CATEGORY

Zippers

Zipper is a commonly used device for binding the edges of an opening of fabric or other flexible material, such as on a garment or a bag.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Zippers.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoZippers Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Zippers category is 6.60%

Payment Terms

(in days)

The industry average payment terms in Zippers category for the current quarter is 71.6 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Zippers Suppliers

Find the right-fit zippers supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Zippers market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoZippers market report transcript

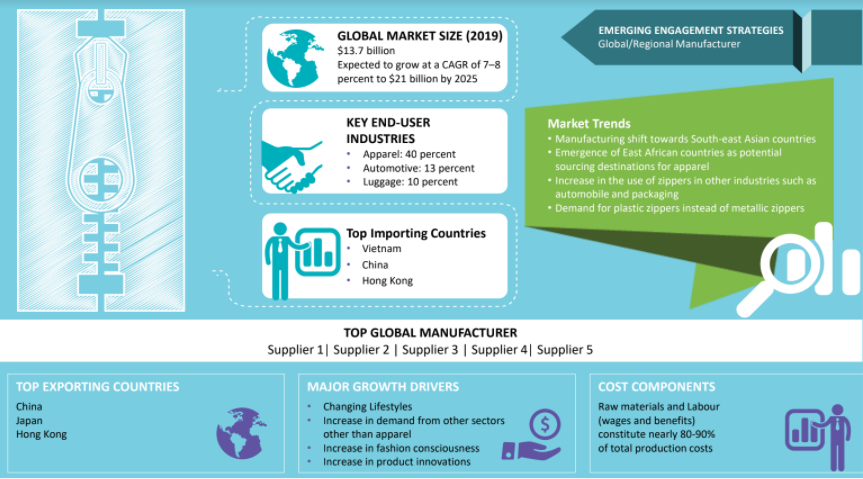

Global Zipper Market Outlook

-

The global zipper’s market value in 2022 stood at $15.93 billion

-

The market is forecast to grow at the CAGR of 7.42 percent to reach $24.48 billion by 2028

-

Asia Pacific is the largest Zipper manufacturing geography followed by North America and Europe

-

The apparel industry is the key driver of zipper demand (40 percent). The end-users are becoming brand-conscious and fashion-oriented. Hence, there has been an increased demand for high-quality branded zippers and exposed zippers

-

Demand from the automobile sector demand (13 percent) is increasing, especially the flame-retardant types that are used in seat covers and other upholstery parts

-

The other major demand applications are from the luggage sector (10 percent), which includes handbags, laptop backpacks, school bags, purses, followed by the upholstery sector (10 percent)

-

Army, marine, PPE, sportswear, and footwear (27 percent) contribute to the rest of the demand

Global Zippers Drivers and Constraints

Drivers

Apparel End-user Segment

-

The apparels industry drives the demand for zippers as a whole; especially, women’s clothing segment fuels the growth in zippers production

-

Other demand driving factors are:

–Changing lifestyles

–Increasing disposable income

–Importance given to fashion orientation

Cross Industries’ Demand

The market is driven by other industries, such as:

-

Luggage

-

Footwear

-

Flame retardant garments

-

PPE

-

Automobile

-

Other upholstery industries

Customers’ Preferences & Innovations

-

Innovations in improving the design and functionality of zippers boost up the demand

-

Air-tight, flame-resistant, water-proof, and exposed zippers open up new avenues for growth in the industry

-

Replacement of metal zippers with plastic ones, due to heaviness, and susceptibility to corrosion

Constraints

-

Increased price of raw materials, material supply crunch, etc.

-

Reduced buying options due to market dominance by a few suppliers

-

Risks involved in international sourcing such as increased lead time, receiving damaged items due to improper handling and packaging

-

Government restrictions such as trade restrictions, consumer taxation and environmental laws etc.

-

The quality and compliance (environmental, labour)of the product differ for developed regions (U.S. and Western Europe) and emerging regions (example - India, China, Brazil) due to which the sourcing operations differs with geographical regions

Major Importers for Zippers: Global

-

Vietnam is the largest importer of zippers and its parts.

-

The top 10 importing countries account for approximately 59.83 percent of the international trade for zippers

-

Asia-Pacific contributes about 58 percent of the total import for zippers

Major Exporters for Zippers: Global

-

Vietnam is the largest exporter of zippers.

-

The top 10 exporting countries contribute about 62.05 percent of the international trade for zippers

-

Major exporters of Asia-Pacific are China, Hong Kong, Japan, Vietnam, Korea, Indonesia

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now