CATEGORY

Creative Advertising

Creative advertising covers all facets of advertising lifecyle ranging from ideation to actual production of the advertising

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Creative Advertising.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

New talent agency has been launched to help black creatives to find jobs

March 30, 2023Wingstop appoints 72andSunny as lead creative agency

April 17, 2023McKinney is the new creative AOR for Popeyes

April 06, 2023Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Creative Advertising

Schedule a DemoCreative Advertising Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoCreative Advertising Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Creative Advertising category is 7.50%

Payment Terms

(in days)

The industry average payment terms in Creative Advertising category for the current quarter is 57.5 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

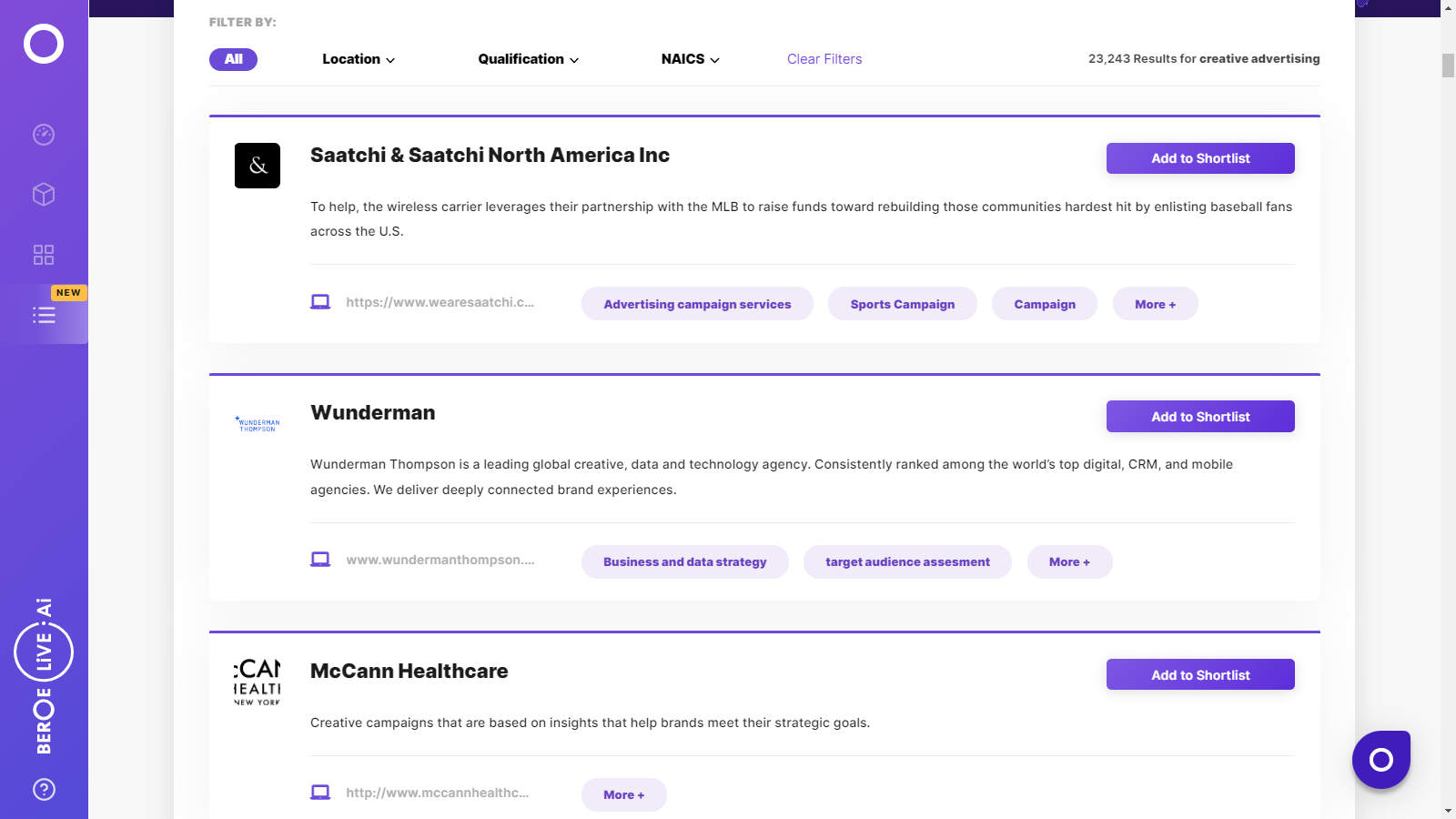

Creative Advertising Suppliers

Find the right-fit creative advertising supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Creative Advertising Market Intelligence

global market outlook

- The global ad spend for creative advertising is expected to be valued at 220 – 250 USD Billion in 2022 growing at a rate of 15-19 percent

- Major sporting events like FIFA World Cup, Winter Olympics, Paralympics are major drivers for advertising in 2022

- Markets such as North America, Europe - UK, Germany, France, Italy, Spain and markets in APAC, such as Japan, Hong Kong, Singapore, South Korea have high market maturity.

- Top advertising networks include; Omnicom Group, WPP, The Interpublic Group of Companies, Publicis Groupe, Dentsu, Accenture Interactive, etc.

Use the Creative Advertising market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoCreative Advertising market report transcript

Creative Advertising Global Market Outlook

-

The global ad spend for creative advertising is predicted to be valued at $222–250 billion approximately in 2023, with an estimated Y-o-Y growth of 3–5 percent

-

Experts predict continued growth in 2023, driven by gains from inflation rather than volume growth

-

Digital is forecasted to account for 57 percent of the spend approximately in 2023

Creative Advertising Global Industry Trends

- The penetration and popularity of digital and device-based platforms will continue to be popular through 2023. Brands will be seen focusing on customization and tap into the potential of the large target audience through a digital medium

Creative Advertising Global Drivers and Constraints

Increased prices driven by inflation, along with events, such as Rugby World Cup 2023 and the FIFA Women’s World Cup 2023, are expected to positively contribute toward advertising revenue in 2023.

Drivers

-

Digital Ad Spend: The increasing importance and penetration of smartphones and social media have encouraged marketers to increase their ad spend in these channels to attract more consumers and improve their brand loyalty. Considering the changing consumer behavior, due to the COVID-19 outbreak, usage of digital platforms has gained more importance. Buyers are using this to capitalize on sales and address the pandemic situation to resonate with the audience.

-

Cyclical Events: Events lined up in 2023, such as Rugby World Cup 2023 and the FIFA Women’s World Cup 2023, are expected to make a significant contribution toward the advertising revenues, especially in Europe and Australia NZ markets.

Constraints

- High Margins and Lack of Transparency: Network agencies continue to enjoy high profit margins due to their billing rates, which are skewed towards senior personnel. Therefore, clients face cost pressures since budgets are decreasing but agencies are unwilling to accommodate the reduced budgets.

Supply Market Outlook

Supply Trends and Insights

Global/Regional Agency

Increase in Digital Advertising:

-

Marketers are slowly shifting to global category planning to streamline their services by engaging creative agencies on the global contracts

-

Digital advertising spend is increasing because it reaches the same target audience with less spend compared to traditional ways. Hence, the demand for digital creative advertising is on the rise

Customized Services:

-

Customization helps to increase the integrity of services and brings high level of expertise

-

Advertisements were created to cater to mass audience before; now, advertising has been customized to serve specific target audiences using various collaborative tools, thus reducing the cost

Agency Trends

Experience across Industries:

- Tier-2 companies are building capability to provide a wide range of services to various sectors, such as branding, creative services, and internal communication

Innovative and Integrated Service Offerings:

-

Suppliers are producing performance-based contracts and service options, like production decoupling for buyers

-

Advertisers are increasingly using technology, i.e., digital techniques based on platforms, to have better reach and receive higher impressions

-

Agencies offer integrated services to clients, wherein they have access to the best mix of channels and strategy, which helps to meet the brand’s marketing objectives

Engagement Trends

In-house and Partial Outsourcing:

- Marketers seem to be interested in building in-house capabilities and consider partially outsourcing for creative advertising activities. This helps them to gain more transparency and control over the project, while saving costs in the long run.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now