CATEGORY

Creative Advertising Australia

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Creative Advertising Australia.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Creative Advertising Australia Suppliers

Find the right-fit creative advertising australia supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Creative Advertising Australia market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoCreative Advertising Australia market report transcript

Regional Market Outlook on Creative Advertising in Australia

Industry Outlook – Opportunities and Challenges in the Australian Advertising Industry

Opportunities

- The increase in digital video advertising and mobile has created a significant surge in the Australian online advertising market. The spread of digital and social media in recent years, as well as changes in patterns of consumer behaviour and the evolution of technologies, will all change the relationship between companies and consumers in the area of marketing

Challenges

- Given the numerous technological advances and changing consumer demand have posed difficulties for many buyers to achieve the required results from their campaigns. This, in turn, increases pressure on the suppliers, as they are looked upon for expertise in attaining the desired output

Industry Trends

- The major trends in the Australian creative industry are rising digital spend (38–46 percent), production decoupling, and increasing customization of advertisements

- Suppliers are improving their supply capability by adopting performance-based metrics for evaluation and monitoring their performance

Australia Advertising Drivers and Constraints

Drivers

Advertising expenditure

- The overall advertising expenditure is expected to increase by 2.4% in 2019. This presents ample opportunity for the overall industry to grow, with various digital channels, like mobile, digital display, social media, experiencing highest spend allocation by buyers across various industries

Major Events expected to drive ad spend

- The NSW election and Federal election is believed to raise the numbers for the advertising industry in Australia

Constraints

High Margins and Lack of Transparency

- Network agencies continue to enjoy high profit margins, due to their billing rates, which are skewed towards senior personnel

- Therefore, clients face pressure, since budgets are decreasing, but agencies are unwilling to accommodate the reduced budgets

Dominance of Select Network Agencies

- The top network agencies have dominated the market through strategic mergers and acquisitions, leading to a situation where the clients have less bargaining power

Porter's Five Forces Analysis – Australia

Supplier Power

- Reduced level of differentiation in the service offerings of the suppliers

- It is observed in Australian market context, a significant portion?of supplier's revenue comes from a limited number of large clients and the net loss of one or more of these clients have a material adverse effect on company. This lowers down the supplier's bargaining power quite significantly

- Rise of in-house capabilities : A significant increase, as comparatively in 2013, 58% of marketers were involved in some form of in-house advertising, which is now expected to reach around 65% by 2019

Barriers to New Entrants

- Capital investments: New entrants will have difficulties investing in technology. They definitely can set up shop within a niche market, but cannot match the global player's services, as high expectations are set in terms of innovation and creative quality

- Most of the engagements are based on long-term relationship between the agencies and advertisers. For instance, customers, like Harvey Norman, Woolworths, Wesfarmers, etc. New entrants may find it difficult to make inroads

Intensity of Rivalry

- High competition in retaining clients: Huge competition exists between the agencies in retaining client accounts and gaining new accounts worldwide

- Agencies building digital capability: By 2020, the digital industry is expected to account for almost 50 percent. Holding companies and traditional agencies are enhancing their digital capabilities through mergers, acquisition, and expansions across the globe. This will lead to an intense competition between traditional and digital agencies

Threat of Substitutes

- Increasing freelancers: The number of full-time and part-time freelancers in Australia is extremely high. They are hired from the market through a crowdsourcing platform. Apart from the developed markets where the freelancers' presence is high, there is no strong substitute for creative agencies

Buyer Power

- Account attractiveness: Major spending clients, especially those in the B2C space, are viewed as attractive accounts because of their budgets and high frequency of launching new advertising campaigns. To overcome this, several other buyers try to engage agencies through regional/ service bundling to increase the attractiveness of the account by accumulative volume spend

- Increase usage of the procurement team: Lately, marketers are employing their strategic procurement teams for scrutinizing and benchmarking the price to industry standards. In a highly competitive and fragmented market, the bargaining power of the buyer is high, since the prices are benchmarked

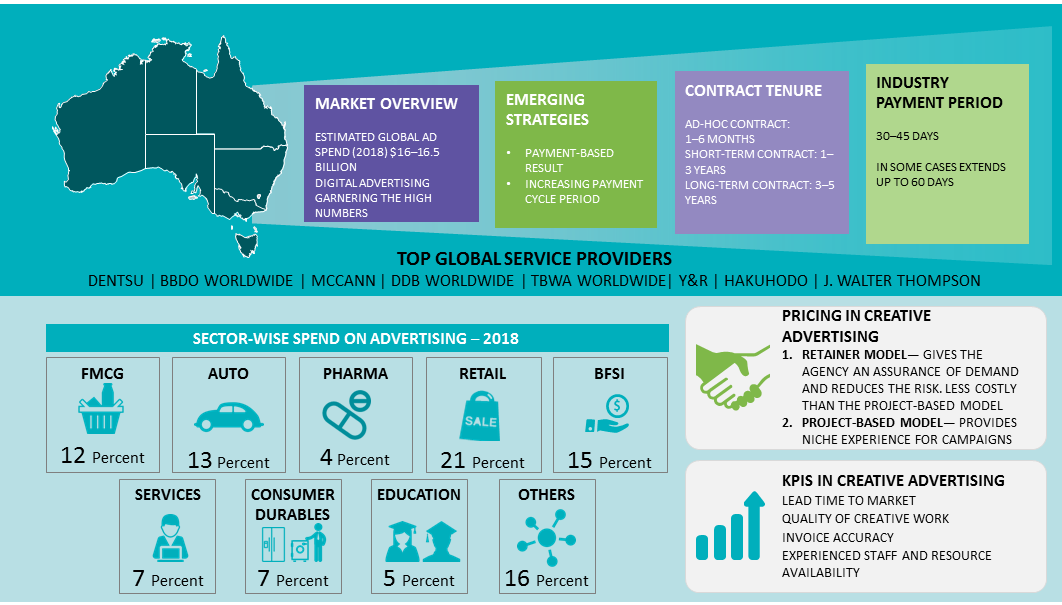

Creative Advertising Australia Market Overview

- Increase in Digital Advertising: Marketers are slowly shifting to global category planning to streamline their services by engaging creative agencies on global contracts

- Digital advertising spend is increasing because it reaches the same target audience with less spend compared to traditional ways. Hence, the demand for digital creative advertising is on the rise

- Customized Services: Customization helps to increase the integrity of services and brings a high level of expertise

- Advertisements were created to cater to a mass number of audiences before; now advertising has been customized to serve specific target audiences using various collaborative tools. It also reduces the costs.

- Experience across Industries: Tier-2 companies are building capability to provide a wide range of services to various sectors, such as branding, creative services, and internal communication

- Small businesses believe that mobile marketing is very effective, and it continues to show the highest spend growth across all media in 2018

- Innovative Service Offering: Suppliers are coming up with performance-based contracts and service options, like production decoupling for buyers

- Advertisers are increasingly using technology, i.e., digital techniques based on platforms, to have better reach and receive higher impressions.

- A large number of Australia-based creative agencies are available to provide end-to-end services in the market. Hence, the maturity of service providers is high in these markets.

- Buyer maturity is high in Australia. Hence, major US-based agencies are trying to open their offices.

- Most Adopted Model Globally: Retainer model

- Contract Length: 2–5 years, with an option of contract extension based on performance linked with SLAs.

Why You Should Buy This Report

- Information on the Australian creative advertising market outlook, drivers and constraints, Porter’s five forces analysis of the advertising industry, etc.

- Supply trends and insights, list and profiles of key suppliers, etc.

- Buyers strategy, sourcing and pricing models, value chain mapping, SLAs, KPIs, etc.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now