CATEGORY

Acrylic Acid

In depth analysis of the acrylic acid market across NA, EMEA and APAC with a focus on capcity-demand analysis, industry analysis, cost structure,historic/ forecast price trends and preferred sourcing strategy.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Acrylic Acid.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoAcrylic Acid Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoAcrylic Acid Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Acrylic Acid category is 6.50%

Payment Terms

(in days)

The industry average payment terms in Acrylic Acid category for the current quarter is 187.5 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Use the Acrylic Acid market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoAcrylic Acid market report transcript

Global Acrylic Acid Market Outlook

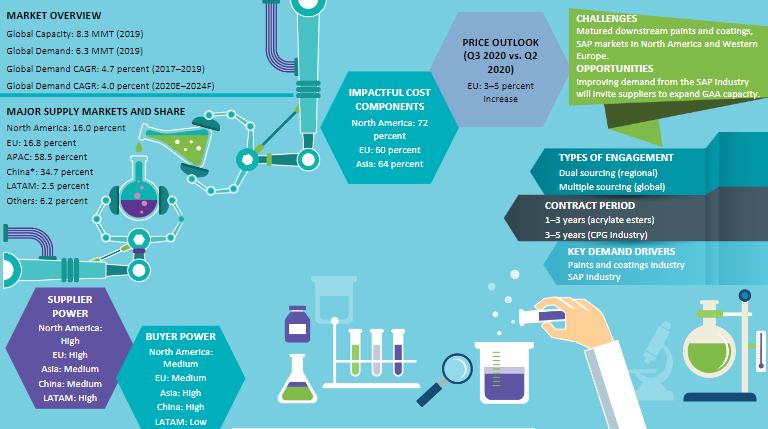

The global acrylic acid market was tight in 2021, owing to several planned and unplanned maintenance turnarounds. This, coupled with lower imports from Asia, have depleted the inventories across the US and Europe, amidst high demand from SAP and coatings sector. Evonik pulled out of the merchant acrylic acid market in Europe, and this has impacted the spot market in Q1 2022. Russia-Ukraine crisis has impacted the upstream crude, propylene and production costs from the end of Q1 2022 to Q2 2022. Prices softened in Q3 2022, on the account of bearish market sentiments and concerns pertaining to inflation and recession. Downtrend in prices is expected to continue in Q4 2022, driven by balanced supply–demand fundamentals and softer raw material prices at a global level

Acrylic Acid Demand Market Outlook

-

2021: The coatings sector and the SAP industry have seen high demand, including during lockdown, and the demand is not expected to ease soon. Demand from the automotive industry has steadily picked up, as manufacturers and OEMs scramble to replenish their inventories to meet the demand. The demand from the textiles and adhesives sectors have seen strong demand, especially during the lockdown period

-

2022: Demand from SAP industry continued to grow in 2022 and is the key demand driver in 2022. However, demand from acrylates segment is restricted by bearish market sentiments in the automotive and construction industry

Global Capacity – Demand Analysis : Acrylic Acid

-

The current installed capacity will be sufficient to meet the moderate global demand of acrylic acid until 2025

-

Owing to the escalation of the COVID-19 spread, and tight supply conditions, which has had a significant impact on the price, the consumption of acrylic acid from major downstream industries, especially the automobile and construction industry, have been impacted

Market Outlook

Sufficient capacity until 2025

-

The current installed capacity will be sufficient to meet the global demand until 2025. The average operating rate of the suppliers is anticipated to be approximately 55–70 percent to meet the current moderate demand

-

New capacities have come online in India in H1 2021 with two more expected in China in H2 2021

SAP industry to drive the demand

-

Growing demand from the SAP industries in Europe and APAC regions will continue to be the key demand driver of acrylic acid

-

Increasing per capita consumption, disposable income, and low penetration rate of diapers in China, India, and other Asian countries will be the key growth drivers of acrylic acid

Increasing demand from other applications

-

Other downstream industries of acrylic acid, such as water treatment and detergent co-builders, are expected to grow by about 4 percent Y-o-Y until 2025. However, they have a less impact on acrylic acid prices, as their market size is only about 10 percent of the total end-use market

Acrylic Acid Global Trade Dynamics

-

Acrylic acid suppliers in APAC hold majority of the capacity share

-

Most of the trade occurs from eastern to western parts of the globe to meet the acrylic acid demand at a least cost

-

The current scenario of the acrylic acid market is that majority of supply in APAC is exported to regions, such as MEA, CEE, and LATAM, to meet its growing acrylic acid demand from the acrylate esters and CPG industries

Industry Drivers and Constraints : Acrylic Acid

Drivers

-

Rising demand for SAP in APAC: A steady increase in demand from the personal hygiene industry, due to the low penetration rate of diapers, is expected to drive the demand of acrylic acid in the future

-

Increasing demand for contract manufacturing: Increasing demand from personal hygiene, paints and coatings from the emerging countries, like Brazil, China, and India, are inviting contract manufacturers to meet their demand

Constraints

-

Environmental concerns: Since acrylic acid is derived from petroleum-based feedstock, there are certain environmental concerns that are associated with the product, which is a key constraint for the growth of SAP. To counter such issues, few companies have invested on the research of bio-acrylic acid

-

Declining demand from automobile industry: There has been a steady decline from the automobile industry since 2019 globally, thus leading to a decline in consumption of acrylic acid

-

Volatile feedstock prices: Feedstock propylene prices are highly volatile, driven by crude prices, which fluctuate M-o-M. Feedstock price pressure hampers the profit margins of acrylic acid, as they are highly dependent on propylene prices

-

Oversupplied market: The global acrylic acid market is oversupplied, which caused the suppliers to reduce their operating rate. There are more capacity additions, following these market conditions, which is a big restraint in the industry

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.