CATEGORY

Academic Research

R&D collaboration in the discovery phase that accelerates innovation.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Academic Research.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoAcademic Research Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Academic Research category is 2.90%

Payment Terms

(in days)

The industry average payment terms in Academic Research category for the current quarter is 101.3 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Use the Academic Research market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoAcademic Research market report transcript

Global Market Outlook on Academic Research

-

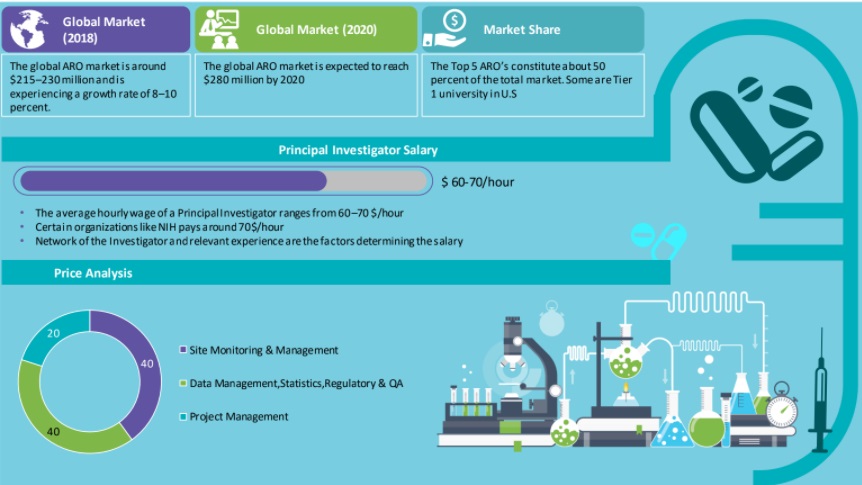

The ARO market ($329.616 million (2022)) is expected to grow at approx. 8–10 percent CAGR through 2020–2025

-

Increasing complexities associated with Pre-clinical, Phase I, II, trials, in terms of protocol, study procedures, trial design,volunteer recruitment, demanding therapeutic expertise, are the major factors driving the market

-

Availability of large networking capabilities among academic institutions with added advantage of having professionals with expertise in a particular therapeutic condition is an increasing trend seen among pharmaceutical companies

-

Large CROs have been continuously expanding their supply base through academic partnerships to provide integrated services, recent trend observed is the hybrid model, which is primarily a pharma collaborating with both ARO and CRO

Demand Market Outlook on Academic Research

- The availability of academic institutions showcasing expertise in a particular therapeutic function, along with their ideal networking capability among other institutions, is the major reason, that is expected to drive the demand in North America and Europe, while in Asia, the necessity to adapt to innovative technologies would be a major driver. Major cost trend is the inflation related increase in pricing

Academic Research: Cost Drivers and Cost Structure

- The cost structure of academic research is revolves primarily on either the strategic collaboration model, resource sharing model or mile stone based approach with majority of the (~50 percent) cost for research entities going towards equipment upgradation, research project and operation and maintenance. The other major cost of investment lies in site monitoring and management, and data management, statistics, regulatory & QA which occupy approximately 35 percent, 45 percent and 20 percent respectively.

Best Practices in Academic Research Industry

The strategic collaboration model followed by Pfizer, resource sharing model followed by Scinovo and Eli Lilly can be implemented by any pharmaceutical supplier in order to improve number of drugs approved per Billion $ spend of R&D.

Strategic relationship management in Academia by Pfizer:

-

Pfizer follows a practice where even the PI relationships become part of the existing strategic deals

-

Each and every project/study is scrutinized from various angles

-

As Pfizer looks everything from a big picture perspective, lot of world class scientists are available in the network and thus their services are even used in those projects not directly related

Resource sharing Practices followed by GSK:

-

GSK follows a milestone based payments for all academic relationships

-

Financial rewards are always shared on the successful launch of a medicine

-

Both these practices has increased the trust factor of GSK among the academia and has lot many academic partners

-

GSK has two centers namely, Tres Cantros and Scinovo where both resources and facility are shared. Various platforms, including the drug discovery platform is shared

-

The collaboration has strong links with Stevenage bioscience catalyst, an open innovation campus

-

The entire internal work of GSK is managed by Scinovo

Academic Research: Drivers and Constraints

Drivers

Failure Rate of Drugs:

- The failure rate of drugs has increased dramatically over the years, and thus, an increase in the drug development cost. Currently, only 0.4 drugs get developed per billion dollar spending. By extrapolating the current trend, hardly any drugs will be produced per billion dollar spending by 2023

Requirement of technical/therapeutic area expertise

- The subject-matter expertise provided by the therapeutic area experts is unmatched in various areas. Therefore, the analysis provided by the academia experts, and thus, the pharmaceutical players have to engage the academia, either for the execution of the entire clinical trial or for specific functions, like analysis, regulatory, etc.

Adoption of innovative decentralizedor hybrid models among the pharmaceutical players for conducting clinical trial

- There is an increased adoption of decentralized clinical trials as a viable approach among the academic research organizations and pharmaceutical players alike. For instance, DCRI launched first direct to family study to improve medical dosing and adherence in children and teens with lupus

COVID-19 a global pandemic has caused ARO’s and pharmaceutical majors to tie up for three main purposes

- Vaccine development, diagnosis, and effective treatment development. On a short-term level, this is bound to major driver currently observed.

Constraints

Increased lead time of the engagements and also the process

- Increased lead time of the academia in conducting the clinical trials may decrease the demand/adoption of hybrid trials (both CRO and academia are engaged)

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.