CATEGORY

Logistics Cost Increase Trend Japan

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Logistics Cost Increase Trend Japan.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

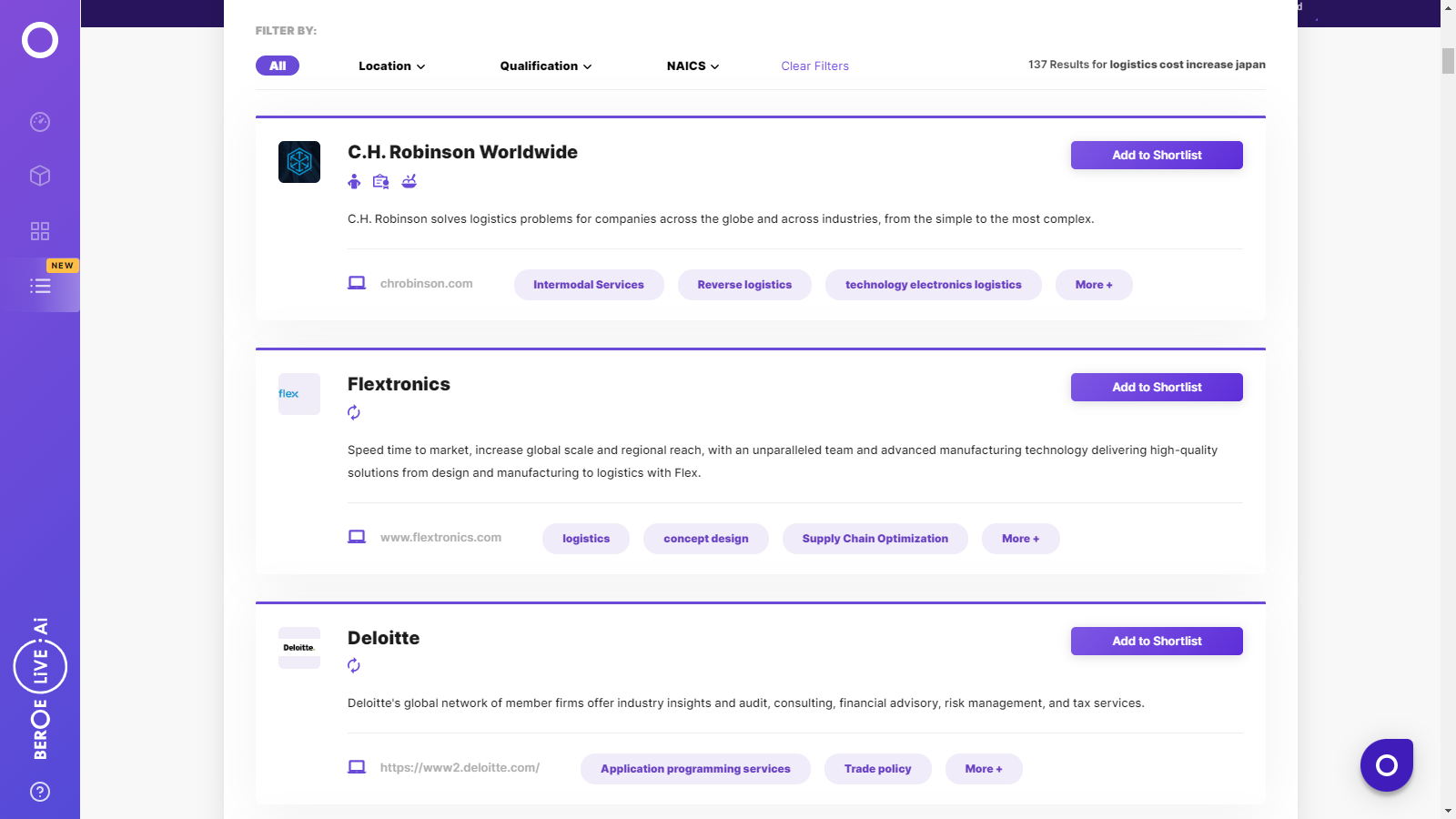

Logistics Cost Increase Trend Japan Suppliers

Find the right-fit logistics cost increase trend japan supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Logistics Cost Increase Trend Japan market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoLogistics Cost Increase Trend Japan market report transcript

Regional Market Outlook on Logistics Cost Increase Trend for Japan

Tokyo, Nagoya and Osaka are the major logistics locations in Japan, where Tokyo contributes to approx. 70–75% of the total warehouse space in Japan

Greater Tokyo is considered as the major warehouse location with more than 400 million sq. m. of stock; buyers have lesser negotiation power here, since Tokyo being a demand-driven market, it faces difficulties in attracting labors, which has forced the companies to look for an alternative locations.

Trucking Market Overview

- Road is the predominant mode of freight transportation in Japan, as it transports 90 percent of the total freight in the country

- Strong economic environment and augmented global trade are predominantly driving the trucking market in Japan

Trucking Supplier Landscape – Japan

- Japanese trucking industry is highly fragmented with more than 63,000 registered trucking service providers present in the market

- Majority of suppliers are present in Tokyo, Nagoya, and Osaka, and these cities have high truck utilization and also the presence of service providers are higher in these regions, as most of the industry consumers are present across these cities

- As the overall freight volume is declining Y-o-Y, the number service providers are also reducing significantly

- Mini cars, vans and light trucks with capacity of less than two tons constitute nearly half of the commercial transport vehicles hauled

Supply–Demand Scenario in Trucking Industry

Demand Drivers

- The number of vehicles operating in the market decreases as the demand for cargo transportation reduced due to decline in Japan's total freight transport volume

- However, there is a growth in demand for new standard trucks as well as in the number of standard trucks in use continued

- The reason behind this is the strong interest from individual business operators in fleet expansion, particularly among larger-sized enterprises

Truck Operating Cost Structure

The driver wages and fuel are the main cost drivers for trucking in Japan. It is observed that there is shortage of drivers in the market in recent times which will have an impact on overall trucking operating cost

Assuming the service providers has absorbed these costs from 2016, in order to mitigate the risk, the service providers are expected to increase their prices by 3–4 percent by 2018 thereby maintaining their profit margin

Courier Services Market Overview

- The Japanese CEP market is expected to grow by approx. 5 percent in 2017 Y-o-Y to reach USD 23.5 billion, majorly driven by purchases from e-commerce sector

- Share of the international segment is estimated to decrease in 2017, due to relatively slower growth in manufacturing and exports. However, cross-border shipments to the US, China, and other Asian countries will drive the market

- The Japanese domestic CEP market is highly consolidated, with 92 percent of the market dominated by three Japanese players, namely Yamato Transport, Sagawa Express, and Japan Post

- Global integrators, such as DHL, FedEx, and UPS operate in the international business segment. However, Japan's stringent licensing policies prevent their participation in domestic market

Major Warehouse Locations

Greater Tokyo is considered as the major warehouse location with more than 400 million sq. m. of stock, buyers have lesser negotiation power, since Tokyo being a demand driven market.

Greater Tokyo, Greater Nagoya, and Greater Osaka are the major logistics locations; about 5–6% of the total space accounts for modern logistics space across these locations.

Major Logistics Locations

- Tokyo, Nagoya, and Osaka are the major logistics locations in Japan, where Tokyo contributes to approx. 70–75% of the total warehouse space in Japan

- Tokyo Bay, Gaikando area, Route 16 area and Ken-O-do area are the key logistics market in greater Tokyo region

Japan Warehouse Market

Greater Tokyo is majorly driven by demand, however, few locations in Tokyo, such as Ken-O-do area, are facing some difficulty in attracting labors, which has resulted in less attractiveness for having warehouse, hence higher vacancy rates.

New supplies in 2017 remained tight in the Greater Tokyo region, with majority of the stock pre-leased, and demand is majorly driven by e-commerce and 3PL sectors. Increase in labor shortage has also forced the companies to look into the option of automating their logistics facilities.

- In Q1 2017, new supplies in Greater Tokyo stood at 22,000 Tsubo and net absorption was only 27,000, the lowest since Q3 2015

- E-commerce continues to drive the demand, vacancy rate for properties more than one-year-old in the Greater Tokyo Area is rising, and this is due to vacancy in some of the facilities in the Ken-O-do Area, which are seen to face some difficulty in attracting labors

- Increase in labor shortages has forced the companies to focus on automating their logistics facilities, and automation rate is likely to increase in the next two years

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now