CATEGORY

Bank Card Distribution South Africa

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Bank Card Distribution South Africa.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Bank Card Distribution South Africa Suppliers

Find the right-fit bank card distribution south africa supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Bank Card Distribution South Africa market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoBank Card Distribution South Africa market report transcript

Regional Market Outlook on Bank Card Distribution

The cost-effective channel for distribution of bank cards is delivery through bank branches, due to absence last mile door delivery services

Banking and financial institutions in South Africa, generally outsource cards distribution to logistics and courier companies. Depending on the distance and service, these courier providers have multiple pick up time daily and delivers either the same day or next day.

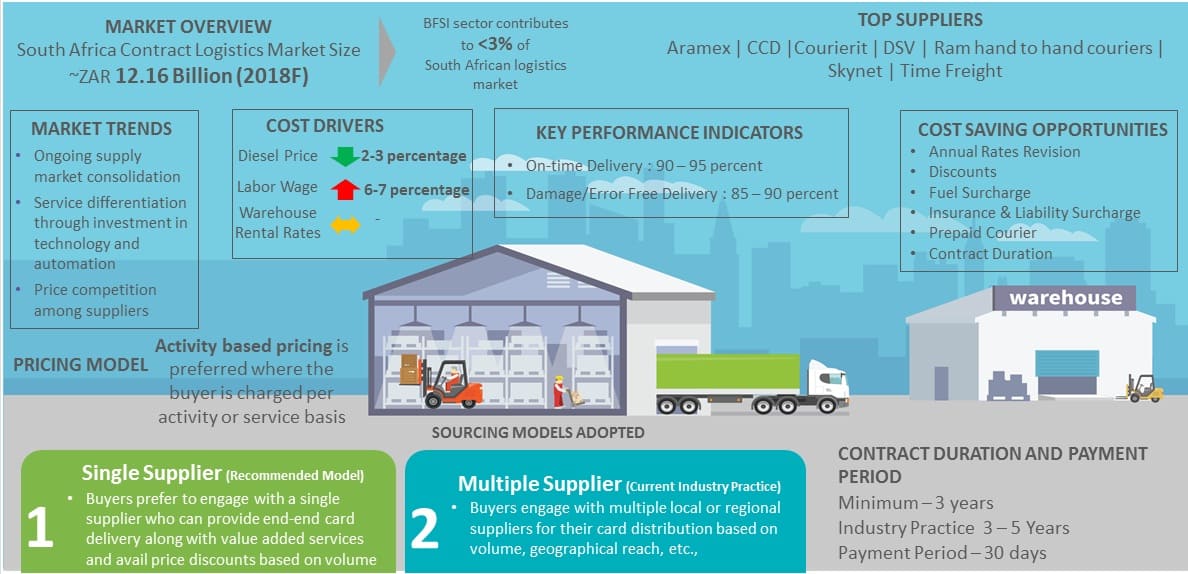

Distribution and Logistics Market Overview

Banking and financial industry contribution to logistics in South Africa is highly limited; however with growing logistics market, industry can expect service availability throughout 2018

South African logistics market is expected to grow at a CAGR of ~4.3 percent (2016-2019F) to reach a revenue of ZAR 12.7 Billion for 2019 majorly driven by e-commerce and FMCG sector

South Africa Contract Logistics Market Size (2013-2019F)

- Contract logistics market in South Africa recorded a revenue of ZAR 11.6 billion for 2017, with ~4.4 percent growth rate from 2016. The market is expected to grow at a CAGR of 4.3 percent until 2019 with demand from e-commerce and FMC industry

- 3PL market in South Africa includes international suppliers such as DHL Supply Chain, UPS SCS, DB Schenker Logistics and Panalpina. There are also few global logistics providers which have their origins in South Africa such as UTi (now acquired by DSV Global Transport and Logistics), Imperial Logistics

- However with respect to BFSI sector which contributes less than 3 percent in the South African logistics market, only limited national and global service providers offer services such as courier distribution, secured and non-secured deliveries, etc.,

- The most prominent national courier service providers catering to banking sectors include CCD, Mr. Delivery, RAM couriers, and global players such as DSV and Skynet

Market Trends

With fragmented supplier market for distribution and courier services, industry is undergoing price competition to increase business. However, the impact for industry can be medium due to limited number of service providers catering to the BFSI sector.

Merger and Acquisition

- South African CEP market is fragmented with several regional and global players

- There is a growing trend of merger and acquisition happening in the industry as suppliers seek to attract volume and extend their network in order to stay competitive in the market

- Ex: FedEx acquired Supaswift in South Africa, Aramex acquired South Africa's domestic courier company PostNet

Supplier Market Landscape

- South African courier delivery market is highly fragmented however specific to BFSI sector it is concentrated with only limited number of service providers such as CCD, RAM, DSV, Skynet

Service Differentiation

- High volume from robust e-commerce sector has created both challenges and opportunities in the market

- Also South Africa currently faces shortage of skilled labor for logistics sector

- In order to cope these obstacles, established suppliers invest in technology and automation to improve their service

- DSV has invested in automated card sorters for serving the banking sector clients

Engagement and Contract Models

Industry can consolidate its shipments and engage with a single supplier for bank card distribution. This can help Industry to negotiate with supplier on volume discount and improved service levels.

Engagement with multiple suppliers has advantage of better geographical reach and lesser risk; However market is shifting towards single supplier engagement model with maturity in supplier service capabilities and opportunity for discounted rate due to increased volumes

Multiple Supplier (Local/Regional Suppliers)

- Buyers engage with multiple local/ regional suppliers for their bank card distribution

- Supplier are engaged mainly based on volume and geographical coverage

- Eg: First National Bank engages with DSV , CCD Couriers and Mr. Delivery; whereas Nedbank engages with DSV and Skynet

Single Supplier (Global supplier)

- Buyers engage with one single supplier for their bank card distribution

- Preferred due to higher volume in order to get discounted rates and value added services

- E.g.: Standard Bank engages with DSV, a global service provider

Pros and Cons of Engagement with Multiple Suppliers

Pros

- Operational Risk: Lower operational risk for buyer as incapability of any one of the supplier, buyer can switch easily to other

- Geographical Reach: Better geographical coverage is possible when engaging with multiple players

Cons

- Complicated supplier management: When engaging with multiple players, it becomes tedious to coordinate and communicate. Since delegating responsibilities to multiple player is difficult , it may be a challenge in managing the supply base

Pros and Cons of Engagement with Single Global Supplier

Pros

- Quality of Service: Global service providers can offer better quality service as well as other value added service because of their sophisticated investment in resources

- Scope for Negotiation: When engaging with single player with cumulative volume, better negotiation is possible hence discounted rates

Cons

- Dependency Risk: When engaging with one single player, buyer eventually becomes dependant. Hence in case of any incapability of the supplier may lead to financial loss to the buyer and services disruption

- Long Contract Duration: Global players generally offer better rates when contract duration is long. Buyers are forced to engage for long duration for better rates

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now