CATEGORY

Wooden Pallets

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Wooden Pallets.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoWooden Pallets Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Wooden Pallets category is 6.40%

Payment Terms

(in days)

The industry average payment terms in Wooden Pallets category for the current quarter is 63.8 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Use the Wooden Pallets market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoWooden Pallets market report transcript

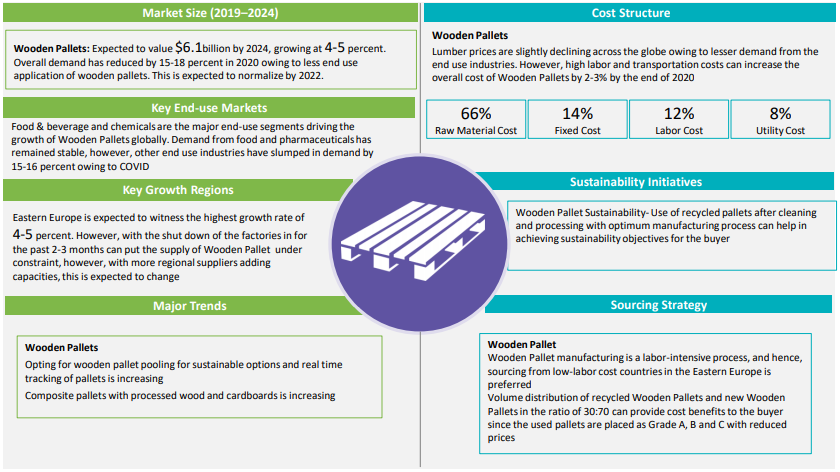

Wooden Pallets Global Market Outlook

MARKET OVERVIEW

Global Demand: 4.5 Billion Units (2023E)

Global Demand CAGR: Approx. 4–5 percent (2023-2027F)

-

The major driver for growth of Wooden Pallets will be the need for light weight and less costly means to carry heavy loads

-

Recycled pallets, real time tracking of pallets are new trends adopted by suppliers to increase the market share

Global Market Size: Wooden Pallet

-

The wooden pallets market is expected to have a growth rate of 4-5 percent until 2027 and reach 5.3 billion units in 2027

-

They are the one of the most predominantly used packaging solutions for transportation and storage of goods, with application across industries due to their ease in material handling solutions

-

Wooden pallets would continue as a preferred choice in transportation and storage particularly with small and medium manufacturing sector as compared to other alternatives such as plastic, metal or corrugates

-

Owing to the advantages of wooden pallets like easy availability, cost effectiveness, low switching cost are expected to continue dominating pallets market in the next 5 years. Pallet pooling is increasingly being adopted by top CPG companies to help them in easy access to pallets and better pallet management

-

Increasing demand from end–use manufacturing industries, food and beverage product transportation are the key drivers for pallets market

Global Trade Dynamics – Wooden Pallets

-

Wooden pallet export, import trade traffic has been stable last year. The major importing region was Europe contributing to more than 30 percent of the imports. The labor-intensive Wooden Pallet manufacturing process has led to buyers opting for low-cost labor countries, like Poland, Belarus, Czech Republic for their Wooden Pallet requirements, making Europe the best sourcing location and the largest exporter.

Industry Drivers and Constraints : Wooden Pallets

Drivers

-

Advantages in Bulk goods transportation: Wooden Pallets are cost effective, efficient for load handling, easy to handle, and resistant to chemicals. Standardized pallets are easier in loading and unloading goods on a truck and can be easily handled with forklifts etc.

-

End-use Industries: Apart from demand from the food and beverage industry, which is set to grow significantly in APAC, other major end-use segments, like chemicals, pharmaceutical, construction, metals & mining, etc., are increasingly adopting wooden pallets due to benefits, like low cost and more convenient handling

-

Low weight alternatives: As part of sustainability options, pallet pooling, pallets made of processed wood and paper are increasingly being adopted to reduce carbon footprint and overall sustainability targets

Constraints

-

Raw Material Capacity Crunch: Restrictions across the regions in sourcing of lumber for wooden pallets from the forest registries create supply constraints and increase in raw material prices

-

Labor Intensive Process: Labor cost contributes to 8-11 percent of the total Wooden Pallet cost, which discourages bulk packaging manufacturers in developed regions with high labor costs to enter the Wooden Pallet segment. Shift to automation is capital intensive

-

Limited Innovation: Scope of innovation is limited in wooden pallets as it is a fairly simple manufacturing process. However, lightweight, composite pallets are entering the market as part of innovations

Cost Structure Analysis: Wooden Pallets

-

Europe has the highest availability of raw materials and movement of pallets within the region. Countries, such as France and Germany, contribute to raw material within Europe. North America is aided by Canada and few countries in US

-

The Lumber prices are tracked based on the forest registry and the availability of lumber. Asia does not have a governing body and a government affiliated agency to track lumber prices. However, country-wise forest registries track lumber prices

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.