CATEGORY

Activated Carbon

Activated carbon is a processed form of carbon that can be derived from either wood or coconut shell charcoal. It is an adsorbent that finds its applications in water and air purification industries

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Activated Carbon.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

US based Ingevity, enters the electric vehicle market through their USD 60 million investment in Nexeon

August 16, 2022US based Ingevity, enters the electric vehicle market through their USD 60 million investment in Nexeon

August 16, 2022US based Ingevity, enters the electric vehicle market through their USD 60 million investment in Nexeon

August 16, 2022Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Activated Carbon

Schedule a DemoActivated Carbon Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoActivated Carbon Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Activated Carbon category is 1.50%

Payment Terms

(in days)

The industry average payment terms in Activated Carbon category for the current quarter is 30.0 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Use the Activated Carbon market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoActivated Carbon market frequently asked questions

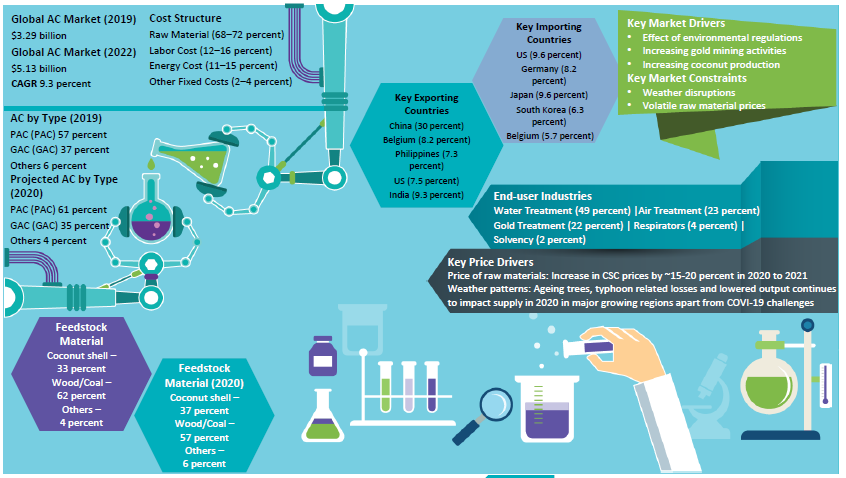

As per Beroe's activated carbon market share report, the demand for activated carbon has been associated with the gas-phase end-use industries that account for nearly 30% of the total consumption share. As per the analysis, the carbon industry will likely grow at a CAGR of 8.2 percent reaching 2.5-5 MMT by 2021. On the contrary, the liquid phase end-use industry is estimated to grow at a CAGR of about 8 ' 20 percent.

The activated carbon market report by Beroe indicates that China is the leading exporter of activated carbon accounting for nearly 18%. Next in line as per Beroe's activated carbon industry report are countries like the US (16%) and Belgium (7%), while countries like the Netherlands (6%) and India (6%) occupy a much lesser portion. If we look at the key importing countries, the list is being led by the US (9%), followed by other countries like Germany (7%), Korea & Japan (7%), and the least being China (5%).

According to the activated carbon market research report, the pricing of Coconut Shell Activated Carbon (CSAC) is driven by ' the availability of raw materials, the onset of weather patterns (like El-Nino) caused a drop in production of coconuts leading to surge in cost, and even the labor costs impact the overall production cost.

Activated Carbon market report transcript

Activated Carbon Global Market Outlook:

-

The global AC market is anticipated to be evaluated by $3.8 billion by 2025 at a CAGR of about 2.9 percent between 2023 and 2026. The production by volume is estimated to be around 3.24 MMT for 2023

-

Coconut shell-based AC is most prevalent in APAC regions and constituted to about 33 percent of the total production in 2023 and expected to grow at a CAGR of about 3.1 percent until 2025

-

Conformance to stringent environmental regulations in water treatment applications in the US and augmenting prominence for air pollution control are the key drivers for this market

Cost Break Up

Cost Model for CSAC - Cost Per MMT

-

Raw material cost accounts for 75 percent of the total production cost of CSC. The cost of the raw materials depend on the supply and availability of coconuts

-

The high cost of raw materials, stemming from a current coconut supply crunch in major growing regions like Philippines and Sri Lanka in addition to the fertilizer shortage supports increase in production costs

-

Also higher energy/fuel costs due to the Russia-Ukraine war will add to production costs in the current year

Price Drivers

-

The availability of raw material plays a major factor in the production cost of CSAC

-

Coconut shells are seasonal and dependent upon weather conditions for the yield

-

Weather patterns, like El-Nino, causes drop in production of coconuts, which leads to surge in production cost

-

Labor costs constitute to about 12–16 percent of production costs and in labor intensive regions, such as India and China, the cost of production will be comparatively lesser than regions with labor scarcity

-

Currently seasonal increase in coconut supply has marginally increased coconut shell availability

-

However, the supplies are not sufficient to cater to the strong demand

Porter's Analysis on Activated Carbon

Supplier Power

-

The availability of coconut shells is seasonal and dependent upon weather conditions for the yield, which increases the supplier power significantly

-

Quality-specific demand from buyers on type of wood leads to relatively higher supplier power in the industry

Barriers to New Entrants

- Capital cost, access to advanced technology, and limited raw material availability, especially coconut shells are hindering the entry of new players

Intensity of Rivalry

-

AC is used in multiple industry applications, which facilitates the need of different types of quality in AC

-

Suppliers compete in the market with quality grades as point of differentiation

Threat of Substitutes

- Substances, like granulated rubber and coke breeze, have been tested as substitutes for AC, especially in water purification applications, but these materials have not been used on a large- scale basis

Buyer Power

-

End-user applications, like industrial water purification, edible oil refining, and waste water treatment demands higher volume, and hence players in these segments have higher bargaining power

-

Buyers with custom specifications, like pore size and other value-added specifications, have less room for negotiation

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.