CATEGORY

Digital Marketing Services

Digital Marketing Category involves tracking of digital agencies that gives the creative, strategic, technical development of screen based products and services. A full digital agency can offer clients search engine marketing, online advertising, web design and development, user experience and user interface design and e commerce consulting

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Digital Marketing Services .

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

Microsoft Introduces category-based targeting to improve campaign performance.

March 27, 2023Havas Group strengthens its North American footprint.

April 05, 2023Litmus an email marketing agency launches new capabilities for inclusive and accessible email experience.

April 05, 2023Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Digital Marketing Services

Schedule a DemoDigital Marketing Services Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoDigital Marketing Services Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Digital Marketing Services category is 6.70%

Payment Terms

(in days)

The industry average payment terms in Digital Marketing Services category for the current quarter is 63.8 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

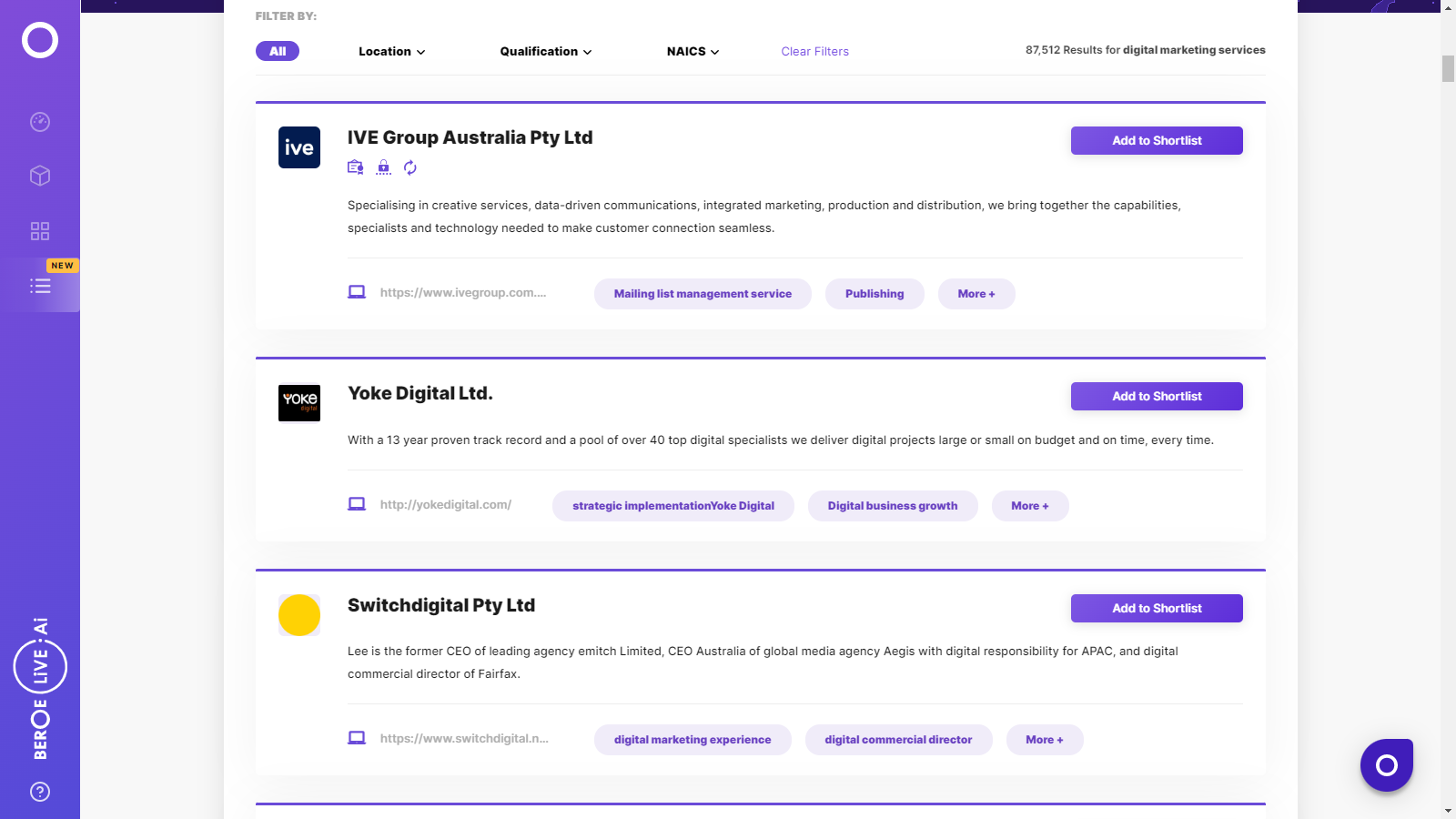

Digital Marketing Services Suppliers

Find the right-fit digital marketing services supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Digital Marketing Services Market Intelligence

global market outlook

- The Digital Marketing Services market is estimated to grow to $420–470 billion (2022)E at CGPR of 17 - 20 percent, followed by North America $135–150 billion, growing at 3–4 percent. Further, the Digital Marketing services market size in APAC is $100–107 billion, growing at 11–12 percent.

- The top Digital Marketing Services providers in the world include Publicis Groupe, Denstu, iprospect, Havas Media, Isobar, RAPP.

- Retail industry digital spend has increased by 25.7 percent, due to high adoption of e-commerce during lockdown and Search advertising is the largest digital advertising format grew by $182 billion in 2021.

- APAC will continue to be the most dominant region in terms digital activity due to high scale B2C digital and e-commerce advertising in China, Japan and Australia.

Use the Digital Marketing Services market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoDigital Marketing Services market frequently asked questions

As of 2019, digital marketing spend globally was valued at $290- $310 billion. The future of the industry looks promising considering the continual attraction towards digital channels. According to the forecasts, the digital marketing industry is expected to grow at a CAGR of 12.8 percent and reach a market value of around $330-340 billion in 2020.

In North America and Western Europe, the overall digital marketing spend is driven by online video and mobile advertising. About 39-42 percent of the digital spend in the Western European market regions like the UK, Germany and Spain is contributed from mobile ad spends. However, the end-users in the European market find the in-app display on their mobiles as intrusive. This will lead to a decrease in the spend on mobile in-app display as it can hurt brand value.

North America dominates the digital marketing industry and contributes around 39-40 percent towards the global digital marketing category spend. The growth of digital ad spend in APAC is driven by China and emerging Asian markets and with increasing investments on technology and digital platforms, the market in these regions has exceeded Europe.

From the digital marketing market analysis, it has been found that the indicators driving the performance are innovation, cost, quality and service.

The regions of medium digital marketing market maturity are Nicaragua, Nordic Region, parts of Western Europe, parts of Middle East, India, Singapore, ASEAN countries, Mexico, Chile, Egypt, Peru

Digital Marketing Services market report transcript

Digital Marketing Services Global Market Outlook

-

The global digital ad revenue is expected to reach $440 billion in 2023

-

About 80–90 percent of digital advertising will come from Alphabet, Meta, and Amazon, excluding the China

-

Latin America and Middle East & Africa are expected to grow at a CAGR of 6–8 percent

-

Retail industry digital spend has increased by 25.7 percent, due to high adoption of e-commerce during lockdown

-

Search advertising is the largest digital advertising format, which grew by $220 billion in 2022

Demand Market Outlook

- The retail and pharma are expected to drive the demand in North America and Europe, while in Asia, the e-commerce segment would be the key driver, due to an increased online shopping.

Global Digital Marketing Maturity

- The ad spend is expected to increase by 14 percent with the situation returning to normalcy. China’s ad spend increased by 16 percent in 2023

Global Digital Marketing Industry Trends

-

Extensions in Mobile Paid Search Ads: Advertisers are increasingly using ad extensions (e.g., click-to-call) in mobile paid search ads to improve click-through rates (CTR) and conversions.

-

Mobile users in the European market has increased and it has led the mobile apps to occupy a significant position in digital lives of consumers. In 2022, the mobile ad spend in Europe accounted for 46 percent of digital ad spending.

Global Drivers and Constraints : Digital Marketing Services

Digital video ad spend has increased by 31 percent in Q3 of 2022 to reach $55 billion accelerated from short-form platforms, like YouTube. Digital media consumption is large since lockdown, large and small brands ramped up the digital business to promote and target audience efficiently.

Drivers

RTB and Digital OOH Media

-

Rising adoption of Real-Time Bidding (RTB) of online display ad slots and increasing consumption of rich media and video advertisements are expected to be the key driving factors for display advertising spend in the coming years in Western Europe

-

Adoption of digital Out-Of-Home (OOH) media is limited to the developed countries; e.g., the emergence of digital TVs in gas stations, where 78 percent of the drivers (in the US) watch TV as their vehicles are refuelled

Targeted Mobile Ad Delivery

- Emerging advertising technologies (such as RTB platforms, location-aware, and bandwidth-aware technology tools) are enabling contextually relevant and personalized ads based on device features, mobile internet speed, location, and other factors.

Constraints

Difficulty in Calculating ROI

- Most marketers believe that they are not sure about the impact of digital marketing, as they often encounter lack of synergy between marketing and procurement centers. Thus, securing a budget for digital marketing investments becomes difficult because providing a digital marketing return on investment is the most critical challenge.

Sustainability Initiatives : Digital Marketing Services

Energy

- Though, the services categories such as Digital Marketing requires lower energy for operations compared to manufacturing and industrial categories, most of the top suppliers in the marketspace such as Havas Media, WPP, Publicis, and Dentsu have set up roadmaps to shift to sourcing and consumption of electricity from Renewable Energy

Carbon Emissions

-

Most of the top Digital Marketing Agencies have established measures to reduce Carbon Emissions from their operations and achieve net zero by the year 2030, some even earlier.

-

A few organizations are also in the process of decreasing their emissions across the supply chain by 2030.

Supply Trends and Insights : Digital Marketing Services

Global/Regional Agency

Effort Reduction of Agencies

- The global marketers are harnessing opportunities to reduce the effort of agencies’ leadership and account management teams with marketing technologies, which promise to automate customer identification, customer profiling, customer query management, customer targeting, campaign concept development and review, campaign deployment, and campaign performance reporting

Partnering with Agencies

- Marketers, who share monetary and non-monetary resources with incumbent agencies, tend to strengthen the ongoing relationship and expect value-added services. Agencies are willing to offer 2–10 percent billing rate discounts for additional contracts

Agency Trends

Line between Core and Developing Capabilities is Blurred

- Traditional print publishers, such as NEJM and Elsevier, are employing digitally skilled human resources to compile live CME events (meetings, symposiums, conference lectures) into virtual CME course apps, which are then integrated into various independent or branded platforms

Building digital capability is the main focus in the recent M&A activities

-

Health analytics and educational company acquired 34D Medical, a startup specializing in digital media educational tools. Digital tools that help students and medical professionals study 3D anatomical models

-

Accenture has acquired CreativeDrive in august, to enhance the content creation on digital and ecommerce channels

-

Direct-to-consumer genomics startup the DNA company announced its purchase of digital therapeutic My pain sensei for about $30 million

Engagement Trends

Cost saving is realized through production decoupling

- Marketers selectively spend to realize higher savings potential and are expected to unbundle routine digital production units (transcreation/versioning, web hosting, etc.) from incumbent lead agencies.

Retail Digital Marketing Spend Outlook

Market Information

Fastest growth in Ad Spending:

- The retail industry was the fastest growing vertical for digital ad spend followed by consumer packaged goods (CPG) and financial services

Retail industry spend maximum on digital marketing services:

-

Consumers are aggressively using digital mediums to compare & purchase products both in offline and online retail stores. The retail industry is seeing increase in ad spend from Amazon, eBay and online market places

-

The retail industry accounted to almost 31 percent of the entire digital ad spending in the US in 2023

-

Nordics region has been performing well compared to Europe on online retail revenue growth. Product pricing across the UK market is dropped by 2–3 percent to drive sales

Why You Should Buy This Report

-

The digital marketing industry report provides insights into the global and regional market trends, market size, value chain analysis, and market outlook for North America, Western Europe, APAC, and MEA.

-

The research study lists out the industry drivers and constraints and a detailed Porter’s five force analysis for emerging and developed markets.

-

It lists out the agency billing rates across the globe and does a SWOT analysis on key players, such as Havas Digital, iProspect, Publicis Sapient, among others.

-

Furthermore, the intelligence report offers the best digital marketing procurement practices, sourcing and pricing models, and end-user digital marketing market update.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now