CATEGORY

Warehousing and Distribution of Animal Healthcare Products Brazil

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Warehousing and Distribution of Animal Healthcare Products Brazil.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Warehousing and Distribution of Animal Healthcare Products Brazil Suppliers

Find the right-fit warehousing and distribution of animal healthcare products brazil supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Warehousing and Distribution of Animal Healthcare Products Brazil market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoWarehousing and Distribution of Animal Healthcare Products Brazil market report transcript

Regional Outlook on Warehousing and Distribution of Animal Healthcare Products in Brazil

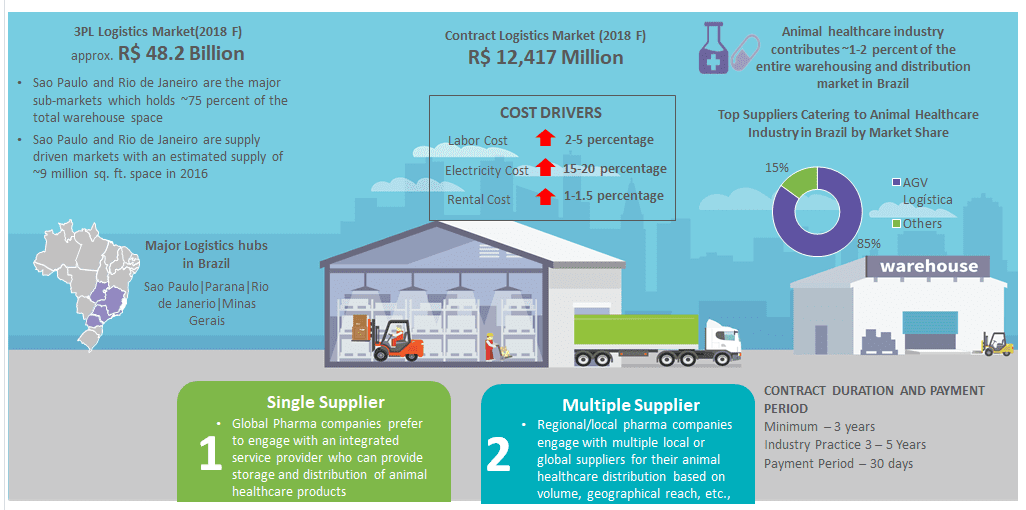

Brazil's contract logistics market is expected to grow at ~2-3 percent for 2018 to reach R$ 12,417 million mainly driven by e-commerce and manufacturing industries, pharma market share is expected to be around ~7-12 percent.

- Brazil's major pharma hubs are located in Sao Paulo, Parana, Rio de Janerio and Minas Gerais where the major pharma production units are located

- Brazil holds ~40 percent of the regional demand in Latin America; it also has compelling healthcare demographic growth drivers, such as strong projected GDP per capita growth, which will lead to increased healthcare consumption

- Brazil 3PL market is expected to grow at a CAGR of ~3-4 percent from 2017 until 2020 following the growth in retail and manufacturing industries

- The 3PL market in Brazil is highly fragmented. The leading vendors face a tough competition from local players.

Nearly 75 percent of the overall inventory is located in the South East region mainly in Sao Paulo and Rio de Janeiro. Approximately 62 percent of the total inventory is located in Sao Paulo (7,703,000 sq. m.) and 13 percent in Rio de Janeiro (1,590,516 sq. mt.).

- Majority of the warehouse space is located in the South East region, mainly in Sao Paulo and Rio de Janeiro. Major chunk of the inventory space is located in Sao Paulo (7,703,000 sq. m. – 62 percent of the total inventory)

Supply Demand Analysis

The demand is catching up with the supply especially for class A warehouse spaces, thereby rental rates for 2018 are expected to increase slightly by 0-1 percent

- Brazilian warehouse market grew approximately 47percent from 8,494,000 sq. m. in 2013 to 12,472,000 sq. m. in 2016

- The net absorption followed a declining trend from 2013 to 2016. For example, the reduction was 66% from 2015 to 2016

- The vacancy rate increased to approximately 25 percent in the last quarter of 2016. It's the highest vacancy rate in the last 3 years

- In 2018, due to no additional space, and increase demand post recession, Sao Paulo rental value is expected to be ~R$19.5/sq. ft. /month, 0.4 percent increase from previous year

- In 2018, due to the new addition of supply, Rio de Janeiro is expected to reach rental value of ~R$23/sq. ft. /month, 1 percent decrease from the previous year

- The overall Brazilian rental rates are expected to increase for class A warehouse for 2018, by ~1-1.5 percent due to improving economic conditions

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now