CATEGORY

Vials and Ampoules

This report covers Vials demand across 4 regions with key innovations by top players in the market

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Vials and Ampoules.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

Schott invested in renewable energy for Indian glass facility

March 30, 2023SCHOTT invests EUR 75 million for amber pharma glass plant in India

March 15, 2023SGD Pharma and Corning expand pharmaceutical packaging in India

March 01, 2023Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Vials and Ampoules

Schedule a DemoVials and Ampoules Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoVials and Ampoules Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Vials and Ampoules category is 2.60%

Payment Terms

(in days)

The industry average payment terms in Vials and Ampoules category for the current quarter is 45.0 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Use the Vials and Ampoules market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoVials and Ampoules market report transcript

Vials and Ampoules Market Analysis and Global Outlook

MARKET OVERVIEW

Global Demand: $31 billion (2023E)

Global Demand CAGR: 7-8 percent (2024-2027)

CHALLENGES/OPPORTUNITIES

Challenges: Increasing consolidation levels in the industry

Opportunities: Significant demand hike in the market owing to COVID-19, expected to last another three years.

-

The global vials and ampoules market has been significantly impacted by the pandemic, with demand doubling over the previous years. Demand would slow down by the second half of 2023, growing with a 7-8 percent CAGR until 2027.

Regional Demand Overview

-

Increasing Capacity and Demand in the APAC market would result in the region becoming a key supply and demand hub over the next five years.

Global Market Size: Parenteral Containers

The global demand for parenteral packaging, which is forecasted at 11-12 percent CAGR in 2024-2027, being largely driven by increasing occurrence of chronic and lifestyle diseases, driving demand for biopharma and insulin. Increasing cost of parenteral containers owing to technology improvements would also add to value growth in the market.

-

The parenteral containers market is forecasted to grow at about 11-12% CAGR over the period 2024-27, once the impact of pandemic completely subsides, driven by growing demand from biopharma and insulin

-

Increasing demand from geriatric drugs and other chronic conditions such as arthritis would also continue to drive demand for parenteral containers.

-

The industry has faced a gradual shift towards advanced drug delivery devices, resulting in slowdown in vials and ampoules and growing market for PFS and cartridges. But the pandemic has caused an increased growth in vials and ampoules. Investments into these categories has resulted in new technologies that could potentially offer better performance

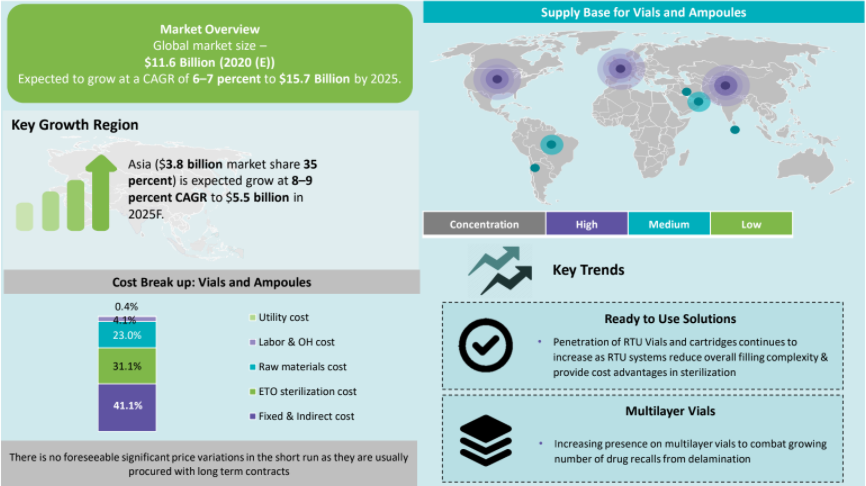

Global Market Size: Vials and Ampoules

-

The impact of COVID-19 would result in significantly higher demand for vials and vaccines until end of 2023, after which the market would grow by about 7-8% CAGR, driven by increasing demand from vaccines and biopharma.

-

The Vials and Ampoules category has been the most impacted market from COVID-19, with demand from both COVID-19 treatments and vaccine manufacturing increasing significantly over the 2020-21. Demand from vaccine increased by about 100-150 percent during the period but has fallen back to almost pre-pandemic levels over the last year

-

Demand hike from the pandemic and vaccine manufacturing will continue until the end of 2023, after which the vials and ampoules market will grow at about 7-8 percent driven by key downstream segments of biologics, and insulin

-

Increasing investment into healthcare infrastructure by emerging markets in Asia, Middle East, Latin America and Africa would also result in increasing demand from vaccines segment over the next five years

Major Cost Drivers : Vials and Ampoules

Raw Materials

-

Glass raw material prices are expected to witness an increase of 5-8 percent over the next 12 months, owing to growing supply-demand gap in key raw materials, such as tubular glass, silica and soda ash.

Conversion Cost

-

Increasing energy expenses in Europe and Asia, owing to the energy crisis in the regions, has led to increased conversion costs. Conversion costs are forecasted to increase by an additional 2-3 percent over the next 12 months.

Freight and Packaging

-

Freight charges are expected to continue to increase, especially in Europe and North America, over the next year. Packaging costs would remain stable, with small fluctuations of about 2 percent.

Fixed Costs

-

Fixed and Indirect costs will continue to increase, owing to higher cost pressure and increasing utility expenses for container manufacturers.

Why You Should Buy This Report

The report provides information on the cost breakup, supplier analysis and key profiles, SWOT analysis and critical performance indicators of suppliers like SCHOTT AG, Gerresheimer, Nipro, etc. It lists out the industry drivers and constraints, key trends and innovations in the Vials and Ampoules Market and Porter’s Five Forces Analysis of the developed and emerging regions.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.