CATEGORY

Whey Powder

Value added whey products have a high market growth of CAGR 10% compared to dried whey growth rate of CAGR 2-5%, posing a significant threat to dry whey supply

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Whey Powder.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoWhey Powder Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoWhey Powder Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Whey Powder category is 5.30%

Payment Terms

(in days)

The industry average payment terms in Whey Powder category for the current quarter is 75.6 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Use the Whey Powder market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoWhey Powder market report transcript

Global Market Outlook on Whey Powder

-

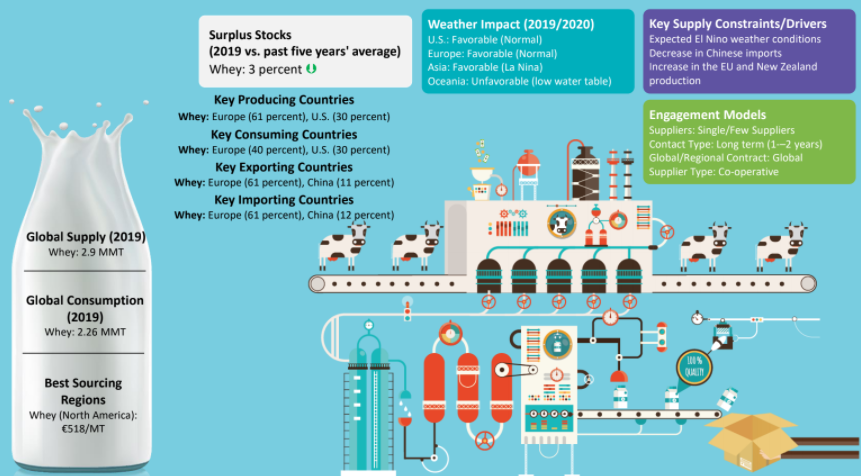

The global supply–demand dynamics scenario is stabilizing in both milk and dairy derivatives, as the oversupplied condition in the market is lightening. The regional differences and skewed trade dynamics are expected to govern the global price volatility in the near term

-

Oceania is a key market, as it produces only 5 percent of the global milk, but contributes to more than 40 percent of the milk derivatives export market

Whey Value Addition

-

The first two layers at the bottom of the pyramid represent the basis commodities used as a raw material for the above hierarchy products. These products are value-added derivatives and used in specific applications in the pharmaceutical and nutritional industries.

-

Whey products are experiencing increasing demand in drug and consumer health products. Increasing demand will lead to increased pricing in the upper levels of the whey value chain

-

Whey products including whey and lactose derivatives have wide applications. 43 percent of whey and lactose are used in nutrition and pharmaceuticals, 36 percent is used in processed foods like confectionery, meat and bakery and 21 percent is used in feed applications

Whey: Industrial Production and Material Flow

-

Separation is the processing of milk with separators to create a skim and cream portions. Separation produces a skim portion that is less than 0.5 percent fat and a cream portion that is usually 40 percent fat. The cream portion is used in the production of butter and cheese, where whey is formed as a by product of the cheese and casein manufacturing process.

Whey: Supply–Demand Analysis

-

The global production is growing ahead at a CAGR of 1.78 percent closely followed by demand growth at 1.73 percent

-

Innovation and trends in the sports nutrition industry drive demand of the category

Market Outlook

-

The whey production is in line with the cheese and casein production as it is produced as a by product of both the production process. Also, since the yield rate is high, the product is a low cost dairy derivative product

-

The capita consumption of whey in developing countries is expected to increase on average by 0.4 percent/annum

-

Agropur, a leading Canadian Dairy Co-operative, would be investing $168 million to expand its cheese manufacturing facility in Wisconsin, expected to function by 2023 likely to increase whey derivatives supply

Value Addition across the Value Chain & Cost Structure Analysis : Whey Powder

Raw material is the key cost factor (47-52 percent), in cheese and butter production. Since whey is a by-product of cheese and casein, no raw material cost is calculated to it. The profit margin of producing derivatives is 30 percent, which is higher than that of milk powders (~15 percent). Thus, major producing regions, concentrate more on butter and cheese.

Key cost factors and feedstock that impact the materials:

-

Raw material is the key cost factor, which constitutes around 50 percent of the total production cost. Labor cost accounts for nearly 30 percent, which includes manpower cost in cheese making (22-25 percent), packaging (20 percent), Engineering and maintenance (21 percent), etc.

Key factors tracked for pricing estimations:

-

Total annual production, capacity utilization, cost components (fixed cost, operating cost overhead cost), and profit margins.

Cost factors between co-operative and private dairies:

-

In large producing countries, such as India, co-operatives like Amul, dominate the organized dairy industry (80 percent of revenue), as raw-material sourcing dynamics favor them

-

Dairy farmers own the shares in co-operatives, whose objective is sustainable input cost maximization and co-operatives work on a no-profit no-loss principle, thus benefitting farmers

-

Indian dairy and derivatives producers for co-operatives retain a large share (77 percent) of the price that consumers pay for the dairy products

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.