CATEGORY

Aerosol Cans

The report covers both Aluminum and Aerosol Cans. The demand dynamics and trends are covered across 4 regions

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Aerosol Cans.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

Greenway Environmental to open a new aerosol can recycling plant in UK

March 30, 2023Alucan to open its new sustainable plant for Aerosol Cans in Lummen, Belgium

April 19, 2023Turkey Earthquake to impact Aerosol Cans Market

February 07, 2023Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Aerosol Cans

Schedule a DemoAerosol Cans Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoAerosol Cans Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Aerosol Cans category is 10.00%

Payment Terms

(in days)

The industry average payment terms in Aerosol Cans category for the current quarter is 60.0 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Use the Aerosol Cans market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoAerosol Cans market report transcript

Global Market Outlook on Aerosol Cans

-

The global aerosol cans production is expected to be at 19.6 billion units in 2023E. Demand for the same is expected to grow at a CAGR of 3.5–4.4 percent from 2023E to 2027F

-

The APAC is expected to witness high demand at a CAGR of 6–7 percent for aerosol cans during 2023E–2027F

-

In terms of Value, global aerosol cans market is expected to reach $9.9 billion, growing at 3-4 percent CAGR from 2023E to 2027F

-

Increased penetration of sustainability in aerosol can formats indicate a positive growth in the future

Global Market Size: Aerosol Cans

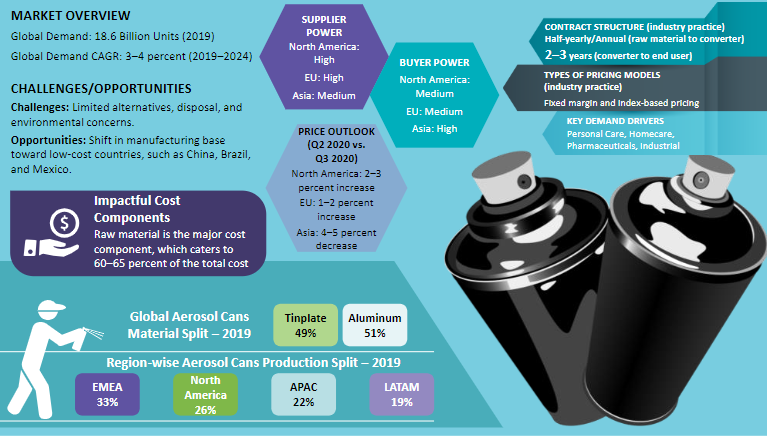

Aerosol cans allow consumers to both address concerns about disposability and gain a cost advantage in packaging. Also, globally, there has been a shift in demand for tinplate aerosol cans as opposed to traditional aluminum cans, owing to price fluctuations and trade regulations.

-

The global aerosol cans market size is estimated to be 19.6 billion units in 2023E and is forecasted to reach 22.9 billion units by 2027F, at a CAGR of 3.5-4.5 percent from 2023E to 2027F

-

The fastest-growing markets, APAC and LATAM, are expected to increase demand for aerosol cans at a CAGR of 6-7 percent and 3-4 percent, respectively, in 2023E-2027F

-

Growing middle-class disposable income and increased levels of hygiene awareness are the major impetus for growth in these regions

-

One of the other major factors driving the demand for aerosol cans is that recyclable aluminum is used to manufacture them, making them extremely environment friendly, cost-effective, and energy-efficient

-

Aerosol cans are produced in accordance with environmental laws and disintegration standards. Additionally, recycling metal cans can contribute to energy savings of up to 74 percent, encouraging recycling products to use less energy. As a result, recycled cans are less expensive than cans that are newly manufactured

Global Market Drivers and Constraints for Aerosol Cans

Drivers

New designs and innovations

-

The improvements in the aerosol can designs, such as development of reduced seam, from 5 mm to 1.5 mm, have helped in providing better aesthetics

-

Aerosol systems offer companies a way to differentiate their products in a competitive market through enhanced and new methods of product delivery

Demand from rising end use segments

-

Food, Automotives are the latest end use segment for Aerosol Cans. Canned whipshots and Canned oil are recent products increasing the demand for aerosol cans. After the pandemic, the demand from pharma segment has also been steadily increasing mainly due to the growing demand for disinfectants

Constraints

Buyer power

-

The FMCG and personal care product companies constitute nearly 75 percent of the end-use market, which gives them high bargaining power

-

Small buyers and can suppliers face price disadvantage, since majority of cans manufactured are according to the specifications of high-volume buyers, who dominate nearly three-fourth of the market

Volatility of feedstock

-

Propellants, aluminum, and tinplate are subject to a lot of price fluctuations in the global market scenario

-

Trade restrictions imposed by the US and the EU against Chinese steel and aluminum had strong impact on the volatility of raw material prices in the market

Other growth constraints include

-

Developments in plastic aerosol cans

-

Regulatory restrictions in the future for aerosol products

-

Growing energy concerns and increasing energy prices

Global Aerosol Can Industry Trends

Environment and Manufacturing Sustainability

-

The aerosol manufacturing industry has started adopting sustainability as one of the major focus areas

-

Few sustainability initiatives include light weighting, increasing reusable packaging and recycling

Capacity Rationalization

Suppliers are trying to improve the production efficiency by increasing their plant utilization rates

-

They are shutting down plants to reduce excess capacity in the industry

-

The production requirement is met by shifting production capacities among their manufacturing locations

Growth in Developing Countries

-

The APAC, LATAM, and other developing countries are the major demand drivers of aerosol cans. Manufacturers are expanding their manufacturing capabilities in these regions

-

Increasing urbanization, growing middle class, and increasing buying power have enabled people to switch to aerosol alternatives

Down Gauging/Light-weighting of Cans

-

The presence of recycled aluminum improves the strength of the aluminum slug, which reduces the weight of packages by 10 percent

Emergence of Low- cost Countries in Production

-

The is an increase in aerosol can manufacturing base in countries such as China, Mexico and Brazil due to low production cost in these regions

-

Manufacturers are expanding to developing countries and setting up manufacturing base, as it gives them access to developing markets and the cost of production is lower in these regions

New Designs

-

New designs and improved aesthetics, such as matte finishes, are emerging to attract consumers

-

The ergonomics of packages is enhanced through shaping, as containers can be contoured in comfortable, easy-to-grip shapes, allowing convenient product dispensing

-

Product shaping also helps the consumers to easily differentiate between genuine and counterfeit packages, as it is difficult to duplicate asymmetrically shaped containers

New Aerosol Can Product Applications

-

New aerosol can applications in skin care, such as sun protection and self-tanning, and food products, such as vegetable oil and gelatin spray, will drive the demand in developed countries, like North America and Europe

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.