CATEGORY

Cross Channel Campaign Management

A Cross Channel Customer Management (CCCM) platform with integrated channel marketing empowers’ brands to convert consumers with insight-led engagement. CCCM refers to making all media channels to work together and deliver better results, and provide a better experience for brands and for consumers.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Cross Channel Campaign Management.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

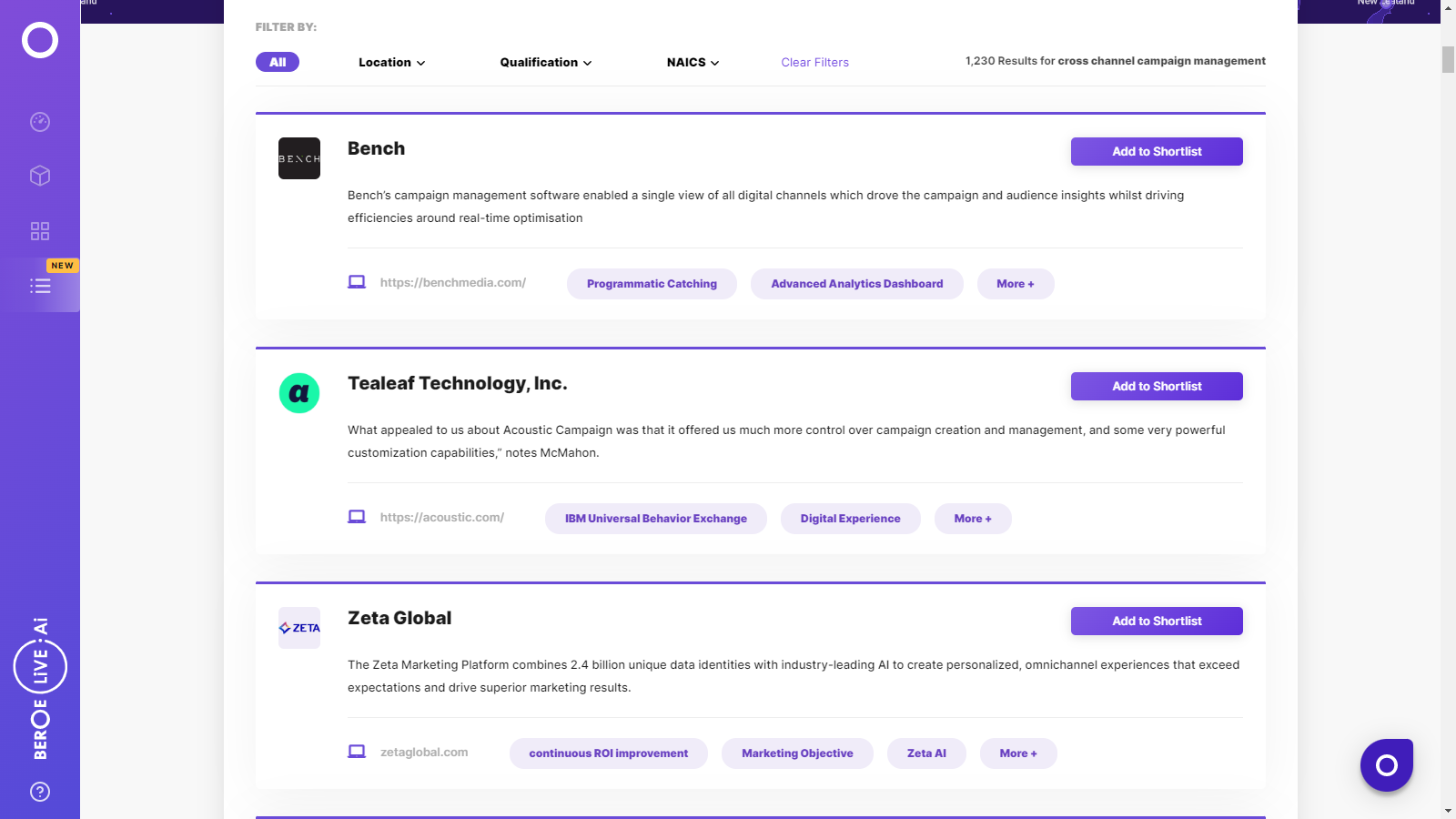

Cross Channel Campaign Management Suppliers

Find the right-fit cross channel campaign management supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Cross Channel Campaign Management market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoCross Channel Campaign Management market report transcript

Global Market Outlook on Cross-Channel Campaign Management

The retail sector leads in CCCM service procurement, followed by IT, media, FBT, and CPG. The retail industry buyers can leverage their account attractiveness to negotiate with the suppliers. The cost of fragmented outsourcing for multiple channel and the need to deliver a unified message to the consumer are major drivers of spend for CCCM.

- The major reason for growth in the CCCM market is the need for B2C segments where marketers had concerns with the high cost of outsourcing and insufficiency of delivering a unified message to consumers. Managing contents and timeline for the campaigns to focus on multi-digital channels posed another area of trepidations for the marketers in need of CCCM services. The new platforms of CCCM have solved all these issues at once and provided “all in one place campaign management” that is efficient in cost and time. Hence, CCCM suppliers, particularly the big brands with their existing huge portfolio of client base, have managed to introduce the CCCM as a new product, and it becomes attractive to buyers of large organizations with the hope of cost reduction and higher benefits in reaching out to consumers with efficient tools

- The retail industry is an attractive account as a CCCM buyer. The brands under retail can leverage its account attractiveness to negotiate price with the suppliers.

Innovation in CCCM

Fragmented data and communication is a major challenge for the buyers of CCCM in today's market. The innovation is to amalgamate the three elements, data, insights, and action in a single environment, and this is done by a concept know as Modern Marketing Architecture (MMA). This is a forward-built approach, grounded in the requirements of digitization. MMA helps orchestrate messaging across online and offline channels and is capable of consuming huge data and extracts insights through embedded machine learning. This innovation helps marketers to respond intelligently to each customer's needs individually.

- Sophisticated algorithms are used by adaptive learning modules, in order to identify the optimal offers, message, and channels for each customer.

-

Centralized user environment helps marketers build a unified multi-channel strategy, thus executing campaigns across any and all relevant channels from a centralized platform.

-

Allows the marketers to adapt to the ever-changing consumer needs and competitive landscape. The first, second, and third-party data is combined to create the richest and the most actionable profile for each targeted audience and prospect.

Supply and Demand Trends

- Cloud-Based Solution: A gradual movement from on-premise to cloud-based computing is observed in most of the industries, if there are no privacy, multi-country security requirements.

- Privacy/Data protection: A declining demand for on-premise is noted, however, any place where data protection is a major concern, on- premise installation is preferred.

-

Deep Learning/Machine Learning: One of the fastest moving phenomenon under data science is the development of deep learning algorithms, which is strengthening the marketing and automation campaign. Fortune 500 buyers of CCCM make sure that the vendors selected are already active and are investing in this field. (Example: By asking how much of the income is reinvested in R&D).

-

SaaS Solution: Most vendors are switching from license agreements toward PaaS/SaaS deployment. This model has proved to be very convenient for buyers who need flexibility (because of seasonal peaks where more people will be involved with more campaigns) or make a sporadic use of the solution. Buyers, however, while considering this kind of agreement, take into consideration the estimated volume and have some buffer for the negotiation of the pricing.

-

Software assurance:Fortune 500 buyers who do not opt for SaaS do make sure to include software assurance in their maintenance contract; this is done by paying a little extra and this guarantees that the software the buyers will be using will be the latest version.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now