CATEGORY

Intermodal Transportation Mexico

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Intermodal Transportation Mexico.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

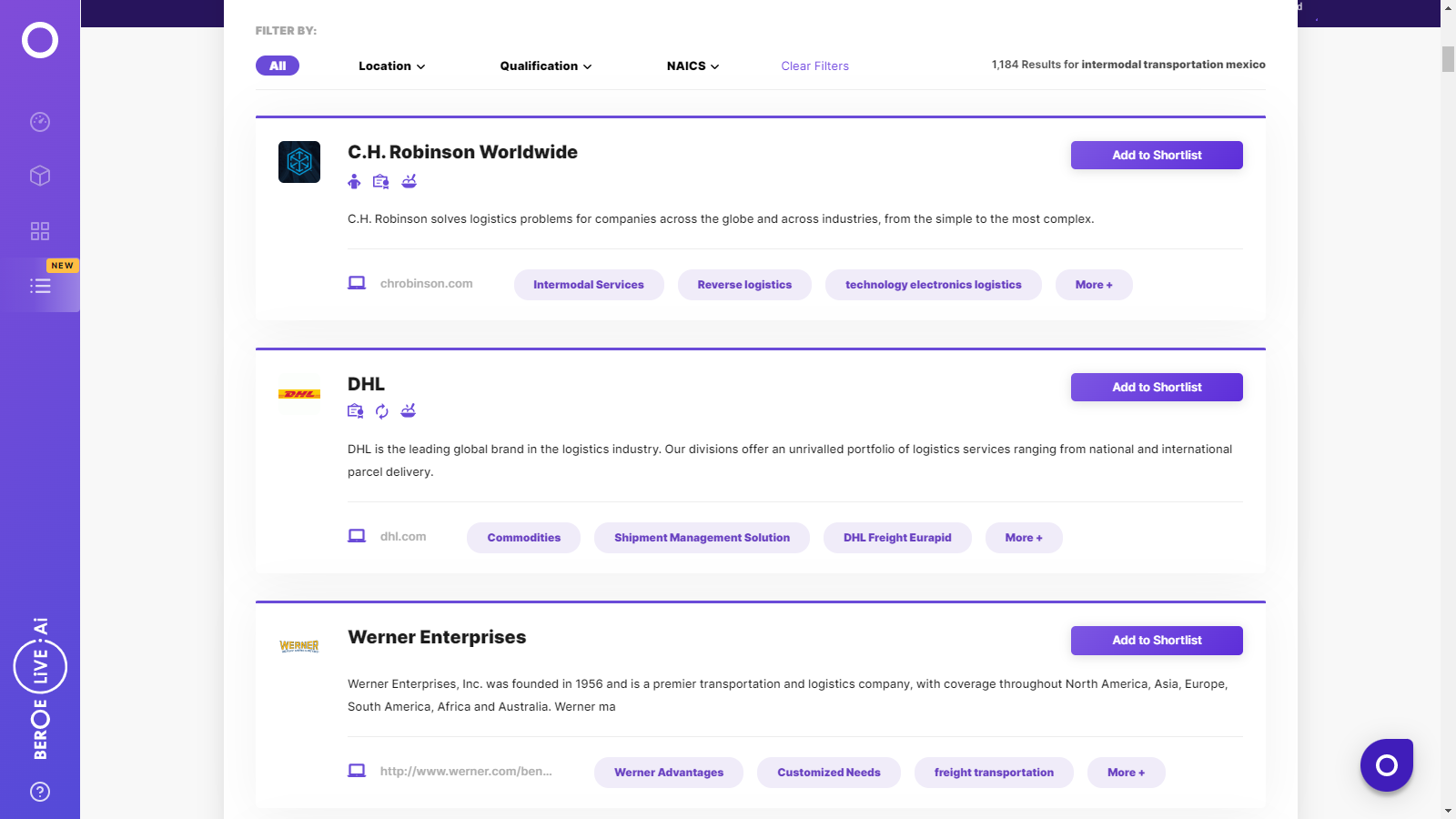

Intermodal Transportation Mexico Suppliers

Find the right-fit intermodal transportation mexico supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Intermodal Transportation Mexico market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoIntermodal Transportation Mexico market report transcript

Regional Market Outlook on Intermodal Transportation

Growth of foreign rail freight volume by more than 52 percent indicates an increase in the number of shippers, who prefer rail freight for cross border transportation.

Mexico's rail freight benefits the country's cross border transportation on a large scale, with the country's railroad foreign trade growing by 52 percent in the last five years.

Market Overview of the Mexico Rail Freight

- The Mexico rail freight industry is completely privatized and highly consolidated among two operators, owning own railroads and railcars

- The rail industry consists of 26,891 Kilometres operated by 2 class 1 railroads and 6 short line rail roads

- USD 6.9 billion of rail freight was moved between the US and Mexico in 2017, highlighting the importance of rail freight for cross border transportation

- On the rails, bulk freight, such as grain, motor vehicles and parts, metallic ores and parts, non-metallic minerals, and chemicals is moved, in general

Outlook of Rail Freight Market

- Domestic rail transport grew by 9 percent, while railroad foreign trade has grown by 52 percent, from 50 million tons in 2012 to 77 million tons at present

- Tight cross border trucking regulations into US has impacted the demand for rail freight, as shippers prefer rail for movement of goods despite the increased transit time

- The rail freight industry was expected to grow by a CAGR of 1.4 percent between 2015 and 2020, but the current trend indicates a higher growth percentage of more than 3 percent

Rail Freight Supply Market Analysis

Rail freight operators have invested in renewal of locomotives to increase productivity and with demand for intermodal on the rise, new locomotives with higher pulling capacity are expected to meet the increasing demand.

Rail freight operators plan of replacing old locomotives with new ones and investment in tank cars is expected to serve freight industry better and improve rail freight volume.

Rail Freight Supply of Freight Cars & Locomotives (2010–2017)

- The number of freight cars in Mexico was the highest in 2015 with 32,054 freight cars, due to regular investments in rail freight by both the government, as well as the three major rail freight operators

- The number of freight cars in service has not increased in the past two years, yet the demand (carloads and intermodal traffic) is on a surge in the same time frame, denoting the demand for rail freight service

- The supply market, as well as infrastructure, is set to strengthen in the upcoming period, with the government allocating 500 billion dollars in 2018

- Demand for fuel has increased, as a result of which, KCSM has acquired 50 locomotives in the first half of 2018, with an aim to operate more fleet and service for tank cars movement

- Companies, KCSM and Grupo Mexico, have purchased new locomotives and replaced the older ones (Low horse power) in order to improve productivity and meet the increasing demand

Mexico Rail Freight Infrastructure

Government's move of privatizing the rail freight has resulted in the development of rail freight infrastructure, as private rail operators are responsible for maintaining the lanes they operate and has benefit the shippers, in terms of freight movements.

Rail freight operators have invested in rail tracks that will enable them to support movement of double stacked trains, as the share of intermodal transportation has been on the raise.

- The main railroad companies, Ferromex and Kansas city Southern de Mexico, are expected to invest about US$ 3 billion by 2020 to expand the traction of locomotives and also in the renovation of tracks and trains

- Ferromex will be capable of moving double stacked trains on completion of inter-Pacific rail project, while KCSM has capability to handle double stacked trains across 90 percent of its tracks

- The Mexican government has provided concession to the major rail operators; KCSM and Grupo Mexico, which authorizes the companies to provide rail freight transportation services

- The concession enables the rail operators to use the tracks, but does not own it and the operators must maintain the facilities during the period of operation

Performance of Rail Transportation in Mexico

Transporting about 25 percent of the total freight, rail freight industry gained a growth of 4 percent from 2016 to 2017 and is expected to grow sustainably, as the demand for rail freight and intermodal increases in the country.

The modal share of rail freight has been on the upward curve in the last few years, with imports dominating the exports, in terms of foreign trade.

- The modal share of rail freight increased from 15 percent in 1995 to 23 percent in 2015

- Demand for rail freight increased largely in the last two years with rail freight, owning 25 percent of the overall freight volume by end of 2017

- The volume of foreign trade railway cargo was 78.9 million tons with imports contributing 61.2 million tons and exports of 18.6 million tons

- 2017 saw the highest fuel efficiency level of cargo in the last eight years standing at 122 tons-km per litre

- Tanks saw the highest increase in the supply with 13% increase to the existing number

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now