CATEGORY

Zinc Oxide

In depth analysis of the zinc oxide market across NA, EMEA and APAC with a focus on capcity-demand analysis, industry analysis, cost structure, historic/ forecast price trends and preferred sourcing strategy

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Zinc Oxide.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoZinc Oxide Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoZinc Oxide Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Zinc Oxide category is 6.50%

Payment Terms

(in days)

The industry average payment terms in Zinc Oxide category for the current quarter is 70.4 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Use the Zinc Oxide market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoZinc Oxide market report transcript

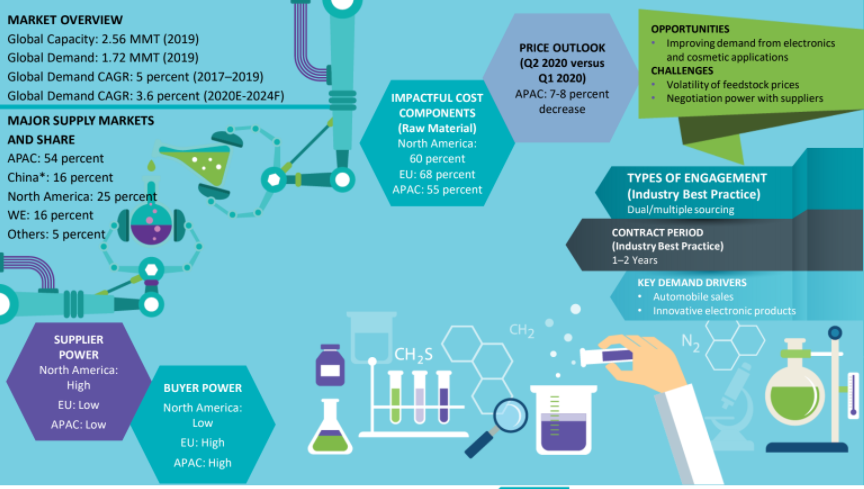

Global Market Outlook on Zinc Oxide

-

There is growing demand for zinc oxide from the electronics sector for use in metal-oxide-based semiconductors with relatively bio-safe and biocompatible properties which is suitable for sensor/transducer applications

-

The other factor driving zinc oxide demand growth includes the demand from cosmetics and personal care products, including makeup, baby lotions, bath soaps and foot powders. It is used as a bulking agent, a colorant, a skin protectant in over-the-counter (OTC) drug products and as a sunscreen

Zinc Oxide Demand Market Outlook

-

The global zinc oxide market has sufficient supply, and it is expected to remain the same up to 2026

-

The demand for zinc oxide is presently driven by the demand from innovative electronics sector and cosmetic products. With the automobile industry on a steady decline in from Q2 2022, the zinc oxide market to witness a stable trend in 2023

Impact on CPG

-

The CPG industry accounts for a very small share of the downstream demand

-

CPG buyers are low volume buyers of zinc oxide compared to rubber, ceramics, and electronics buyers

-

As a result, CPG buyers have less leverage during contract negotiations and have to contend with higher prices and supply unavailability during tight supply situations

Global Market Size: Zinc Oxide

-

Rubber, chemicals, and agriculture together accounted for the largest share of the zinc oxide market

-

APAC accounted for the largest share of zinc oxide in 2023, and it is projected to be the fastest growing market in terms of value until 2026. The growth of the zinc oxide market is primarily driven by the downstream automobile industry in countries such as China and India

-

The market size witnessed a drop in 2020, in line with weak demand and dip in prices. However, the prices recovered in 2021 in line with firm demand, which caused an increase in the market size. Similar trends were observed in 2022

-

Buying trends are expected to drop largely in 2023, amid lower consumer spending, which is expected to have negative effect on the prices and market size

Global Capacity–Demand Analysis : Zinc Oxide

-

Increasing use of zinc oxide in cosmetic products and innovative applications such as electronics is a major factor driving the growth of the global zinc oxide market

-

Buyers are recommended to secure their supply with medium-scale suppliers, in long-term contracts, based on zinc prices

Market Outlook

-

Capacity: No major capacity additions are planned due to alternate substitutes available in the market

-

Demand: Global zinc oxide demand is expected to increase at approximately 3-4 percent CAGR through 2026, primarily from the rubber industry in the developing countries

-

Operating rates: The operating rates declined to 60 percent in 2020 due to Covid-19 pandemic, however the scenario improved in 2021 with operating rates in the range of 70 percent. However, post the Russia-Ukraine crisis the run rates declined and are currently in the range of 60-70 percent

-

Supply Security: Overall, there are no supply issues expected in the zinc oxide market until 2026 as there is sufficient material to cover the moderate to weak demand from the major downstream industries

Engagement Outlook

-

Low volume buyers are recommended to have long-term contracts with zinc oxide suppliers, as they have lower bargaining power

-

Spot and contract price mix is the preferred mode of engagement, with a 40/60 ratio

Zinc Oxide Cost Structure Analysis

Due to steady increase in the utility costs, the cost contribution of utilities increased significantly from 2021. The current trends to continue in 2023

-

Raw materials, including zinc scrap, zinc hydroxide, contribute to 55–70 percent of the total cost of zinc oxide across all the three regions: US, Europe & APAC

-

Tracking LME zinc and electricity prices for each of the region may give the best estimate toward arriving at the future trend of costs in producing zinc oxide

-

The best way to negotiate prices for small volume buyers, like CPG, includes having a mixed formula-based pricing, wherein the risk of raw material price fluctuation is covered with partial weightage

Why You Should Buy This Report

The report gives the cost breakdown and zinc oxide market price analysis. It lists out the major zinc oxide suppliers and gives SWOT analysis of Zochem Inc, Umicore, etc. It provides information on the best sourcing models, pricing formulas and contract models. The report gives Porter’s five force analysis, the industry drivers and constraints and industry trends and innovations.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.