CATEGORY

Customs Brokerage Service IMEA

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Customs Brokerage Service IMEA.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Customs Brokerage Service IMEA Suppliers

Find the right-fit customs brokerage service imea supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Customs Brokerage Service IMEA market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoCustoms Brokerage Service IMEA market report transcript

Regional Market outlook on Customs Brokerage Service

Customs Clearance Scenario in IMEA Region

- IMEA countries adopt electronic customs data interchange system, which automates the customs entry and exit procedures

- Risk-based customs inspection is widely used across most IMEA countries, however, the frequency of manual inspections remains at 10-15 percent coupled with meager port infrastructure and high burden in customs procedure. The processing and transit time in clearing cargo shipments are decreasing in most of the IMEA courtiers

Customs Brokerage Market Analysis

Industry can leverage from the presence of large number of customs brokers/freight forwarders and can benefit from low switching cost across countries.The market is highly fragmented in IMEA counties and the operational knowledge, competency levels with regard to the customs brokers differ from player to player; and hence the operating procedures vary from the best-in-class to the least acceptable levels in the industry

Highly Fragmented Industry

- Customs brokerage services is highly fragmented across the IMEA countries such as Egypt, Ghana, Kenya, Morocco, Nigeria, S with about 400+ companies offering service in service each country

- In Kenya, there are around 868 licensed customs agents and in West African countries such as Ghana, Morocco, and Nigeria, there are about 650+ companies offering customs brokerage service. Compared to other countries in IMEA region, Egypt and Saudi Arabia has limited customs brokers/freight forwarder

Considered as Value Added Activity

- Large freight forwarders like DHL, CEVA & Kuehne Nagel also has their own customs brokerage divisions; however the same is provided as a value added activity and they use multiple partners in the countries of IMEA regions to provide a one-stop solution for Industry who are interested in reducing the complexity

Low Margins & Exclusive Service Providers are Less

- Customs brokerage is viewed as business activity with low margins and considered as a value added activity by the most freight forwarders

- National service providers in different locations provide customs brokerage services along with freight forwarding activity to leverage their earning potential

- Standalone customs brokers with large regional presence are few and limited

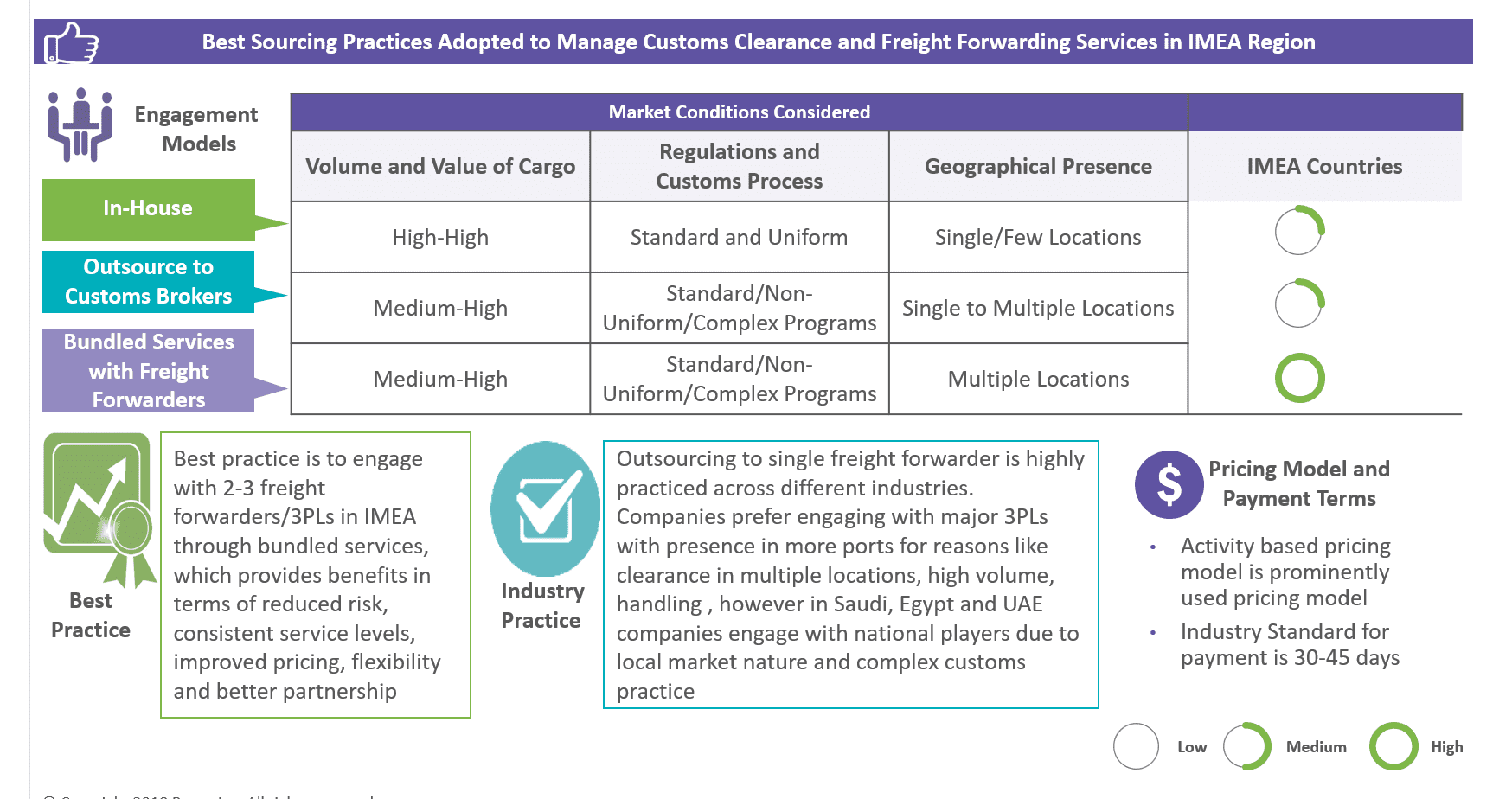

Sourcing Models

The industry can engage with more that two freight forwarders/3PLs for bundled services, which provides benefits in terms of single point of contact for all the activities, consistent service levels, improved pricing, flexibility and better partnership

Outsourcing to freight forwarders is highly practiced across different industries. However companies with higher volume prefer engaging with major 3PLs or freight forwarders for bundled services with presence in more ports for reasons like clearance in multiple locations, handling and operating procedures

In-House

- Companies with high import/export volume/ sensitive good, general maintain a separate in-house customs teams in order to obtain better control and clarity over the customs process

- This trend is in devolving stage in the countries in IMEA region

- With the introduction of AEO, customs regulations in the Africa have been better standardized and uniform

- In-house customs brokerage service providers will enable companies to have a dedicated team especially to cater to their customs clearance compliances

Outsourcing to Customs Brokers

- Industry with medium to high volume of goods, multiple import/export countries, local market nature/niche where only local customs brokers have prominent presence are the situations where outsourcing to a customs broker is prevalent

- This trend is prevalent in countries in IMEA region due to the local market nature such as complex customs process, etc.,

- Customs agents have better understanding of the local arrangements of the customs process

Bundled Services to Freight Forwarders

- Customs clearance procedures and compliance are not standardized and involves complex procedures especially in emerging countries. Thus, outsourcing is preferred over in-house in African countries

- Industry with high volume goods, in general prefer to outsource to a 3PL or a freight forwarder as a bundle of services integrating supply chain activities including intermodal, last mile, forwarding and clearance activities in order to leverage volume discounts and cost benefit

Major Cost Drivers

The volume and value of cargo are major factors in determining the prices levied for customs brokerage services. Also, technology is the key factor which drives the efficiency of the customs brokerage service provider

Volume

- As the volume of cargo increases, the level of completeness and correctness of the document with respect to declaration of cargo, license norms, shipping documents etc. becomes more complicated. This would increase the customs brokerage fee

- Inspection procedures as well as the bundle of services, such as transportation and warehousing will be more cumbersome as the volume of cargo increases, which will add to the customs clearance cost

- Based on the nature of goods as dutiable goods, controlled goods, or prohibited goods, the cost of customs clearance varies

Regulation & Bureaucracy

- The duty and customs fee varies with regard to each region, which adds to the customs clearance cost

- The customs procedures, the complexity of entry, the channel of entry, etc. are determined by the regulatory authority and it will increase customs brokerage charges

- The governments in IMEA countries are making efforts to promote coordination between different regulatory bodies to standardize customs clearance procedures.The new regulatory norms further add to the complexity of customs clearance as well as the overall cost

Technology

- The use of technology reduces the labor intensity in customs brokerage. Technological advancements help in increasing the efficiency of customs clearance procedures, however they act as a major cost driver

Customs Brokerage Market Trends- Egypt

Market Trend

- Egypt customs import accounted to $25.9 billion in 2017 with growth rate of 15.3 percent compared to 2016. However, only 0.07 percent of consumer goods are imported in 2017 which is valued only ~$19 million

- Egypt has concluded free trade agreements with four countries of EFTA (European Free Trade Association), Turkey Egypt, Morocco, Jordan and Tunisia

Regulations

- For importation into Egypt for the purpose of trade, companies/individuals should register with the Register of Importers where Importing procedures are highly regulated by the Egyptian government permitting Egyptian nationals only and fully owned and managed Egyptian companies to import into Egypt

- The manufacturer's name and the product description must be labeled in Arabic with the country of origin for all finished goods imported for distribution and sale in Egypt; companies that do not comply fully with the ECL are highly risked in losing their import licenses

Technology

- Availability of ICT systems that support the logistics functions with the development of the custom clearance system, the customs clearance process is being standardized at a faster rate in Egypt

- USAID assisted Customs in establishing a risk management system where commodities would be channeled into green (no inspection) or red (inspection) channels. In recent year only fewer commodities are being channeled through the green channel due to security concerns

Trade Indicators

Major Port Infrastructure

- As a main gateway to container goods, Alexandria is the major port in Egypt, handling over 60 percent of Egypt's foreign trade. Currently, the port handles 3.6 million tons of container cargo in 2017

- Due to the increase in the volume of container movement, few containers move to Dekheila Port which is a natural extension of the Alexandria Port

- There are ten commercial ports in Egypt of which Damietta Port has the largest container terminal and most modern equipment for cargo handling

- Port Said, Arish, Suez, Adabiya and Sokhna are the other commercial ports in Egypt

Trade Indicators – Time to Import based on Border Compliance and Documentary Compliance

- The time and cost for border compliance include time and cost for obtaining, preparing and submitting documents during port or border handling, customs clearance and inspection procedures

- Customs clearance process is complex where every component of a product be inspected regardless of meeting the compliance, however time to import: Documentary compliance (days) in Egypt was reported at 11 days in 2017

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now