CATEGORY

Acetic Acid

Acetic acid also known as ethanoic acid is an organic compound widely used in manufacturing of daily use commodities like PET bottles, films, personal care products like diapers, wet wipes and commercial products like printing inks and paints & coatings.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Acetic Acid.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

Chang Chun Petrochemical to shut its acetic acid plant in Taiwan

March 14, 2023Henan Shunda Chemicals shuts its acetic acid plant in China

March 14, 2023Kingboard Chemical has shut down its acetic acid plant operations in China

March 02, 2023Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Acetic Acid

Schedule a DemoAcetic Acid Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoAcetic Acid Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Acetic Acid category is 6.50%

Payment Terms

(in days)

The industry average payment terms in Acetic Acid category for the current quarter is 70.4 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Use the Acetic Acid market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoAcetic Acid market frequently asked questions

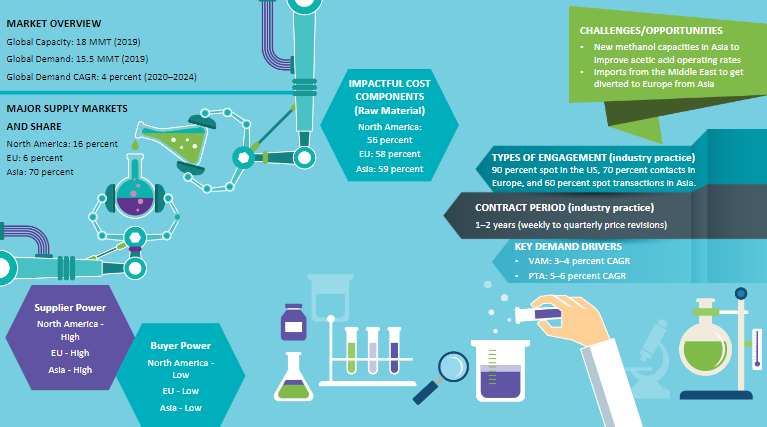

The global acetic acid market has been growing at a CAGR of 4 percent since 2017 and is expected to continue with the same rate until 2022.

The momentum for growth rate of the acetic acid market is majorly supported by the demand in Asia, which is expected to grow at 5-6 percent owing to the anticipated growth in VAM and PTA segments.

A major part of the supply share of the global acetic acid market comes from Asia, i.e. 70 percent, followed by North America and EU, which hold 16 and 6 per cent of the market respectively.

New methanol capacities in Asia will further improve the acetic acid operating rates. Besides, imports from the Middle East will be diverted to Europe from Asia.

Some of the major names among the global suppliers of acetic acid are Celanese Corp., BP Chemicals, Jiangsu Sopo Group, Chang Chun Petrochemical, and Eastman Chemicals.

In the largest acetic acid supply market in Asia, the spot and contract price movements are set by the spot price movements of methanol. In North America, demand dynamics set the acetic acid price trends. In Europe, acetic prices are set based on methanol contract prices. For the assessment of contract prices, consumers of more than 10-100 KMT/ year are considered. On the other hand, transactions for cargos of 1-2 KMT/year are considered for spot price assessments.

The global acetic acid capacity reached 17.8 MMT/year when CPDC's Kaohsiung acetic acid plant of 160 KMT/year was shut down permanently in 2015. The operating rates witnessed significant lows, but are expected to go above 95 percent levels by 2021 as the demand is growing faster than the minimal capacity demands. The plans for 4MMT/ year will receive the support from Celanese in the US and Assam Petrochemicals Ltd in India. Over the coming years, the demand growth looks promising considering the PET sector in Asia.

Acetic Acid market report transcript

Acetic Acid Market Analysis and Global Outlook

-

The global acetic acid market is expected to grow at a CAGR of 4 percent during 2022–2025. The impetus for this growth comes from demand in Asia, which is expected to grow at 5–6 percent, due to anticipated growth in VAM and PTA segments

-

VAM demand is expected to be driven by the construction segment (3–4 percent CAGR) and PTA to be driven by PET (4–5 percent CAGR) for the next 4–5 years

Acetic Acid Demand Market Outlook

- The global acetic acid market supply–demand gap is expected to regain balance, as nominal capacity additions are planned in the next five years against the growing demand.

Acetic Acid Industry Best Practices

Engagement Models

Engagement Preferences

-

North America: Spot market

-

Europe: Contracts

-

Asia: Both spot market and contracts

Role of IPROs

Assessment by IPROs

- Consumers of above 10–100 KMT/year are considered for the assessment of contract prices, while transactions for cargos of 1–2 KMT/year are used for spot price assessments.

Pricing Structure

-

North America: Demand dynamics play a major role in setting the acetic acid prices.

-

Europe: Methanol contract prices are used to arrive at acetic prices.

-

Asia: Methanol spot price movements are the base to set both spot and contract price movements of acetic acid.

Global Capacity–Demand Analysis on Acetic Acid

-

Current Market Scenario: The global acetic acid market demand is estimated to be approx. 16.20 million MT in 2022 and is expected to reach approx. 18.2 million MT by 2025

-

Key Trends in Downstream Demand: Demand for acetic acid from VAM and PTA segments, which finds application in the construction industry is expected to drive the demand during the forecast period

Market Outlook

-

Capacity Dynamics: Capacity improved over the past two years with Bushehr Petrochemical’s 300,000 MT/Yr. plant startup in Iran

-

Celanese is planned to increase its production at its facility at clear lake Texas facility. The capacity of the plant is expected to reach to 2.6 MMT/YR from 1.3 MMT/YR

-

Capacity Additions:. Capacity additions about 1.5 MMT/YR is planned in Asia during the forecast period, other planned capacity additions are still in the feasibility period

Engagement Outlook

-

Shift in Negotiation Power: With anticipated demand growth of 5 percent CAGR, the supply–demand gap is expected to diminish at a faster pace. Lack of sufficient capacity additions during 2023-2025 is expected to shift the negotiation power from buyer market to supplier market

-

Shift in Engagement Patterns: By 2023, shift from spot to contract engagements is likely in regions, where the spot market is more prevalent, like the US and Asia to minimize supply risk. Small volume buyers are likely to resort to consortium buying, in order to avoid contract premiums

Industry Drivers and Constraints : Acetic Acid

Drivers

-

Low-cost Feedstock in the Americas: The anticipation of grim outlook in natural gas prices in the Americas is expected to favor methanol production at significantly lesser cost, in turn, protect the margins of acetic acid producers

-

End-use Segment Growth: Packaging (PET bottle and films), construction and housing sectors (paints and coatings) are expected to have a promising outlook in the next five years, with an average growth rate of 4–5 percent across the globe

-

Market Transparency at Every Node of Value Chain: Across the major acetic acid value chains, either in Methanol to PET or Methanol to PVOH value chains, price discovery is done for every commodity, due to high maturity and transparency of the market. End users have opportunity to be aware in accessing the cost pass-on across value chains, making it easy for buyers to achieve cost effective procurement

Constraints

Limited Feedstock Availability in Asia and Europe

-

Capacity Idling: Both Asia and Europe are net importers of methanol, with the US and Middle East being their sourcing destinations. Close to 1 MMT/year of acetic acid capacities were idled in Asia, due to low methanol availability

-

Growth of MTO Plants in China: Methanol to Olefins (MTO) in China is expected to witness 3–4 MMT/year of capacity addition, which is expected to reduce the methanol availability for acetic acid production

-

Unfavorable Market Conditions for Capacity Expansions or Additions: Methanol supply shortage has resulted in not only idling of capacities, but also postponement of new capacity additions, like large-scale ventures of BP & Reliance JV or BP & IOCL JV plans to open acetic acid manufacturing facilities in India

Why You Should Buy This Report

This report gives insight into best industry practices, acetic acid demand and supply trends, imports, exports, and regional market outlook. It provides an overview of the industry drivers and constraints and Porter’s five forces analysis of North America, Asia, and Europe. The report provides insight into major industry events and innovations. It outlines the acetic acid cost structure analysis and acetic acid market price forecast. It gives an exhaustive suppliers list and does a SWOT analysis of major players like Jiangsu Sopo Group, BP Chemicals, Chang Chun Petrochemical Co., Ltd., etc. The acetic acid market report will help businesses get a complete picture of the market. This will be a valuable tool in decision making.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.