CATEGORY

Yeast

Yeast and Enzymes are produced by fermentation process using different feedstocks. They are widely used in Food & Beverage Industry as flavour enhancer and catalyst in processing of food.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Yeast.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoYeast Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoYeast Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Yeast category is 5.30%

Payment Terms

(in days)

The industry average payment terms in Yeast category for the current quarter is 75.6 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Use the Yeast market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoYeast market report transcript

Yeast Global Market Outlook

-

The global fresh yeast market is expected grow at a CAGR of 8.79 percent between 2023 and 2030

-

Growth in demand is expected to be high in Asia Pacific, especially in China and India, owing to the expected rise in demand from processed foods and alcoholic beverage markets in these regions

Value Chain Analysis : Yeast

Yeast used for alcohol fermentation accounts for almost 31 percent in the total end-use applications. However, the share of brewer’s yeast is minimal. A large portion within this category is consumed by other alcoholic beverages such as wine, spirits etc., and by the industrial alcohol segment.

With the current market potential for growth in the craft beer segment, the yeast industry is likely to witness a shift in the trend of rising alcoholic yeast production at a supplier level in the near future.

Brewer’s Yeast Production: Current Scenario

-

Most breweries propagate their own pitching yeast for bulk beer production

-

Depending on the strain type and company policy, yeast can be re-used 5 to 15 times, however, some breweries re-use their yeast over 100 times or until fermentation performance significantly declines

-

Stock cultures and strains are maintained either in-house or purchased from external suppliers

Outside Yeast Supplier

-

Some brewers yeast is also produced by yeast suppliers

-

Micro-breweries directly purchase ready to pitch yeast in dehydrated/liquid form from yeast suppliers for smaller beer volumes

Yeast Strain: Saccharomyces Species

-

Yeast strain is a one-time procurement expense for $1000-2000/strain. The cost of strains within the whole production process is nil

-

Strains for alcoholic fermentation are comparatively expensive as they are specialized to survive in complex production processes

Yeast Substrate

-

Molasses are considered as the most economical substrate for yeast production at an industrial level. A concentration mix of 80:20 of beet to cane molasses respectively is considered ideal for high yields

-

Homebrewers who propagate yeast in-house, use dried malt extract and agar as a solid growth medium

New Trends in Brewer’s Yeast Procurement

-

There has been a shift in beer consumption, arising from the increasing popularity of craft beers over traditional beer among consumers. Breweries, in order to reduce the complexity and cost involved in maintaining various yeast cultures and propagating them in-house for small batches of beer, have started procuring ‘ready to pitch’ dry yeast from outside suppliers

-

Some wine and distillers yeast is also being produced at yeast supplier plants now a days

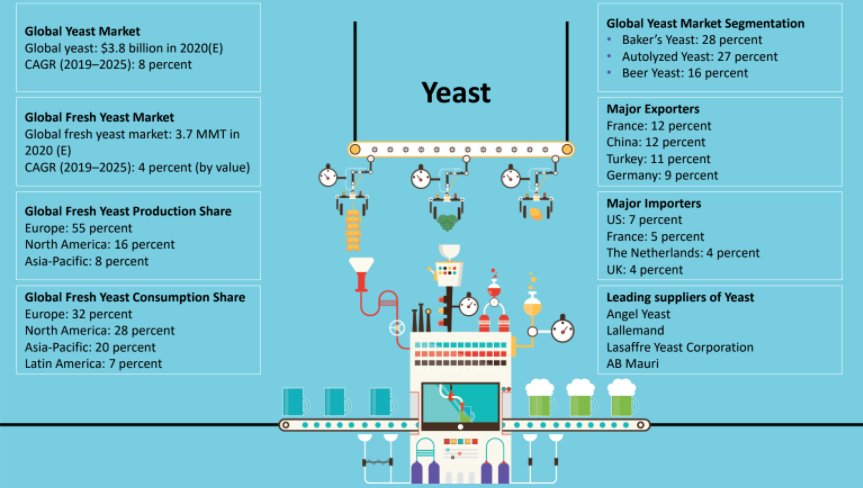

Geographic Landscape: Yeast Production

Europe is the major producing and consuming region for yeast and yeast products, followed by North America and China. The yeast industry is flourishing and production is further expected to rise owing to growing demand for brewer’s yeast, probiotic yeast, yeast extracts etc.

-

Europe, North America, and China contribute to almost 80 percent of the total yeast production and consumption. The global yeast market is currently valued at around $4.2 billion and is believed to continue prospering at a CAGR of 9.0 percent to develop a market of $6 billion by 2025

-

Europe predominantly leads world’s yeast production over others due to high supplies of beet molasses (yeast substrate) in the region

-

Competition for basic raw material, molasses, is the key restraint in North America and Europe. Chinese players are posing stiff competition for global yeast market players due to lower molasses prices and high capacities

Geographic Landscape: Yeast Consumption

Europe currently leads the yeast market, ahead of Asia Pacific and North America. Countries such as India, China, South Korea, Japan and Australia are expected to bolster the Asia Pacific market growth. Higher growth rate can be witnessed in the Asian countries owing to consumer’s changing lifestyle and demand for processed foods.

-

The North American yeast market is projected to grow at a lower rate, while APAC is growing at a faster rate of 9.6 percent CAGR between 2021 and 2026

-

Future demand projections are favorable, from the rising consumer interest for craft beers, resulting in increased demand of brewers yeast, rising consumption of processed bakery goods, fast foods like pizza, breads and new applications of specialty yeast products, such as yeasts auto-lysates, yeast extract, beta-glucan and others

-

European domestic yeast market is currently saturated and a significant volume of yeast produced is exported worldwide. The yeast industry in Europe is operating with tight environmental regulations, high energy costs, high wages and high international competition

Global Active Yeast Trade Dynamics

The EU is the largest consumer of yeast, which is reflected in the trade. Countries within the EU are major importers and exporters, apart from China and the US. The overall trade is highly fragmented across the world.

-

Except Australia, Israel and Srilanka, all the countries across the world have import duty for active yeast

-

China, Turkey, and France are the major countries to export active yeast to the countries with zero duty

-

The US and EU are the largest importers of active yeast

-

Import tariff ranges between 0–28 percent, depending on the destination

-

Top manufacturers of yeast, exports yeast to the countries, where they do not have production plant to meet the importing country’s domestic demand

Cost Structure: Yeast

An increase in the price of molasses, the raw material for fresh yeast production, and energy price led to an increase in total fresh yeast’s cost of production, which is generally passed on to the buyers through an increase in yeast prices.

-

Beet molasses is the most economical feedstock for fresh yeast production, followed by cane molasses. The substrate concentration mix of 80:20 of beet to cane molasses respectively, is considered ideal for yeast production

-

The two highest cost components (raw material and energy), exhibit price volatility and account for 62 percent of the total production cost. The margin for fresh yeast production is 22-25 percent and hence, there is a tendency on the part of fresh yeast producers to pass on the cost increase to the buyers

-

Packaging and waste water treatment are termed as post production cost and these costs constitute a significant 37 percent of the overall cost. Yeast producers price their product above this cost component with a margin of 22 percent to 25 percent

Innovations/Trends : Yeast

Innovations in yeast industry is driving the competition between large players. Studies to improve various parameters of yeast and fermentation process are under process that is expected to shift the yeast industry to more customized form.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.