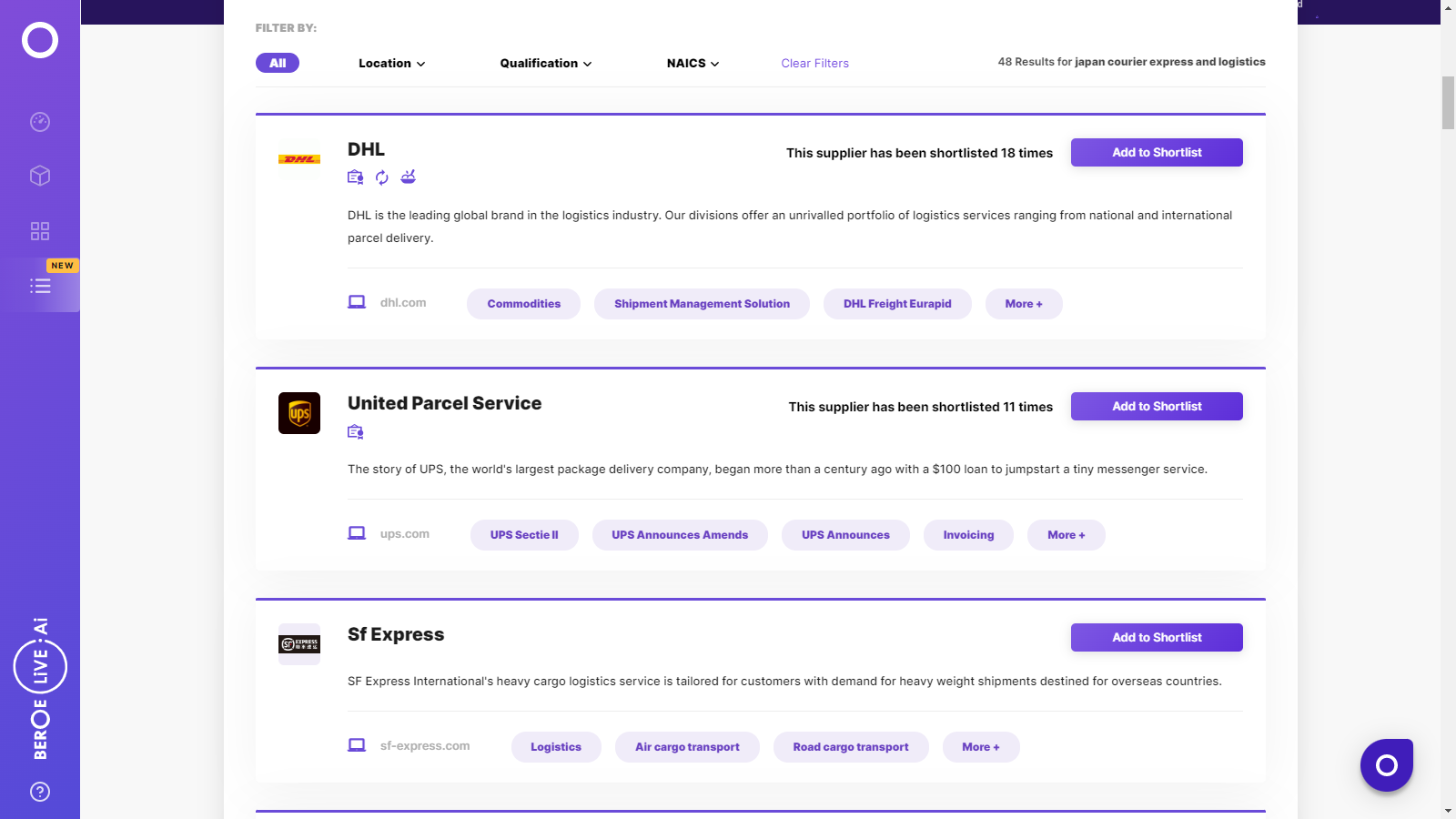

Japan Courier, Express, and Parcel Logistics Suppliers

Find the right-fit japan courier, express, and parcel logistics supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Japan Courier, Express, and Parcel Logistics market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoJapan Courier, Express, and Parcel Logistics market report transcript

Regional Market Outlook on Courier, Express, and Parcel Logistics

The CEP market is expected to grow by ~5 percent in 2017 Y-o-Y to reach $23.5 billion, majorly driven by purchases from e-commerce sector.

Market Analysis

- The Japanese CEP market experienced a growth rate of ~5.1 percent in 2016 Y-o-Y to reach ~$22.4 billion, majorly driven by the e-commerce industry

- The domestic courier market experienced a growth rate of 5 percent Y-o-Y to attain ~$19.8 billion in 2016 and is expected to reach $20.8 billion in 2017, with an annual growth rate of 5 percent driven by e-commerce

- With increasing cross-border opportunities from the US, China, and other Asian countries, the international parcel market is expected to grow at ~4 percent through 2016 and 2017 annually

Supplier Market Structure

- The domestic courier market is consolidated, with approximately 92 percent of the domestic CEP market dominated by the top three Japanese courier companies. Japan's strong licensing policies have been preventing entry of foreign companies into the domestic market

- Japan's licensing policies have been affecting foreign companies. For instance, freight forwarding licenses can be obtained by Japanese companies only, thereby foreign companies have to depend on Japanese forwarders to ship international parcels

- The Japanese domestic CEP market is highly consolidated, with 92 percent of the market dominated by the top three regional players, namely Yamato Transport, Sagawa Express, and Japan Post. It is mainly due to restriction of foreign companies to enter the market

- The international market is dominated by the global integrator, who has a wide area for network, and national players integrate with global players for international deliveries, due to increase in cross-border relation within Asian countries

- International players, such as DHL, UPS, and FedEx ship parcels overseas, Yamato transport has partnered with UPS and leverages its global network to ship increasing cross-border parcel volume

- Sagawa Express leverages its own subsidiaries Sagawa Global Transport to ship parcel to other Asian countries

Porter's Five Forces Analysis

Supplier Power

Companies do not face challenges, in terms of retaining drivers and sorting personnel, most companies deliver shipments with their own network keeping supplier power low

Barriers to New Entrants

Japan holds tight licensing policies for foreign couriers to enter the domestic market and they depend on Japanese forwarders to ship international parcels, thus keeping the barriers to new entrants high in the domestic segment

Intensity of Rivalry

Competition is weak among the regional CEP service providers, where the top three players hold the same market position for the past 10 years, keeping intensity of rivalry low

Buyer Power

The domestic market is highly consolidated and dominated by the top players, who have market share of 92 percent, and they all offer services at similar prices, keeping the buyer bargaining power low

Threat of Substitutes

Internet penetration into the BFSI sector and public sector is already slowing the demand to ship documents. However, general business needs in the B2C segment would continue to drive the parcel market

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now