CATEGORY

Contact Centers Australia

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Contact Centers Australia.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Contact Centers Australia Suppliers

Find the right-fit contact centers australia supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Contact Centers Australia market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoContact Centers Australia market report transcript

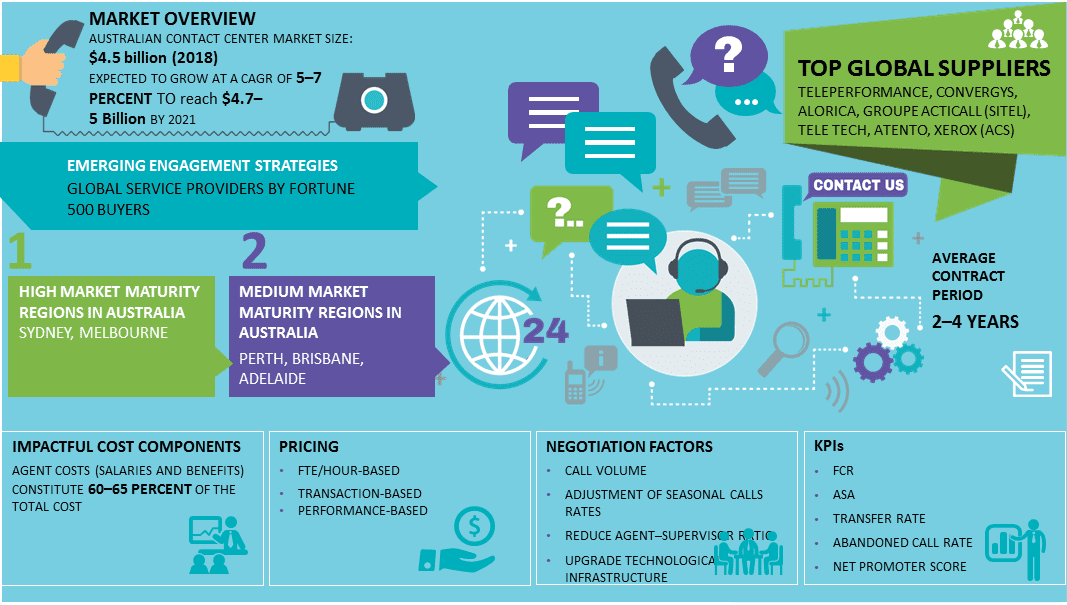

Regional Market Outlook on Contact Centers

- The global contact centers market was valued at $395 billion in 2018, of which, 65–75 percent of contact center services are kept in-house and the remaining 30–35 percent are outsourced to third parties. The industry is dominated by in-house contact centers, and this trend will sustain in the future as well

- The overall contact centers market is forecasted to grow at a CAGR of 9–11 percent to reach $430–438 billion by 2024; however, the outsourcing market is expected to register a continuous growth, but at a slower rate, due to sluggish demand. In-house segment witnessed higher growth, due to an increase in new captive center set up

- Demand perspective: North America is the leading buyer of customer care outsourcing services, but the region's share remained stable last year, followed by Europe (mainly Western Europe), the UK, and some parts of the MEA. Some parts of APAC drive the outsourcing demand, due to rising domestic demand

- Supply perspective: India and the Philippines are the foremost countries in managing contact center outsourcing demand, and they will continue to maintain their top positions in the near future. However, a moderate number of contracts are expected to move toward nearshore locations, such as LATAM, and emerging destinations, like the Caribbean, Central America, and Eastern Europe

Market Drivers and Constraints

Rising customer focus and complexity to provide a better customer experience will encourage buyers to outsource contact center services to third parties. Therefore, it has been noticed that outsourcing spending has grown between 5 percent and 6 percent annually, while in-house spending has been relatively flat.

Drivers

Increasing focus on customer services

- Contact center buyers' focus has shifted from cost saving to maximizing value to end-consumers, due to rising customer demand and competition

- This will lead to high outsourcing spending, in order to maximize customer experience, brand image, and revenue

Need for specialized service capabilities

- The rising demand for contact center analytics and support on different channels, such as social media and around-the-clock mobile services, requires specialized and dedicated capabilities to provide better customer experience

- Buyers are expected to spend more on contact center outsourcing, in order to partner with third-party service providers to meet these needs

Rising demand from small and medium businesses

- Small and medium players will find it increasingly difficult to compete with top players in their fields and will look to outsource processes to limit expenses and tighten budgets

Constraints

Rising quality concern and very limited cost saving

- Very frequently raising quality issues and reducing the cost difference between outsourcing and managing in-house influence the buyer's decision of outsourcing

Regulation implications

- Various regulations, such as the Dodd-Frank Act, Basel III, MIFID II, OCC Guidelines, and FRB, restrict companies to keep personal, financial and confidential data within the country's boundary. This restricts outsourcing various processes to other locations

Porter's Five Forces Analysis: Australia

- Large buyers have a strong buyer power, due to large consolidated business volume

- Service providers are trying to improve their supply capabilities to offer a holistic service portfolio and thereby gain some negotiation power

Supplier Power

- Leading service providers, like Teleperformance, Concentrix, are seen as preferred suppliers, on the account of their wide global presence and the ability to invest in new value-added services/tools

- The supply market is highly fragmented; hence, most of the contact center service providers are vying for buyer contracts, thus negating their bargaining power vis-à-vis buyers

Barriers to New Entrants

- Relatively high investment in technology and agent hiring and training, as well as negative perceptions in the workforce toward smaller businesses prove to be challenging

Intensity of Rivalry

- The industry rivalry has historically been high and will continue to increase, as small and medium-level players continue to enter into the market

Threat of Substitutes

- The substitutes to the sourcing of services from contact centers are minimal and primarily consist of shifting the capabilities to in-house or captive delivery centers

- Buyers are focusing on providing excellent customer experience at an economical cost with modern technologies and prefer to concentrate on their core activities; hence, the threat of substitutes is medium

Buyer Power

- Better customer service at an economical cost is driving the contact center outsourcing spend. Outsourcing spend has registered a continuous growth of around 5–7 percent over the past five years, whereas in-house spending has been flat

- Top spenders, such as Telecommunication, BFSI, Healthcare, and CPG, are consolidating their spend, different locations, and service lines to negotiate, based on call volume

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now