CATEGORY

Clearance and Forwarding Services in East Africa

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Clearance and Forwarding Services in East Africa.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

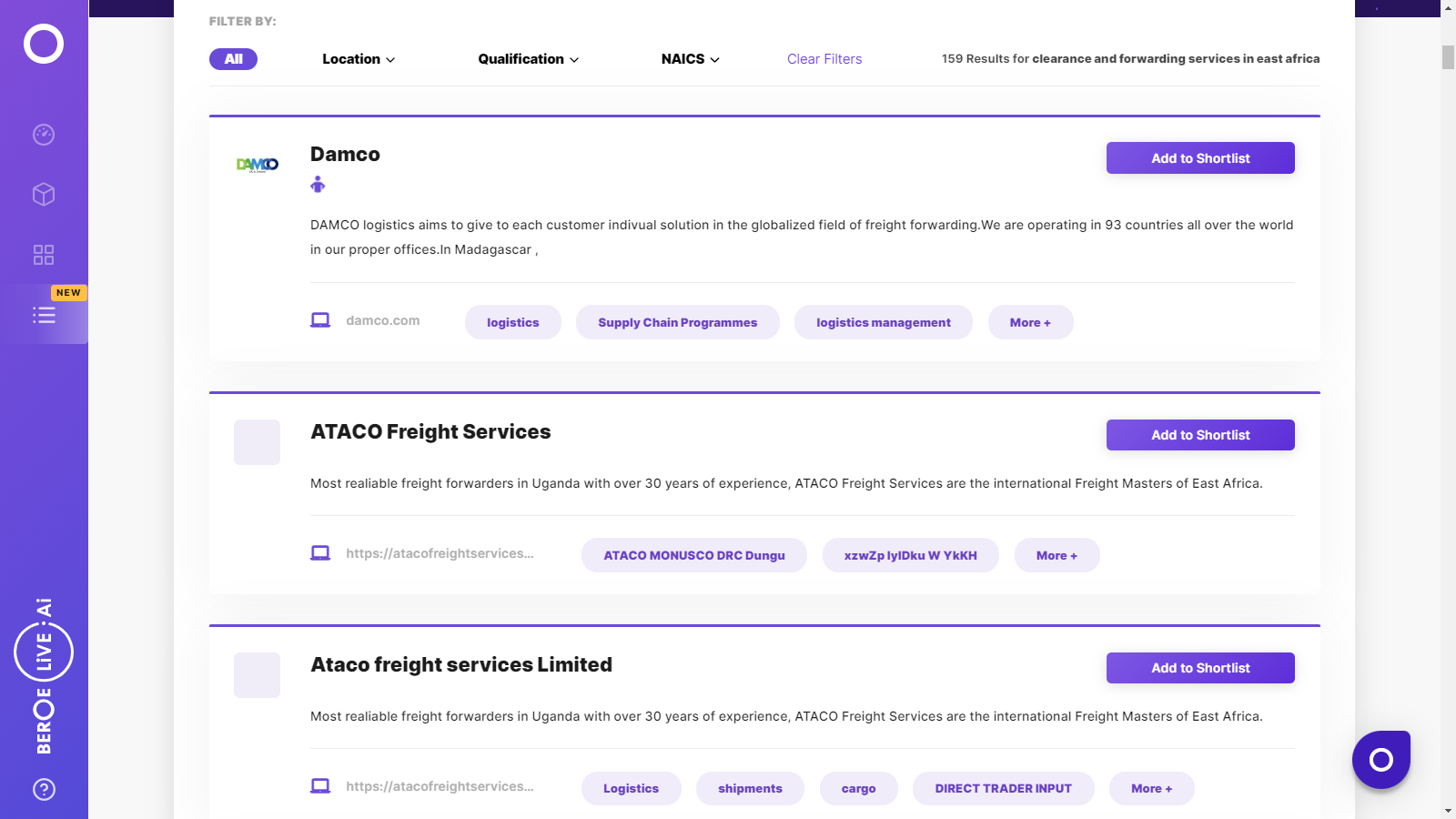

Clearance and Forwarding Services in East Africa Suppliers

Find the right-fit clearance and forwarding services in east africa supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Clearance and Forwarding Services in East Africa market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoClearance and Forwarding Services in East Africa market report transcript

Regional Market Outlook on Clearance and Forwarding Services

Customs Brokerage Market Analysis

The industry can leverage from the presence of a large number of customs brokers/ freight forwarders and can benefit from low switching cost across countries

The market is highly fragmented and the operational knowledge, competency levels with regard to the customs brokers differ from player to player; and hence the operating procedures vary from the best-in-class to the least acceptable levels in the industry

Highly Fragmented Industry

- Customs Brokerage Services is highly fragmented across East African countries such as Ethiopia, Tanzania, Uganda and Kenya with about >500 companies offering service in service each country

- In Kenya, there are around 868 licensed customs agents

Considered as Value Added Activity

- Large freight forwarders like DHL, CEVA and Kuehne Nagel also have their own customs brokerage divisions. However, the same is provided as a value added activity and they use multiple partners in East African regions to provide a one-stop solution for buyers who are interested in reducing the complexity

Low Margins & Exclusive Service Providers are Less

- Customs Brokerage is viewed as a business activity with low margins and is considered a value added activity by most Freight Forwarders

- National service providers in different locations provide customs brokerage services along with freight forwarding activity to leverage their earning potential

- Standalone customs brokers with large regional presence are few and limited

Customs Clearance and Trade Regulations

Kenya

Market Trend

- Customs operations are automated, but the verification and regulatory compliance confirmation is still manual, which states 70 percent of the clearance are automated and 30 percent are manual

Customs Clearance Process

- The Kenya Revenue Authority last month launched Integrated Customs Management System (iCMS) which is built on the latest technology and integrates all customs systems. The new system is expected to cut clearance time by 60%

Regulations

- Customs process in Kenya is regulated by Kenya Revenue Authority which sets out the applicable tariff for each HS code under the East African Customs Management Act

- All imports into Kenya is controlled by Kenya Bureau of Standards which has outsourced inspection at origin to several companies for imports valued above $2000

- Sensitive goods have industry specific regulatory bodies tasked with issuing permits. For example, Pharmacy & Poisons Board (Pharmaceutical )

Trade Indicators

- All Eastern African countries adopt electronic customs data interchange system, which automates the customs entry and exit procedures

- Risk-based customs inspection is not widely used across most countries, however, the frequency of manual inspections remains high, coupled with meagre port infrastructure and high burden in customs procedure. The processing and transit time in clearing cargo shipments are higher in most countries

- Customs procedures in East Africa is a time consuming process and by updating the clearance system from ASYCUDA to iCMS, TANCIS customs clearance systems, burden for customs procedure in 2017 has been reduced compared to 2016

SWOT Analysis - East Africa

Strength

- Availability of ICT systems that support the logistics functions with the development of the custom clearance system, the customs clearance process is being standardized at a faster rate in Ethiopia, Uganda, Tanzania and Kenya

- Knowledgeable and well trained workforce within the region makes good terms with government officials in order to clear the goods faster

- Customs clearance procedures are quite complex thereby major firms need to outsource these services to achieve economies of scale

Weakness

- The industry is highly fragmented with huge number of small and large service providers spread across East Africa. As a result, the bargaining power of customs brokerage service providers is weak

- There is no standard pricing structure followed across the industry. It varies from one service provider to another, however activity based pricing is preferred pricing model

- There exists huge ambiguity in the customs clearance process, thus increasing the lead time

Opportunity

- Political goodwill among East African countries seeking to promote growth of businesses by new initiatives and projects e.g. TradeNet, Port of Mombasa Charter, Standard Gauge Railway that will aid faster movement of goods among East African countries

- Cargo consolidation in collaboration with other small volume importers to reduce sea freight charges

- Africa Free Trade Area initiative - by creating a single continental market for goods and services, the member states of the African Union hope to boost trade between African countries

Threat

- In developing economies, such as Kenya, Ethiopia, Tanzania and Uganda, profit margins of brokers and traders are highly affected due to incidences of corruption and rent-seeking

- Political instability during elections; Internal political uncertainty across the East African region will pose a much greater risk to businesses on the continent than the effect of international geopolitics

- Other than political risk, businesses are facing a growing threat of cyber-attacks, which are a systemic threat

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now