CATEGORY

Wheat

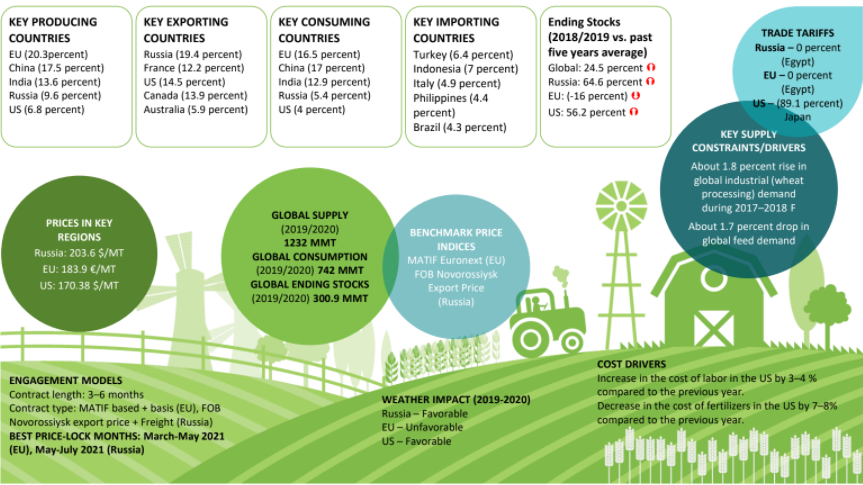

The wheat market is characterized by high global supplies and competition between key regions for exports. The bulk of global demand comes from mills which convert wheat into end products like flour, starch, gluten and protein for applications in various sectors

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Wheat.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

Chicago Wheat Futures Witness an Uptick by 1.5% Due to Concerns Over Black Sea Deal

April 10, 2023Poland Suspends Ukrainian Grain Imports Over Social Unrest and Resignation of Polish Agricultural Minister

April 10, 2023Worst Drought in 100 years Decimates Significant Soy, Wheat and Corn Production in Argentina

April 06, 2023Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Wheat

Schedule a DemoWheat Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoWheat Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Wheat category is 5.00%

Payment Terms

(in days)

The industry average payment terms in Wheat category for the current quarter is 101.3 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Use the Wheat market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoWheat market report transcript

Wheat Global Market Outlook

-

The global production is estimated to increase 1.3 percent on an annual basis. The 2023/2024 global production is pegged at 789.02 million metric tons.

-

Persisting dry weather conditions in key producing regions, like Europe and the US, have ensured that supply tightness continues in H2 2023. It is expected that wheat availability will improve in US 2023, owing to an increase in acreage.

-

Exports are expected to pick up in 2023. Middle East, China, and SE Asia will continue to rely on imports from the EU, the US, Australia, and India. The anticipated rise in exports from Russia is likely to cap the global wheat prices in 2022–2023

Global Wheat Trade Dynamics

-

Wheat trade is expected to remain largely unaffected in 2022–2023, increasing shipping costs, since it is an essential commodity and trade is not largely restricted.

-

China, Egypt, and Indonesia continue to remain the largest importers in 2022–2023. China is predicted to import 12 MMT of wheat from US and Australia

-

Exports from Russia rose by 7.2 percent, owing to a rise in demand from the food and industrial sector

-

Russia has increased its market share for exports by 10 percent over the last five years, growing at a CAGR of approx. 25 percent to displace the EU and US as the top exporter in the world

-

Exports from Russia are estimated to increase in 2021–2023

-

Import to China has increased by 5 MMT in the past five years, owing to an increase in the feed and residual use

Global Wheat Starch Supply–Demand Analysis

It is estimated that ~6.3 MMT of wheat starch is produced on an annual basis. The major regions for wheat starch production are France, US, Germany, the Netherlands, Australia, UK, Belgium, Canada, Japan and China.

-

Approximately 67 percent of the total wheat produced globally is utilized for human consumption, whereas the rest goes into the feed and wheat starch production

-

Since 72 percent of the wheat is known to be milled into wheat flour, which is further processed into bread and confectionery, wheat gluten, wheat protein, and wheat starch, and 28 percent is milled to produce wheat middlings, germ, and bran. It follows that approx. 5 percent of wheat is milled into wheat starch globally

-

The global production of wheat starch averages approx. 4.7–4.9 MMT annually. The major producing regions are France, the US, Germany, the Netherlands, Australia, the UK, Belgium, Canada, Japan, and China

-

The starch content of wheat varieties varies from 65 percent to 70 percent. Soft wheat varieties have a higher starch content than hard varieties, which contain more proteins. The amylose content of wheat varies from 17 percent to 29 percent, with an average of 22–25 percent. However, in waxy wheat varieties, the amylose content is low at 1.2–2 percent.

Cost Structure Analysis: Wheat

The total wheat production cost for the US in 2022 is approx. $325.5/Acre. In case of Russia, the wheat production cost is €220/MT. The costs have increased in the recent months due to the supply constraints forced by the pandemic.

-

The total wheat production cost for the US was $325.5/Acre

-

The total operating cost and total allocated overhead cost comprise of 38 percent and 62 percent of the total cost, respectively

-

Crop inputs and land rent constitute the major cost components

-

The total wheat production cost for Russia was estimated at €220/MT

-

Fertilizers, machinery, and cash cost are the major cost components

-

Russia has a cost advantage in fertilizers, pesticides, and labor. Land costs are also negligible

Porter’s Five Forces Analysis on Wheat

Supplier Power

-

The prices of grains are fixed, according to the future, like CBOT or local domestic prices

-

Due to this, the suppliers do not have major power, since the prices are fixed by global supply and demand factors

-

However, premiums are charged, based on the domestic industry scenario and yield rates

Barriers to New Entrants

-

Supplier market is consolidated to some extent in North America and in the EU

-

Major wheat-producing countries, especially in Asia, also have regional suppliers who have the potential to acquire a sizeable share of the market

-

Thus, barriers to entry in countries, like India, are low

Intensity of Rivalry

-

Wheat is milled to produce end-products, like wheat flour, wheat starch, wheat germ oil, and other products

-

Wheat milling industry is largely fragmented in major growing countries, and intensity of rivalry within the suppliers is weak

Threat of Substitutes

-

There is a threat of substitution for wheat with other crops, like corn in the feed industry

-

In addition, alternatives to wheat in the food industry, especially for gluten free diets include rice, oats, corn, rye, and barley

-

Therefore, the threat of substitutes is high, which could weaken the supplier’s bargaining power

Buyer Power

-

Buyers have the option of sourcing wheat and wheat derivatives from the major global suppliers

-

There are also a number of fragmented regional wheat millers in each country as an alternative sourcing option

-

There are also several substitutes for wheat, especially with the prices of some commodities, like corn, being low

-

Therefore, the bargaining power of the buyer is high

Why You Should Buy This Report

-

This market intelligence report on the wheat industry offers details about the best contract structures, pricing models, and KPIs.

-

The research study lists the wheat price trends, industry norms, and payment terms in countries such as the US, China, the UK, Egypt, and India.

-

It delivers an outline and SWOT analysis of major companies providing wheat.

-

It provides regional wheat market outlook, drivers and constraints, and Porter’s five force analysis across different regions and countries.

-

Furthermore, this wheat market analysis incorporates comprehensive insights into factors that will impact the growth of vendors across the globe.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.