CATEGORY

Direct Mail Services

Direct Mail solution, a form of advertising that offers printed/ written mail communications relying on the postal communications delivering the advertising materials directly to the consumers

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Direct Mail Services.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoDirect Mail Services Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoDirect Mail Services Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Direct Mail Services category is 7.40%

Payment Terms

(in days)

The industry average payment terms in Direct Mail Services category for the current quarter is 58.6 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

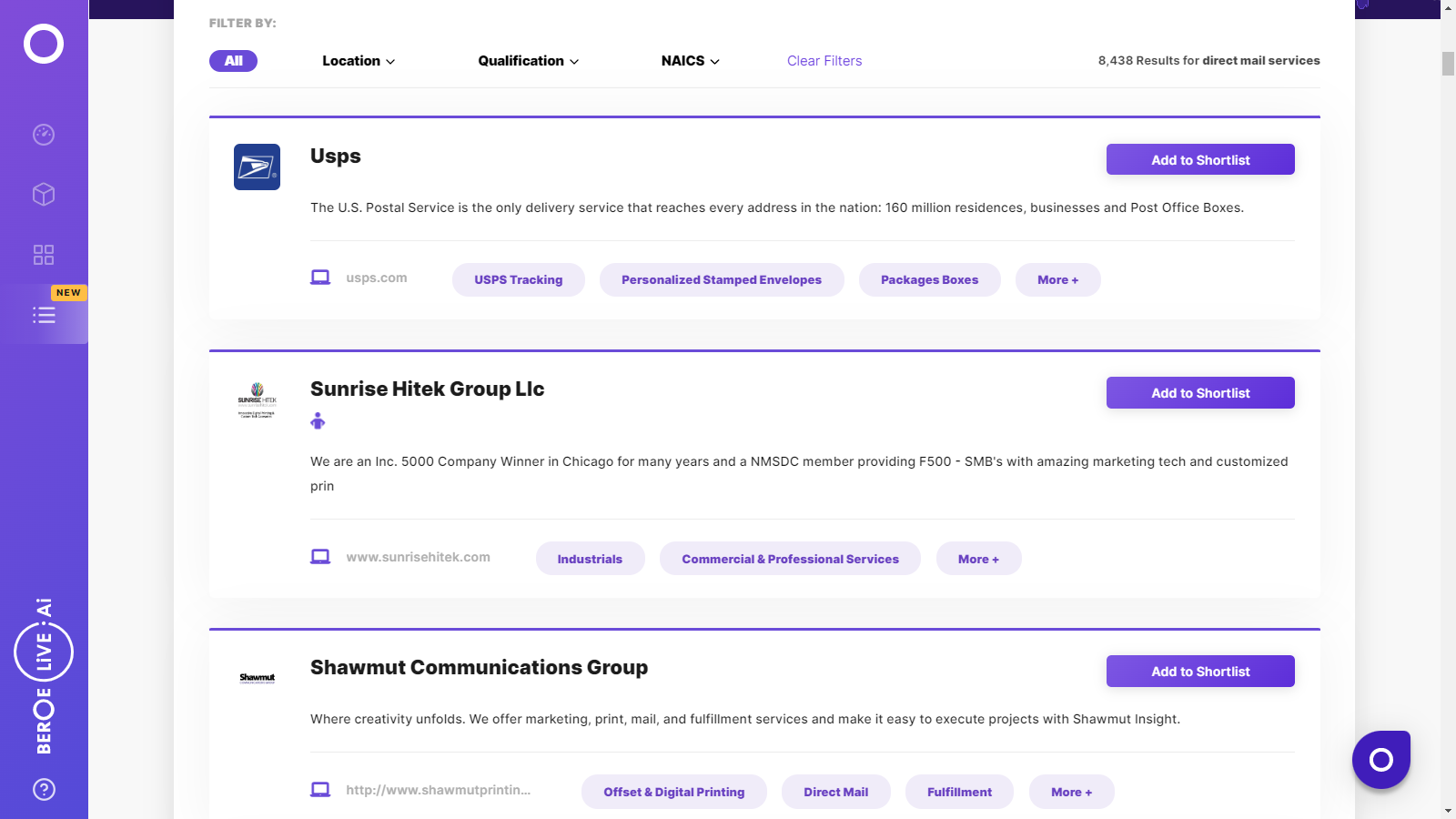

Direct Mail Services Suppliers

Find the right-fit direct mail services supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Direct Mail Services Market Intelligence

global market outlook

- The Direct Mail Services market size in Europe is the highest at$$27–29 billion, growing at 0.5–0.7 percent , followed by North America $15–17 billion, growing at 0.2–0.4 percent. Further, the Marketing Fulfilment services market size in APAC is $12–14 billion, growing at 1–2 percent.

- The top Direct Mail Services providers in the world include R R Donnelley, H H Global, Valassis, Harte Hanks, Cenveo, and Quad/Graphics.

- The global the Direct Mail Services market stands at a stable level with supply and demand at a balanced level.

- According to industry experts, the Direct Mail Services market Expected to grow at a CAGR of 1–2 percent to $66–67 billion by 2024.

- The major Direct Mail Services market include Europe, which holds 46.7% of the total revenue share, followed by North America (26%), and APAC (21.5%).

Use the Direct Mail Services market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoDirect Mail Services market report transcript

Global Direct Mail Services –Industry Outlook

-

The global direct mail market is expected valued at $73–76 billion a CAGR of 1–2 percent to reachin 2023 (E)

-

The direct mail marketing spending in the North American region was 41.9 billion in 2023

-

Regions such as North America, Western Europe and Northern APAC have high market maturity. Until 2024, the market is expected to grow at a CAGR of 0.2–0.7 percent in North America and Western Europe due to an increase in spending on digital marketing

-

The future growth of the industry would be driven by parts of the APAC, the MEA and LATAM, owing to low Internet penetration and a high customer base. Australia is one the markets in APAC which has decent growth potential in direct mail industry.

Direct Mail Services Demand Market Outlook

- The direct mail industry is badly hit, due to the on-going pandemic. Slowly industries, including Retail, BFSI, FMCG, Telecom, are driving the demand in North America, while in Asia and Europe, engagements with the local and regional service providers have increased drastically.

Global Direct Mail Market Maturity

-

Direct mail adoption is high in developed continents, such as North America and Europe. This is because of rich customer databases maintained over a period of time. However, increased adoption of e-mail and mobile advertising is diminishing the demand for direct mail advertising

-

Central and southern parts of APAC, LATAM and the MEA are driving the direct mail market because of low Internet penetration, as compared to developed markets. BFSI, retail, travel and real estate are the major industries that drive demand.

Direct Mail Services Industry Trends

-

Direct mail service providers expand their service portfolios by providing online direct marketing services in order to retain their clients

-

An increased number of M&As in developed continents, such as North America and Europe, is posing a serious threat to new entrants

-

Increased usage of digital printing machines has made printing less labor-intensive, resulting in layoffs, in order to maintain profit

Global Direct Mail Drivers and Constraints

To counter the effect of digitization, direct mail service providers add cross-channel marketing services, such as e-mail marketing, including QR codes in direct mail and clean mailing lists, to retain their clients. However, retail, BFSI, travel and real estate industries sustain demand

Drivers

Integration with digital marketing

- Suppliers in the market compete with each other in their initiatives to integrate online marketing with direct mail marketing. Some initiatives include:

−Inclusion of QR codes in direct mail

−Providing e-mail marketing and other direct marketing services to their clients at competitive rices

−Helping the buyers consolidate their spending to a single service provider

Potential industry sectors

- The demand for direct mail services is driven by retail, financial services and insurance, travel and real estate industries. Demand for flyers, coupons, samples and merchandise items by these industries is a key driver of the industry

Constraints

Increase in substitutes

-

With the increase in digitization, substitute channels, such as e-mail and mobile marketing, gain adoption over direct mail

-

Retail inserts and contact centres affect the demand for direct mail

Quality of mailing lists

-

The mail database in emerging economies, such as LATAM, APAC and the MEA, is of low accuracy, leading to ineffectiveness of direct mail campaigns in reaching their full potential

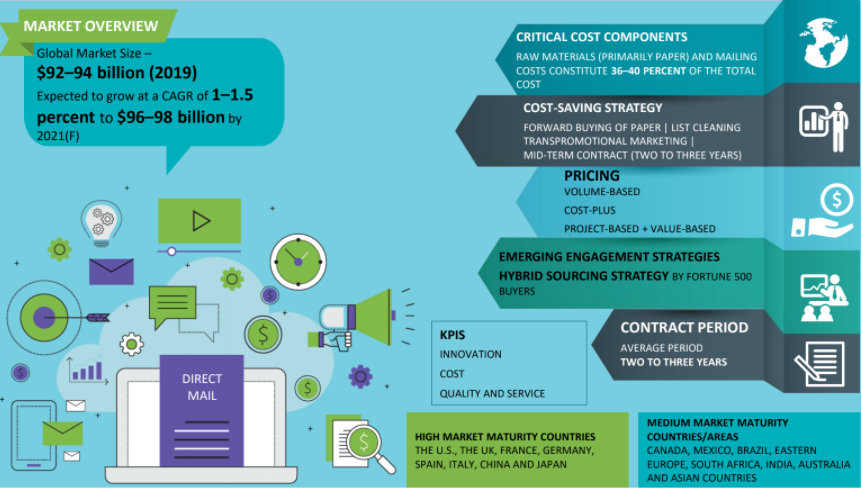

Market Overview

- According to direct mail industry trends, the declining nature of the direct mail industry, lack of business, underutilized capacities and fragmented supplier base provide higher bargaining power to the buyers.

- Direct mail analysis shows that services bundling opportunities with major commercial printers, coupled with the competitive pricing environment, helps the buyers choose the best providers.

- Major cost components involve paper and postage costs.

- Increased threat from digital substitutes forces the service providers to provide end-to-end services at competitive prices.

- Increase in shift of data consumption pattern of end-users from paper to electronic devices, such as smartphones, laptops and mobiles, has forced marketers to cut direct marketing trends budgets from direct mail and increase their e-mail and mobile advertising.

Why You Should Buy This Report

The report gives information on the direct mail market size, maturity, direct mail industry trends, and lists out the industry drivers and constraints. It gives the regional outlook and direct mail trends in the North America, Europe, MEA, and APAC regions. This direct mail analysis report provides the Porter’s five force analysis of the global direct mail market and gives profiles of key suppliers like RR Donnelley, HH Global, Dai Nippon Printing Co., Ltd., etc. It details the cost structure breakdown, sourcing models, pricing models and direct marketing trends.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now