CATEGORY

Acetone

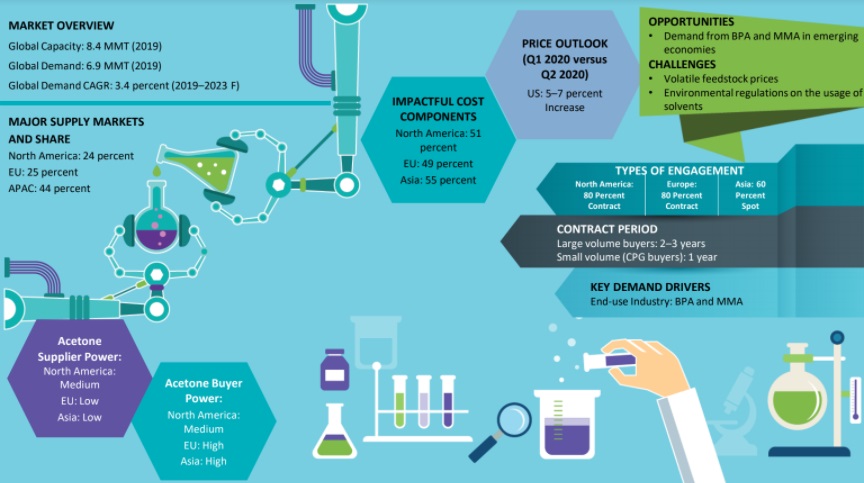

The global demand of acetone is estimated to grow at a CAGR of 3.4 percent to reach 7.74 MMT in 2022 APAC has the largest installed capacity and it is the fastest growing region with demand from downstream construction and automobile industries.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Acetone.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoAcetone Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoAcetone Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Acetone category is 6.50%

Payment Terms

(in days)

The industry average payment terms in Acetone category for the current quarter is 60.0 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Use the Acetone market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoAcetone market frequently asked questions

The demand for the global acetone market is projected to grow at a CAGR of 3.4 percent to reach 7.74 MMT in 2022. With the largest installed capacity, the APAC is the fastest-growing region with demand from downstream construction and automobile industries.

As per Beroe's acetone market report, the major supply share of the acetone market comes from North America (21 percent), EU (26.4 percent), and APAC (46.1 percent).

The major factors driving the acetone production cost in the global market are the fluctuating prices of benzene and propylene. The contract prices of benzene are finalized in the first week of the month, while for propylene, it is done in the last week of the month. Based on this, the market players arrive at the market price of acetone.

The top global suppliers for the acetone market are Ineos Phenol GmbH & Co KG, Sinopec Group, Cepsa Quimica, Mitsul Chemicals Inc., Formosa Chemicals and Fibre Corp ' (FCFC).

The major demand driver for the acetone market is the increasing downstream demand from BPA, MMA, and pharmaceutical segments in Asia and other developing economies.

Acetone market report transcript

Acetone Market Analysis and Global Outlook

-

The global demand is estimated to grow at a CAGR of 4.00 percent in 2022 and is to reach 8.97 MMT by 2025

-

APAC has the largest installed capacity, and it is the fastest growing region with demand from the downstream construction and automobile industries

Acetone Demand Market Outlook

-

Currently, the acetone market is oversupplied, and the capacity–demand gap is expected to increase marginally after 2022, as nearly 0.440 MMT of acetone is expected to come online by the end of 2022

-

The market is, however, far from being tight-supplied, and hence, giving more negotiation power to buyers (particularly, from the BPA segment)

-

Stronger demand for acetone than for phenol would continue to pressure acetone supply, mainly from the growing investment in economies, such as LATAM and India

Acetone Industry Best Practices

-

In North America and Europe, benzene and propylene contract prices are used as a base to arrive at acetone prices

-

About 85–90 percent correlation between benzene and acetone, and the same between propylene and acetone implies greater dependency over the feedstock price movements

-

The top manufacturers in Asia publish their individual quotes and the average, of which is reported as Asian Contract Price (ACP) by the price reporting organizations. Other market suppliers tend to use this as a base in arriving at their contract prices

Global Market Size: Acetone

- Major demand drivers are the increasing downstream demand from BPA, MMA, and pharmaceutical segments in Asia and other developing economies

Global Capacity–Demand Analysis : Acetone

-

About 45 percent of the global acetone capacity is concentrated in Asia. Moreover, 0.440 MMT is expected to come online between 2021 and 2023, making Asia, especially China, to become the major exporter

-

The production of acetone is interdependent on the demand for phenol, as acetone is a by-product during phenol production

-

When there is an excess supply of phenol and high demand for acetone, phenol is converted to acetone to cater the demand

Market Outlook

-

Current capacity–demand scenario: On a global level, there is an excess capacity, however, this excess capacity is mainly concentrated in Asia

-

Demand for acetone saw an incline as a feedstock in IPA, as demand for the same saw an unprecedented increase from hand sanitizers, disinfectants, and wipes

-

Future capacity–demand scenario: About 0.440 MMT of acetone is expected to be added to the overall production capacity by the end of 2023

-

Due to matured demand growth rates in North America and Europe, future capacity additions are mostly planned in Asia, specifically China, where the demand is growing at a faster pace

-

These additions are further anticipated to reduce Asia’s dependency on imports from Europe and North America

Engagement Outlook

-

Low volume buyers in North America, Asia, and Europe are recommended to have long-term contracts with acetone manufacturers for supply security

-

As there is a heavy price volatility, due to high dependency on phenol and feedstock, contract models are much favored compared to spot

Acetone Global Demand by Application

-

Acetone demand is expected to be driven by the developing economies like Asia and LATAM, as the major downstream applications of acetone are directly linked to the construction and automobile sectors

-

BPA and MMA segments are likely to grow at 4.5 percent and 4.3 percent, respectively. This increasing demand is majorly from the automobile and pharmaceutical industries and it is anticipated to drive the demand for acetone

Industry Drivers and Constraints : Acetone

Drivers

-

Feedstock: Abundant availability of feedstock propylene and benzene supply in the market, coupled with cheaper feedstock prices, have a positive impact on the acetone market

-

Downstream Demand: Automobile, construction, and housing sector is having a promising outlook, which is likely to drive the demand for MMA and BPA. These segments are expected to grow at a CAGR of 4–5 percent globally for the next five years, that is likely to increase the acetone consumption by ~3.5 percent Y-o-Y, until 2022

Constraints

-

Overcapacity: The acetone market is already suffering from excess capacity with an average operating rates hitting 80 percent levels. By 2022, close to 0.44 MMT of new capacities are coming online in Asia, which are likely to reduce the export demand from North America

-

Regulations on Transportation: Permitted packaging and clearance for transportation are necessary for marketing acetone, as the UN Committee and the International Maritime Organization have classified acetone (solid, molten and solutions) as a flammable substance

-

Permission Required for Acetone Effluents: In North America, effluent from acetone industry has to follow pre-treatment standards that are to be adhered strictly, which is a restraint in the industry

Why You Should Buy This Report

- Key profiles and SWOT analysis of acetone manufacturers such as Ineos Phenol, Sinopec group, CEPSA Quimica, etc.

- Detailed market cost structure and price trend analysis.

- The report gives information about the drivers and constraints of the global acetone market.

- Best sourcing models and industry practices.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.